The Pernas Portfolio

Our research philosophy

Most investors focus on what is visible: recent earnings, historical ROIC, trailing growth. We focus on the “motor,” the underlying forces that drive a company’s future. In a dynamic world, a firm’s future can look very different from its past. Our goal is to identify positive shifts in business trajectory early, before they appear in the financials and while the market is still looking backward.

Our goal

To build the preeminent firm for equity investors, one that delivers rigorous, high-conviction research with alpha as our north star.

Expertise

Outperformance

Alongside You

Frequently Asked Questions

Here is what to expect:

- On the first of every month at 9:45am EST, we send a ~2000-word Initiation Report on a name. Sample Report

- Every Wednesday at 9:45am EST, we send our ‘Stock Sonar’ which has brief and sometimes actionable takeaways from the top three companies we researched. Sample Report

- Once a quarter, we send our Quarterly Performance Letter. Sample Report

- Timely portfolio updates: Several times a month, we send timely updates on position changes or any other material adjustments in our portfolio. Sample Report

We value idea-quality over idea-quantity and have intentionally structured our communications to be light on your inbox. You can expect to receive roughly 80 emails from us annually, which averages slightly over 1 email a week.

We are of the opinion that there is a significant market opportunity for high-quality stock research. Many would say there is already a lot of research available, but if you look at most of the research out there, it is either from Wall Street-type institutions where the research is more “coverage” that lacks conviction and often contains inherent biases, or it is from “churn and burn” retail outfits that indiscriminately pump out stock ideas, cherry-pick their top-performing stocks for marketing, and often engage in other unethical tactics. So, in our view, trusted high-quality providers are few and far between.

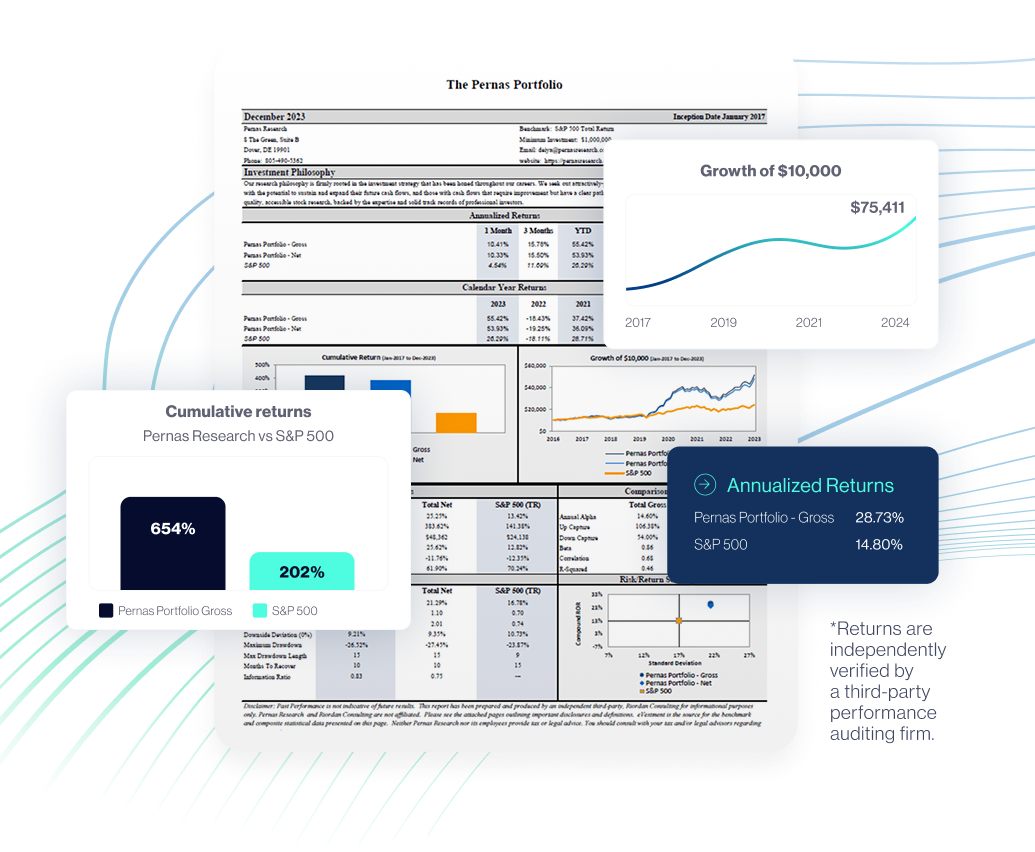

Our track record is comprehensive and reflects all calls we got right and wrong. There will never be any cherry-picking of time windows, stock ideas, or any other charlatan tactics.

Pernas Research is founded on candidness and accountability. And as a result, every single brick our business is built upon reflects a genuine desire to tangibly align our interest with our subscribers.

This is why we only communicate ideas that we would own ourselves. We’ve put our own money into the very same stocks we share and retain an unaffiliated third party to calculate and verify our performance on a quarterly basis.

Who our research is NOT suited for:

• Those Who Think All Stock Research Is More or Less the Same

If you can’t easily spot the difference between high-quality analysis and generic stock write-ups, this isn’t the place.

• Those Who Follow the Herd

If you need to see others investing in something before you pull the trigger, our research won’t add much value. It’s for those who can take the information, combine it with their own due diligence, and make independent decisions.

• Those Looking for Salesy Posts to Nudge Them to Action

If you’re seeking constant reminders of how great we are or how successful our ideas have been to help you make decisions, this isn’t the place. We view excessive self-promotion as borderline detestable. Instead, we focus on being objective and transparent, trusting thoughtful investors to recognize the value we bring.

• Traders or Short-Term Speculators

If your goal is to make a quick buck or you buy research with the hope of flipping positions in a few days or few weeks, this isn’t the place. Although some of our investments are shorter term in nature, the majority of investments have time horizons ranging from 3 months to 2 years.

• Investors Focused Primarily on High-Profile Stocks

If your primary interest is in the most widely discussed, high-profile companies, our research will not resonate. We focus on uncovering less-followed, high-conviction opportunities that often fly under the radar.

• Those Who Can’t Handle Setbacks

As we transparently and regularly display in our performance reporting, not all our investments will work out and that’s part of investing. We’re never going to sugarcoat the fact that we’ll have losing positions—even losing years.

Our research follows our “Motor” Investing philosophy, focusing on identifying mispriced companies with strengthening motors—those poised for value-creating growth based on a forward-looking understanding of their business dynamics. Read more about this philosophy here: Motor Investing

Either value or growth stocks and ones weighted towards mid-cap and small-cap although we do not exclude large caps. Regionally speaking, we exclusively focus on developed countries and are heavily weighted towards the U.S. (~80% weight).

Our typical subscriber to our research has sufficient knowledge and experience to be able to evaluate risks when making their own investment decisions. Our reader base tilts heavily towards those that identify as experienced investors as opposed to traders or speculators.

In a complex and technologically dynamic world, the future of most firms can look very different from their past. We stay away from companies where we cannot reliably anticipate their forward-looking profit picture. For those companies where we can anticipate this, we use our investigative and analytical skill to unearth every possible source of high-signal information.

This involves understanding both the quantitative and the qualitative:

Quantitative (not limited to):

- unit economics

- historical financials

- industry and macro data

- web traffic

- social media traffic & app downloads

- survey data

Qualitative (not limited to):

- Consulting expert transcript libraries: Alphasense/Tegus/Thirdbridge/GLG

- Talking to competitors

- Talking to vendors

- Talking to ex-employees

- Talking to industry experts

- Talking to current management

- Sifting through customer reviews

- Conducting proprietary surveys

- Understanding TAM and how it is changing

- Where possible, becoming users of the product or service ourselves

Once we have enough of an understanding of the company’s future, we begin to construct “forward-looking” financials that we then use to calculate a company’s intrinsic value. The best analysts ask all the right questions and have a resistance to well-sounding answers.

From a process we call “Iterative Pruning.” We are biased towards screens that have a high degree of turnover but here are a few of the screens we run: 52-week lows, decreasing debt levels, special dividends, declining revenue, increasing revenue, a high D&A-to-Capex ratio, and low EV/EBITDA. In addition, depending on the current flow of fear-based narratives, we often find ourselves taking a fresh look at subsectors that experience rapid selloffs.

After each screen, we are left with roughly 50 names which we spend 20-30 minutes researching and do our best to justifiably eliminate as many as we can. After the first round of elimination, this leaves us with roughly 25 names and we go through the list again but now increase our time spent on each name to roughly an hour and again prune the list further. We keep doing this until we are left with one or two names that we greenlight for a much deeper dive. (It is not uncommon for us to pass on the entire list of names).

Yes, 100% independent. On more than one occasion, a company has reached out to us to inquire if we would be open to accepting payment to publish favorable research on their company. Even if this were a company that we liked enough to own, our answer is of course, “No, thank you,” because it would create a conflict of interest with our subscribers.

We do not manage outside capital. Pernas Research LLC manages assets in the Pernas Portfolio which is not open to outside investment.

To build the preeminent firm for equity investors, one that delivers rigorous, high-conviction research with alpha as our north star.