In recent years, the Federal Reserve has played an increasingly important role in our economy and financial markets. "Fed Watchers," including journalists and investment professionals, dedicate their careers to predicting and gaining insight into the Fed's actions and statements. It seems odd that in a market-based economy, so much focus and importance are placed on what is effectively a government institution. The Fed's dual mandate, which has remained unchanged for almost 50 years, is to promote maximum employment and stable prices. Despite this, the Fed's influence has grown significantly.

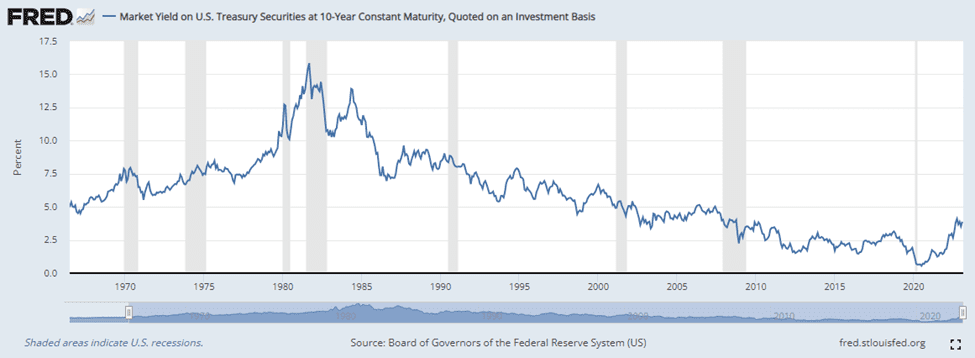

The primary argument for the Fed's increased influence is the secular decline of interest rates over the past thirty years, which has reduced the effectiveness of the federal funds rate, the Fed's primary policy tool.

Reasons that have been hypothesized for decline: demographic pressure, integration of China into financial markets, and global shift in demand for safe assets.

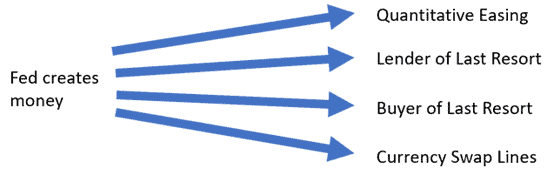

The catalyst for expanding their toolkit was the Great Financial Crisis of 2008, a watershed moment for the Fed and central banks worldwide. The globalized financial world had left the Fed behind, and a significant amount of lending was now taking place outside the traditional commercial banking system1. The Fed found itself straying oceans away from its original purpose, which was to act as a lender of last resort to solvent commercial banks in times of crisis. The Fed's toolkit has expanded significantly, including:

- Quantitative Easing

- Expanded lender of last-resort functions

- Buyer of last resort functions

- Expanded Currency Swap agreements with foreign central banks.

- Novel forward guidance

This categorization is not an official one but rather a framework to help investors interpret the behavior of the Federal Reserve more intuitively. We have observed confusion among investors, and ourselves, regarding the distinction between different tools, including which tools are used during crises versus normal times, and which require approval from the Treasury versus those at the discretion of the Fed. For instance, some credible publications may conflate the functions of Quantitative Easing, lender of last resort, and buyer of last resort. However, each of these tools serves a different purpose, and the Fed can create money to support each of them, with some requiring significantly more money creation than others.

To better understand the Fed's tools, it can be helpful to think of them as different nozzles on a giant hose, with each nozzle serving a distinct purpose (see figure below). It's crucial to differentiate between the individual nozzles and avoid confusing them with the hose or with each other.

Unblurring these distinctions is critical as it provides investors with a clear understanding of the Fed's extensive toolkit, helping them anticipate the efficacy and timing of its deployment. Among the vast array of subjects and areas of knowledge that an investor can possess, we believe this is arguably the most important when it comes to investing portfolio capital.

The primary focus of this multi-part series is to provide a clear definition of each function and offer investors an intuitive understanding of its purpose. Additionally, we will discuss how traditional tools, such as the federal funds rate and discount window, have evolved over time. The series will conclude with a discussion about the future of the Fed and the potential risks that lie ahead.

The Fed's Quantitative Easing

We will begin by examining the most popular, controversial, and misunderstood tool in the Fed's toolkit: Quantitative Easing. The prevalence of misunderstanding surrounding QE is evidenced by a range of partially correct to incorrect definitions. For instance:

Wikipedia: "Quantitative easing (QE) is a monetary policy action whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity." (This definition is too vague and unhelpful, as it could apply to any central bank action that involves buying T-bills to lower the federal funds rate. The amount of purchases need not be predetermined.)

Investopedia: "Quantitative easing is a form of monetary policy used by central banks to increase the domestic money supply and spur economic activity." (This definition is too vague and could apply to almost any stimulative central bank action.)

Oxford Dictionary: "The introduction of new money into the money supply by a central bank." (This definition is incorrect, as QE does not directly increase the money supply (M22). QE credits bank reserves, and if banks choose to lend out this money, then the money supply increases.)

Is all this parsing necessary; are we just being pedantic? If we are not careful, QE could quickly become a catch-all term for a wide variety of separate Federal Reserve actions, making it difficult to assess the full range of the Fed's capabilities. By defining the term correctly, we can gain a better understanding of what QE is and, more importantly, what it is not.

The clearest definition is from Ben Bernanke: "QE is the large-scale purchases by the central bank of longer-term securities ('OMO eligible' - Treasuries and government-backed securities), aimed at reducing longer-term interest rates, easing financial conditions, and, ultimately, achieving macroeconomic objectives such as full employment and price stability." The key point here is that it involves the purchase of long-term government securities to influence long-term interest rates downward.

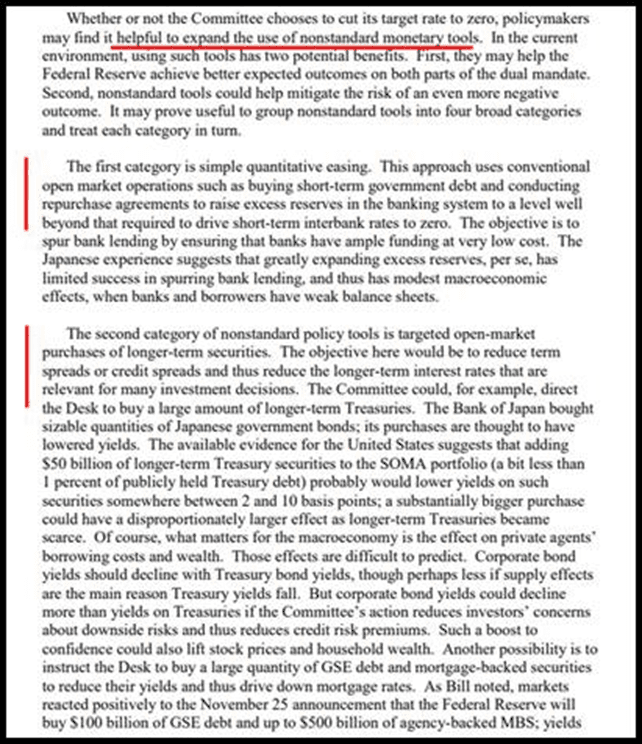

While it is frustrating that there is no consensus on the definition of QE, it is not surprising given the circumstances under which QE was conceived. The exhibit below is taken from the transcript of the Fed's Federal Open Market Committee meeting on December 16th, 2008, during a time when the federal funds rate was near zero and novel ways to effect monetary policy were being considered.

The Fed started implementing QE just days after the conversation cited above took place. The "on the fly" nature of its conception is apparent from the transcript, as even Fed officials were unsure about which course of action to take, and a clear definition had not yet been crystallized. In fact, the media had already labeled the Fed's purchase of MBS securities the previous …