Simulation racing is an e-sport that simulates motor car racing such as those seen in F1, Nascar, and World Rally championships. Sim racing can be played either solo or against others and a player can have anything from a basic setup (all you have is a keyboard/controller) to a complete rig as seen in Figure 1. This includes a cockpit, steering wheel, pedals, gear shifter etc. Sim racing has become more prevalent as it has transitioned from a niche video game to a legitimate e-sport. Sim racing is the nearest a game is to the real sport due to its tactility and immersion. In 2019, a sim racer beat a Formula E champion in a real racing event. It would be hard to imagine this happening in any other sport. Current F1 champion, Max Verstappen, takes sim racing as seriously as the professional sport. Sim racing helps actual drivers with “getting more reps” in to help with track memory and reaction times. As sim racing becomes more immersive, more players, professional race car drivers, and subsequently organizations will be attracted to it.

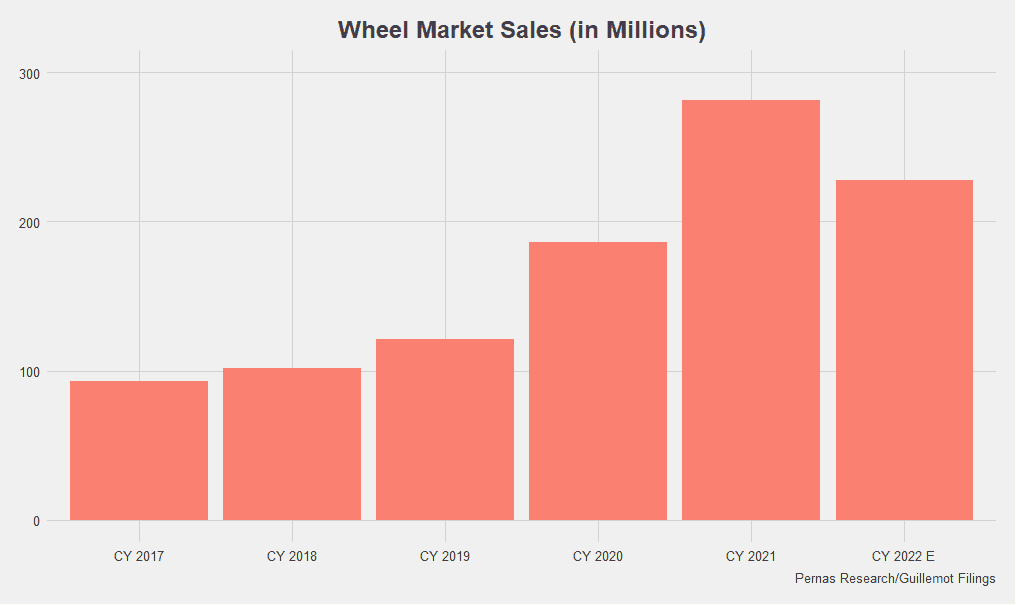

The size of the sim racing market is about $300 mm with about 1.3 mm sim racers globally. The market has been growing at about a 35% CAGR over the last 5 years, shown in FIgure 2 below. European gamers typically made up 80% of sim racing demand however currently revenue is split roughly 50-50 between the USA and Europe. Sim racing tremendously benefited during COVID as Nascar and F1 suspended real events and transitioned races to sim racing as a sporting outlet. These organizations (whose average audience base is around 40-50 years of age) have been trying to gain share of mind to attract younger generations and sim racing is proving to be a successful avenue for them. F1 currently has its own esports championships with purses upwards of $100k and motorsports races are beginning to be combined with sim races in a hybrid format. With these racing organizations and OEMs leaning into sim racing, the entire ecosystem benefits in both legitimacy and interest.

The Players

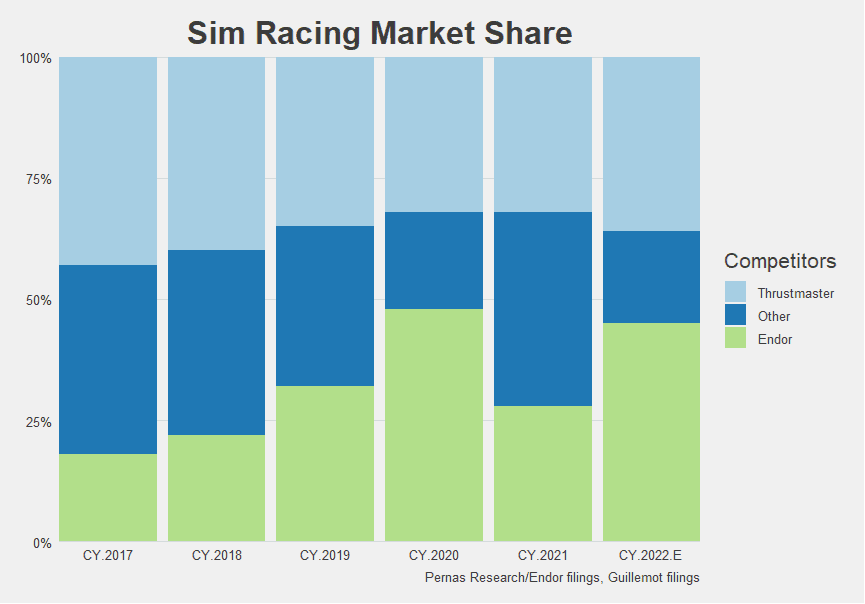

There are three main players in the sim racing industry. These are Logitech, Guillemot (Thrustmaster brand), and Endor (Fanatec brand). Smaller up-and-coming entrants are Moza Racing and Simucube. Logitech is the original wheel manufacturer having introduced the first Force Feedback wheel in 1998 to customers’ delight. Even back then, it sold 1mm wheels within 5 years. Currently, Logitech and Thrustmaster are the low end players with wheels and drives below $1k. Fanatec is the 800 lb gorilla in the high-end sim racing arena. By volume, Thrustmaster and Logitech have the lead with about 85% market share. However, by dollar value, Endor has about 40% market share. A more detailed breakdown of dollar market shares is in Figure 3 below. Typically, a sim racer will begin by buying an entry-level sim wheel from either Logitech or Thrustmaster and if they are passionate enough about racing, they will eventually upgrade to Fanatec. This enables a more immersive experience along with better racing times. Fanatec’s products offer premium-level features and are priced as such, as seen by the costs of purchasing a rig setup:

Logitech ~ $150-1k

Thrustmaster ~ $150-1k

Fanatec ~ $800-4k

It is important to understand the difference between regular game controllers vs. sim racing equipment and why gamers would spend $4k and upwards on a rig setup. Regular game controllers are a commoditized product that don't require a high degree of expertise to construct. Sim racing equipment on the other are complex products that mimic the equipment that race drivers use in reality. It requires such a high degree of mechanical and electrical fidelity that it is converging with real world equipment. For example, Fanatec’s racing wheels have such a high degree of engineering integrity that some of them are being used in actual motorsport races. Fanatec has partnered with BMW and Bentley to manufacture their GT racing wheels and the World Rally champion used a Fanatec wheel in the actual race. Sim racing is nearing a point in which it will become table stakes for professional motor car drivers.

Final Thoughts

We believe the sim racing market will continue growing at a mid to high-teens annual rate over the next 5 years. The main drivers of this are the confluence of technology and legitimacy. Sim racing will continue to expand in size as racing organizations, OEMs, professional motorcar drivers, and gamers lean into the ecosystem. Racing organizations and OEMs will seek to engage younger generations and gain mind share, while professional drivers will increasingly view sim racing as a necessary aspect of their profession. Moreover, advancements in game engines, cloud gaming, and virtual reality will continue to drive immersive experiences, further enhancing the appeal of sim racing.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it's important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.