Advances in pretrained foundation models, synthetic data generation, and massive inference compute have created a compounding flywheel of improvement. The pace of acceleration at a triple exponential is incomprehensible. The trajectory of GenAI is such that the next decade could seemore technological progress than the last several decades combined. Large Language Models have led to Large Reasoning Models which are leading us into the Agentic AI and Physical AI Era. Not only are GenAI capabilities accelerating, but the costs of deploying these models are plummeting as efficiencies increase. This lowers the barrier to deploy AI, having large consequences upon industries.

We examine how GenAI is impacting three sectors: Robotics, Defense, and Biotech – and why forward-looking investors should take notice. In the coming weeks, we will publish a deeper dive on the candidates below and where we are investing.

The Plunging Cost of Intelligence

One of the most important enablers of AI's spread is the rapid decline in computational costs. Key AI metrics like tokens generated per dollar and training cost are improving at staggering rates. These cost declines stem from multiple compounding factors: better chips, algorithmic optimizations, and smaller efficient models. Here are some current base rates on AI progress.

- Every 100 days the parameters a model needs to achieve the same capability decreases by half.

- Inference cost decreases by ~10x per year

- Training cost falls ~3x annually

These lower costs allow Gen AI to become increasingly multimodal (audio and visual), an evolution from Large Language Models.

Killer Robot Moment?

Historically, robots have been relegated to domain specific tasks such as automotive welding or home vacuums. This has led to successes such as iRobot which alone has shipped over 30mm units over the past 7 years. Although experiencing a modicum of success, the “Killer Robot” (we are not speaking about a Terminator here) still has yet to arrive. However, that is about to change.

A key challenge of robotics is their deterministic nature. The need for extremely high precision and feedback are very important (force and achieving millimeter level accuracy is hard). This need increases with the delicacy of the task. For instance, during the first iterations of LLMs, hallucinations were common and while harmless in text, hallucinations in real-world applications can be dangerous. New reinforcement learning methods pioneered by DeepSeek—without human feedback—allow GenAI to thrive in deterministic fields. General purpose models can be trained in physics simulations and use synthetic data to train for objective outcomes such as picking up objects or running. It essentially allows AI to “understand” the world. The era of synthetic data is here.

Physics simulations are critical for generating realistic synthetic data in robotics, allowing AI models to train and be tested in highly accurate virtual environments. These simulations enable billions of iterations, dramatically accelerating learning. This approach enabled AlphaZero to master Go and Chess through millions of self-play iterations. Examples of physics simulators used by AI today are NVIDIA Isaac (shown below) and Omniverse.

In a recent NVIDIA study by Jim Fan, it only took 2 hours of simulation for a humanoid to learn how to walk. And this was only a 1.5 million parameter model. An amazing achievement once thought to be computationally prohibitive. Engineers now train robots in simulation and transfer learning to physical systems, eliminating manual programming and costly real-world data. This significantly expands the capabilities of robots, enabling a broader range of autonomous tasks. To accelerate progress, NVIDIA has released GROOT, their Visual Language-Action (VLM) Model which is like ChatGPT for text. VLMs taken in pixels and outputs motor commands (instead of tokens). AI models will replace the PLC as the brains of the robot.

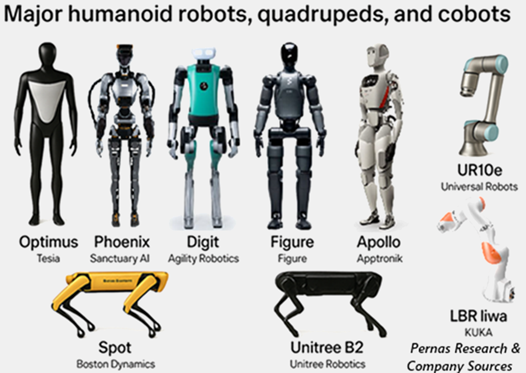

Robotics is entering a new era where AI-trained machines work safely alongside people. Leading adopters like Amazon have deployed over 750,000 mobile robots in warehouses worldwide. As the utility of robots increases and the costs to manufacture decrease, the form factors of robots will explode: Drones, Quadrupeds, and Humanoids are some of the ones existing today and will evolve into increasingly niche applications. In certain fields, as humanoid robots (or others) reach parity with human labor, entire industries will be upturned. The hardware costs of developing these robots has gone from $1mm in 2000 to about $50k today with room to fall significantly more. While humanoid production is still in its infancy with global production estimates currently below 10k units, we believe this number will asymptote very soon with 2026 production targets exceeding 100k units. Humanoids (and other form factors) will be the interface between moving bits to moving atoms.

Companies to watch:

- Harmonic Drive Systems (TK:6234) : Harmonic Drive Systems makes high-precision gears that are essential for accurate and reliable robotic movement. Its technology is used in fields like surgical robotics and semiconductor manufacturing, where precision is critical. As global demand for automation grows, Harmonic is positioned as a key supplier powering the next wave of robotics.

- Tesla (NYSE: TESLA ): Although there is some hype already, robots could be the real breakthrough where Tesla holds a lasting advantage. It is the only U.S. company building humanoid robots at scale, combining AI, advanced manufacturing, and full-stack integration. As automation needs rise, Tesla’s Optimus project could become a defining force in the future of labor. Tesla aims to produce 50-100k humanoids in 2026.

- BYD (HK:211) : BYD is often called the Chinese Tesla, with deep expertise in EVs, batteries, and vertical manufacturing. It is beginning to move into robotics and AI integration, positioning itself as a key player in China’s push toward automation. Although the robotics side is early, BYD has the scale, infrastructure, and government support to become a major force in robotics. BYD aims to produce 20k humanoid robots by 2026. Other players in China that are at the forefront of robotics are Unitree but it is a private company.

Drones and Digital Shields in Defense

Add rising geopolitical tensions to the rise of AI and …