| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 22.7% | 45.6% | 28.7% |

| S&P 500 | 2.4% | 25.0% | 14.8% |

| Russell 2000 | 0.3% | 11.3% | 7.8% |

| DJ Industrial Average | 1.0% | 14.8% | 12.3% |

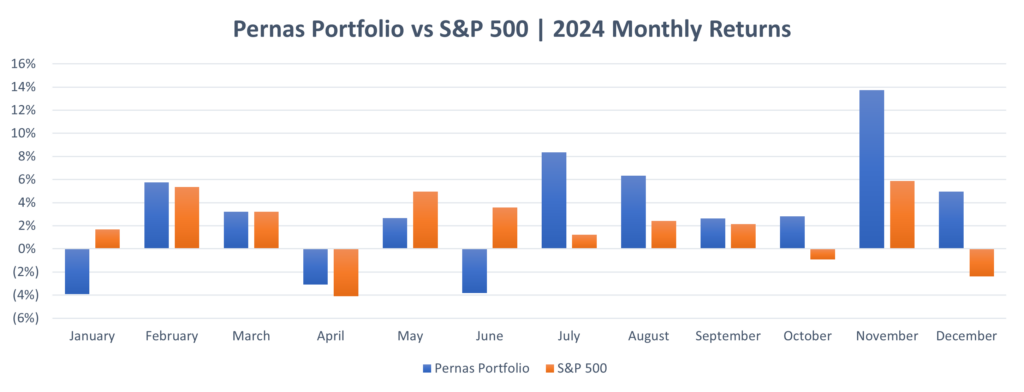

This Year in Review: A Tale of Two Halves

This year was defined by two starkly different halves. In the first half, our portfolio was roughly flat, underperforming the S&P 500, which was up 15.2%. Core Positions weighed us down, while smaller positions like TSSI and ARQ delivered outsized gains that kept our portfolio afloat. The second half told a different story, with significant outperformance from Core Positions such as Xometry, Upwork, and Remitly, as well as broader strength across most of our holdings, driving the full-year 2024 outperformance of 45.6%. This year served as a reminder that excess returns rarely accumulate linearly and that enduring significant volatility in relative performance is an inherent trade-off in the pursuit of compounded returns that exceed the S&P.

Every year brings its share of mistakes and, occasionally, valuable lessons. We take great care to ensure we are deliberate in extracting the right insights. It’s all too easy to be misled by randomness and mistakenly attribute unforeseeable developments to error. In our business, the correlation between the quality of the research/decision-making process and the quality of the investment outcome is definitely not 1. The hallmark of a good investor is the ability to identify mistakes and extract the correct lessons. This requires the right blend of behavioral (i.e., self-honesty) and analytical skills. To the best of our ability, below are some mistakes and lessons we have to share from the year.

Mistakes & Lessons

Red Robin (NAS:RRGB) – When You Can’t Spot the Sucker at the Table

We took a speculative position in Red Robin, intending for a holding period of less than six months. The high short interest suggested that hedge funds, not retail investors, were betting against the stock—and funds typically short for good reason. Initially, we believed the short interest was primarily due to the broader restaurant industry being in decline. Red Robin’s heavy debt load added a layer of vulnerability to a company in a declining category. Our thesis was that the market was overly pessimistic about Red Robin’s prospects and that management’s initiatives to deleverage and improve operations would soon yield results, potentially triggering a significant rerating.

It turns out we misjudged the situation. The primary reason for the high short interest was less about industry trends and more about alternative data in the possession of hedge funds. Alternative data specific to Red Robin included credit card transactions, web traffic, email receipts, app downloads, and social media trends—tools that provide predictive insights into near-term earnings. Of these, anonymized credit card data is particularly powerful; intermediaries selling to funds acquire this data from payment processors and card networks. This card data often represents a random sample of 1-3% of total sales for B2C companies. Funds use this data, corrected for biases, to forecast whether a company will beat or miss sell-side earnings expectations, engaging in what’s called “playing quarters.”

If our investment horizon had been much longer, we might have been comfortable holding through short-term volatility, confident in long-term fundamentals that short-term players overlook. However, in a short-term scenario where other investors possess superior data and similar time horizons, we were, unfortunately, the sucker at the table (not to mention the ~43% realized loss we took on the name).

The takeaway: for speculative, short-term trades, avoid areas where funds have a clear informational advantage, such as companies heavily exploited by credit card data. Instead, focus on opportunities in B2B businesses driven by ACH/wire transfers/checks, cash-based sales, or companies selling primarily to distributors—blind spots in alternative data where funds have far less visibility. It is also worth noting hedge funds are finding it more difficult to exploit alternative data given the proliferation of this data amongst funds.

We extend our thanks to our friends at Point72 and other funds who generously shared insights about the types of data they utilize and the statistical methods they employ.

Duolingo (NAS:DUOL) – Too Quick to Call It an AI Loser

Duolingo represents a sin of omission for us. We routinely revisit stocks we have passed on to analyze how their fundamentals have evolved, often learning as much—if not more—from missed opportunities as from the investments we’ve made. Duolingo was one such name that initially caught our attention, but we dismissed it too quickly.

At the time, we wrote: “In a post-AI world, DUOL’s moat is drastically reduced—technologies like ChatGPT allow users to engage in interactive conversations and receive personalized learning programs.” This assessment proved to be flawed. Our decision overlooked the enduring appeal of Duolingo’s gamified learning experience, expertly designed curriculum, and highly engaging user interface—elements that are crucial for language learning.

Ironically, rather than being an AI loser, Duolingo appears poised to be an AI winner. With its vast user base and ability to seamlessly integrate AI tools into its offerings, the company is well-positioned to enhance its platform rather than be disrupted by AI. Duolingo is up over 90% since we first evaluated it, and we missed the opportunity to buy when the prevailing narrative labeled DUO as an AI loser. We have since re-evaluated and added nuance to our framework regarding criteria for AI winners and losers.

Doc Martens (DOCS:LON) – When an Opportunity Doubles as a Risk

Our primary thesis, which ran counter to market perception, was that the Doc Martens brand was not in decline and carried limited fashion risk due to its broad appeal across genders, ages, and geographies. We believed the strength of the brand, especially for boots, made it resilient. However, what applied to their boots did not extend to their sandals which grew to 9% of sales in ‘24—a segment we initially considered part of their growth opportunity but did not recognize as a risk.

Unlike boots, the sandals segment is predominantly purchased by female consumers, who tend to be more trend-driven. As fashion markets shifted, the lack of staying power led to a significant collapse in sandal sales, revealing a degree of fashion risk we had overlooked. Understanding brand strength requires nuance, as it can vary significantly across product categories.

Our core thesis around the enduring appeal of Doc Martens boots remains intact, and while a growing sandals segment would be advantageous, it is not essential to our overall investment case. Despite the misstep, we continue to believe there is significant upside from currently low valuation levels.

Outlook for 2025

Equity valuations remain stretched, with the forward P/E for the S&P 500 at 21.5x. With interest rates expected to remain elevated, it’s reasonable to expect bouts of “flight to safety” throughout the year. Our approach to managing risk is fourfold:

- Maintain excess cash during periods of heightened volatility.

- Appropriately size down positions with significant downside risk.

- Build a collection of names with solid industry diversification.

- Manage overlapping risk factor exposures between names.

While we are less optimistic about market cap-weighted indices, we are more bullish on broader equities and selective small-cap names that stand to benefit from a strong economy. In 2024, excluding nano-caps and illiquid stocks, there were 108 multi-baggers (stocks that increased > 200%) —more than double the typical number observed over the past 20 years (source: Factset). We believe this trend will persist, driven by increased capex around technological changes. Small caps generally benefit from shifting markets in two ways:

- Their smaller size allows them to pivot more quickly and capitalize on emerging opportunities compared to larger companies.

- Even small shifts in industries can lead to large windfalls in demand for companies with smaller revenue bases.

This optimism does, however, hinge on continued economic strength. In 2024, the economy once again defied expectations. The notion of a recession “just around the corner” appears increasingly outdated, as almost every economic forecaster and leading indicator has been proven dead wrong. This resilience suggests there is something unique about the current economy—perhaps linked to AI or a combination of technologies—that traditional models fail to capture. In our view, the persistent underestimation of the economy’s strength points to a deeper, underappreciated momentum that is likely to continue. Looking ahead to 2025, we are excited about the opportunities this dynamic and complex market offers. More than ever, we believe there is potential for outsized portfolio returns.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.