| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 18.3% | 18.7% | 26.4% |

| S&P 500 | 5.9% | 22.1% | 15.0% |

| Russell 2000 | 9.2% | 10.9% | 8.0% |

| DJ Industrial Average | 8.6% | 13.7% | 12.6% |

We entered the quarter relatively flat, and our portfolio gained 18%, significantly outpacing equity indices. Inflation continued its downward trend, the Fed cut rates by 50 basis points, high-yield spreads tightened, and some of our smaller-cap names experienced significant gains. Larger positions like Xometry rose 60%, Applied Digital increased over 30%, and our smaller-weighted position in Total Site Solutions surged over 200% for the quarter. Most of the other 15 names in the portfolio posted low double-digit gains, except for a few detractors: Docs Martens (24%), Burberry (18%), and Red Robin (35%). Given the concentrated nature of our portfolio, it’s not unusual for us to experience substantial divergence from index performance for a sustained period. Since inception in 2017, 61% of our months have been positive compared to 71% for the S&P 500—while we’ve had more negative months than the market, our positive months tend to be outsized.

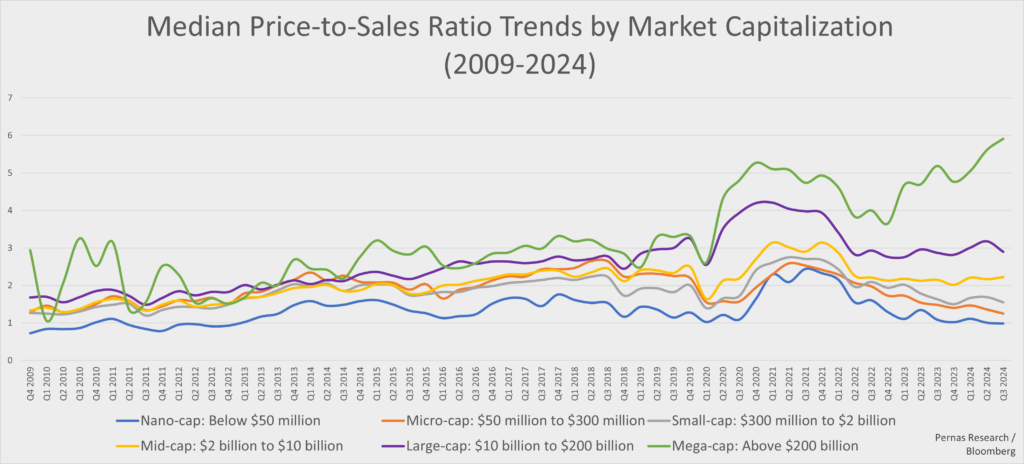

Mega-Cap Valuation Gap

The chart we compiled below illustrates the relative value potential in smaller-cap stocks. While mega caps have been the primary drivers of market returns, this visualization highlights the significant divergence in valuation between mega caps and other market cap segments. Some of this disparity is justified, given that mega-cap companies have strengthened, benefiting from increased efficiencies and market power. However, we believe that a substantial portion of this divergence stems from a general flight to safety that mega caps have enjoyed. This phenomenon of a group of equities being seen as a safe haven is fairly new in modern markets, and it will be interesting to see how long this trend holds.

Our Near-Term Outlook

Our approach to capital allocation involves maintaining a loosely held view of how the market may unfold and anticipating ways (ex-ante) in which our outlook could be wrong. In the near term (~6 months), we expect the most likely scenario to include a sanguine election cycle, increased Federal Reserve easing, continued AI optimism, and a mixed economic picture with both accelerating and slowing sectors. It’s challenging to determine whether this mixed economic state reflects underlying dynamism (aka creative destruction) or the early stages of a larger slowdown, but for now, we believe it is the former.

After the election cycle, as we move into next year, we anticipate that further rate cuts and a broadly healthy economy will set the stage for a rotation out of mega/large-cap stocks into smaller-cap cohorts. There are numerous ways we can be wrong—such as a narrow Harris victory leading to deep social unrest, rapid escalation of conflicts in the Middle East, or a worsening economic slowdown.

For now, there is too much asymmetric upside in quality mid-, small-, and micro-cap stocks that have lagged behind in the multiple expansion of the past 15 years. TTM P/S ratios for small caps are trading at only a 20% premium to 2009 levels, while micro caps are flat. We are energetically evaluating as many of these investment opportunities as possible to position our portfolio for outsized gains.

New Position

Upwork (UPWK) is a leading global platform in the online freelance marketplace, connecting businesses with independent professionals (freelancers) for collaboration. The stock has fallen by approximately 85% from its peak due to concerns over slowing growth and fears of AI disruption. However, our analysis suggests these concerns are overstated. The growth slowdown is primarily due to temporary cyclical factors, while the long-term trend of businesses increasingly turning to skilled freelancers remains strong. Although market sentiment views Upwork’s business case as weakening, we see it as strengthening. We estimate a 70% upside potential from current levels, making Upwork a compelling long-term investment. Long form write-up here.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.