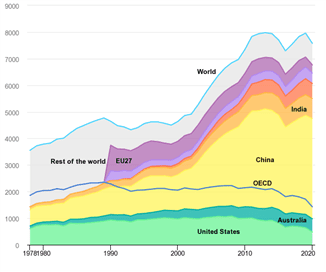

Coal. It conjures up images of smokestacks and rampant pollution. One would imagine that given the push for renewable energy and clean power, the coal industry is on its last legs and about to exit the manufacturing stage. The reality is that global coal consumption is at the highest it has ever been and growing. What is occurring is a bifurcation between the more developed countries and the less developed ones in their coal consumption. Figure 1 below illustrates this disparity. Due to environmental and regulatory pressures, more developed countries have been phasing out coal, using cleaner energy sources as substitutes. More impoverished countries lack that option and out of necessity, use the cheapest energy source that they have. Along with this split in demand between countries, it is also important to distinguish the split between the types of coal: thermal and metallurgical. Thermal coal is used to generate steam which generates electricity via steam turbines. Metallurgical coal is refined to create coking coal which is then used as an input with iron to make steel. Given the faceted nature of coal, the rest of this article will focus on metallurgical coal production in the USA.

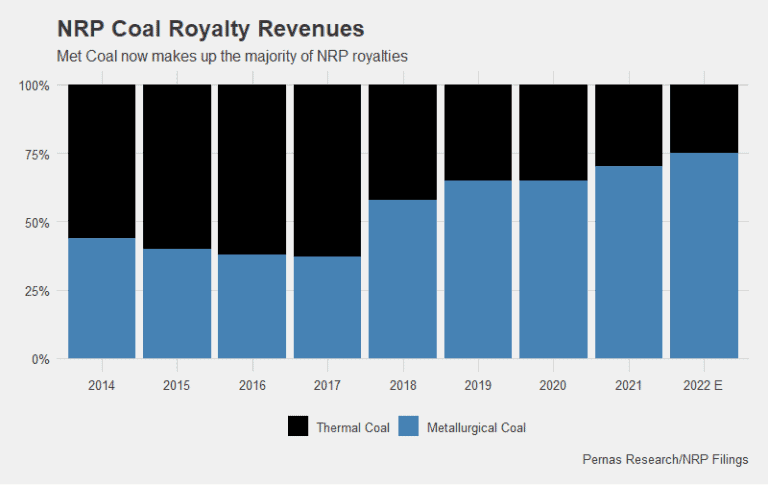

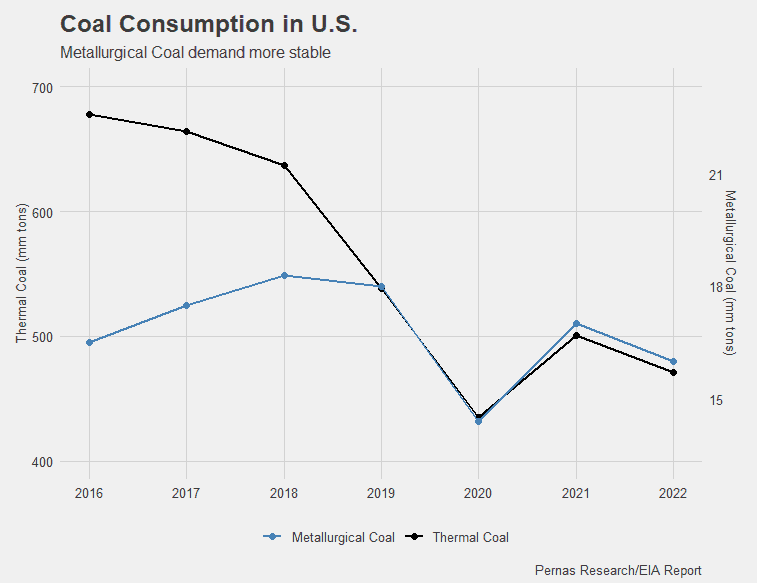

Metallurgical coal is mined through a variety of methods and sent to a coking furnace where volatiles and other impurities are burned off, producing ‘coke’. Coke is then mixed with iron in a Basic Oxygen Furnace (BOF). This produces ‘pig iron’ which is later into steel. This process is done by integrated steel plants. The namesake is due to the entire process they control, from converting iron to pig iron, and then converting the pig iron to steel. The types of steel produced are numerous ranging from rebar to hot rolled coil steed (used in automobiles). For the last ten years, thermal coal usage in the USA has dramatically decreased given the shuttering of coal power plants. Metallurgical coal has seen a less rapid decline, especially in the last 7 years, shown below.

The largest metallurgical coal exporters are Australia, Russia, the United States, and Indonesia. Australia is the largest with about 50% market share. The USA consumes about 30% of the metallurgical coal it produces, with the rest going to exports. The largest importer of metallurgical coal is China with the majority of its coal needs met by Australia and Russia. The costs to produce coal in Australia and the USA have been increasing for the last several years as the rise of ESG activism has regulated and taxed the coal companies. The cost to mine metallurgical coal is roughly the same in Australia and the USA.

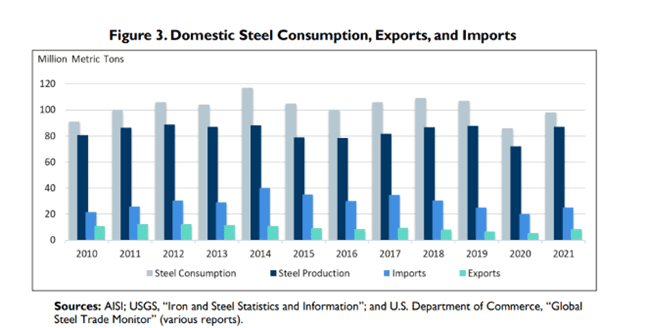

Examining the chart above, steel production in the USA has remained about flat for the last decade. If metallurgical coal production is needed for steel production, how has US steel production remained flat while metallurgical coal consumption in the US has dropped by 25% in a decade? The answer is mini-mills or electric arc furnaces (EAFs). EAFs use scrap steel and repurpose it into more refined products without the use of coke. Because of a lower fixed cost structure and being more environmentally friendly, EAFs have taken share from their integrated competitors via a low-end disruption model.

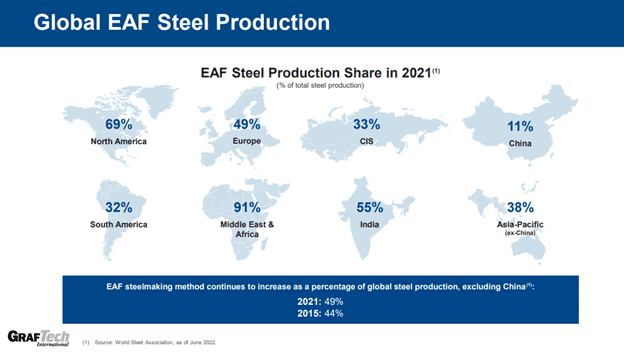

EAFs are especially prevalent in more developed countries with abundant scrap steel. The figure below shows the market share of EAFs by country. EAFs have been going after higher-quality products for the last 20 years with the last stronghold being sheet steel used in auto manufacturing. Once this happens integrated steel manufacturing will likely become another species doomed for extinction. Currently, EAFs have about 70% steel market share in the USA. Along with the competitive pressures from EAFs, integrated steel companies are looking at using natural gas instead of coke to reduce iron. Another threat of obsolescence for metallurgical coal. Although the Infrastructure Act will increase steel consumption by up to ten percent for the next five years, most of this steel will likely be provided by EAFs.

The verdict for metallurgical coal

Metallurgical coal production in the USA will likely decline at 3-5% CAGR for the next several years until 2030 as EAFs take share globally along with natural gas being substituted for coke as a reducing agent of iron. A consolidated integrated steel industry structure along with higher exports will help buoy metallurgical coal demand in the US for the next several years. Past 2030, the picture becomes grim. China will start deriving more of its steel production needs through EAFs (China is targeting a 20% EAF market share by 2030) as scrap steel becomes more plentiful. With China importing less metallurgical coal, there will be excess met coal on the market. The result will be a gradual oversupply of metallurgical coal which will likely depress metallurgical coal prices until more supply goes offline.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it's important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.