| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 5.8% | 21.9% | 24.1% |

| S&P 500 | 8.7% | 16.9% | 13.2% |

| Russell 2000 | 5.3% | 8.2% | 6.6% |

| DJ Industrial Average | 3.9% | 4.8% | 11.2% |

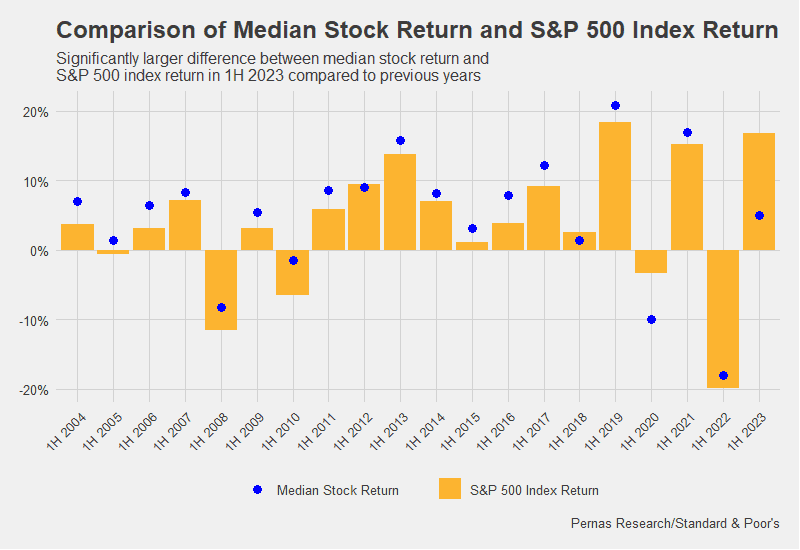

Our first-half performance has remained strong at 22%, outperforming market averages, which returned between 5% and 17%. An interesting statistic about this year is that the dispersion in performance between the S&P 500 index and the median performance of its constituents hasn’t been this large in over 20 years:

As the chart demonstrates, it has been a challenging year for most stock pickers to outperform the index. However, we were fortunate enough to have some successful wins led by META, followed by SES, PTON, DFIN, and small tactical plays. The performance of META, in particular, has left us pleasantly amazed. Despite being one of the most widely followed names in the world, it traded far below intrinsic value, getting as low as $88 a share in November of last year. Such instances throw cold water on the notion that markets are efficient and overfished, given the sheer number of “sophisticated” participants and hedge funds. Meta is up over 250% since its lows. The fact is, narratives, even false ones, can have a significant impact on short-term pricing, creating opportunities for long-term investors such as ourselves. Examples like this reaffirm one of our core principles: Markets rarely price assets accurately. Even though market prices are generally wrong, they should always be respected (‘Our Beliefs’).

In a similar vein, one of our core positions (over 10% of the account), SES Imagotag, experienced a significant 60% drop in a single day due to what can only be described as a manipulative bear raid. Nevertheless, we managed to achieve a positive return on the name by tactically adding to our position before the stock rebounded significantly. You can find more details in the positions section below.

The second half of this year has seen a gradual easing of fears surrounding the economy, inflation, geopolitics, regional banking, and global recession. Economic events have unfolded better than we expected. Our concerns at the beginning of the year were primarily focused on a Federal Reserve bent on rapidly raising rates and deteriorating business optimism. However, the Fed is now nearing the end of its tightening cycle, driven by populist political pressures, slowing labor market momentum, and rapid disinflation. Business optimism, although mixed, seems to have stabilized. While certain areas in banking, trucking, and consumer discretionary sectors are still taking precautions, other industry areas are operating at full speed with growth initiatives. Investments in manufacturing, artificial intelligence, and green energy are all bright spots in the economy. I recall a metaphor used by Ben Bernanke, who likened the economy to a B-747 plane, emphasizing the need to maintain enough speed to avoid stalling and falling. The economy is either growing or shrinking; there is no in-between. Continuing with Bernanke’s analogy, the plane today has two engines out, but the remaining two may be functioning well enough to maintain stall speed.

That being said, there remain legitimate reasons for concern. Over 45% of companies in the Russell 2000 are not profitable, burdened by high-cost debt. It is possible that many of these companies will quietly restructure, with investors shouldering the losses, leaving the broader economy unscathed. On the other hand, credit markets may experience turbulence, putting pressure on the real economy. Predicting the outcome is challenging, and we will refrain from succumbing to temptation.

It is also worth noting that valuations for most companies are quite high. The S&P 500 is trading at nearly 25x trailing twelve-month earnings, and this is not solely due to high-flying, top-heavy tech names. The median valuation stands at around 22x. Even companies that have experienced significant drawdowns this year are still trading well above intrinsic value. The VIX at 14 is much lower than anticipated, and we hope for increased volatility to raise the likelihood that our continual screening and analysis uncovers bargains.

Positions

SES imagotag

SES imagotag (SES) is the leading ESL provider in hardware, service, and software solutions. ESLs are electronic price labels that in the simplest sense, allow for retailers to dynamically price items. This frees up employees’ time to do more value add work such as helping customers and reduces waste. SES has installed close to 400mm ESLs globally and recently won a nationwide contract with Walmart.

On June 22, Gotham City Research released a comprehensive 60-page short report accusing SES of fraudulent practices. The market’s reaction was nothing short of astonishing, as the stock experienced a sudden and significant 60% selloff. As we diligently analyzed Gotham City’s report, we discovered that their central argument revolved around SES allegedly engaging in double counting of revenues through related party transactions with its major shareholder, BOE, a Chinese-owned company. However, the other concerns raised by the short seller lacked substance and primarily served to unsettle investors who had limited knowledge of SES.

Recognizing the need to address the concerns of their anxious investor base, SES management promptly composed a communication to investors. In a commendable display of professionalism, management calmly and systematically addressed each of the points raised by the short sellers, without becoming defensive and litigious. Management also had their external auditors (KPMG and Deloitte) release certificates confirming the legitimacy and proper handling of the intra-company transactions.

Following this, we made the decision to increase our investment in SES, as these responses instilled trust and confidence in us. Remarkably, the share prices still had not recovered given the pending release of a second short report from Gotham City. However, when the second part was released, rather than causing further harm, the stock rallied, surging by 35%. The market had swiftly concluded that the second report failed to provide any new substantial information and raised doubts about its credibility, leading to a dismissal of its claims. The share price is up almost 60% since our add and we expect that SES will continue to outperform.

Zumiez

The most recent addition to our portfolio is Zumiez (ZUMZ), a lifestyle retailer. It has faced a significant 70% decline from its 2021 highs, attributed to recessionary concerns impacting discretionary companies and small caps. Despite these short-term challenges, Zumiez has a history of demonstrating resilience throughout business cycles. By offering exclusive apparel, efficient inventory management, low leverage, and strategic lease negotiations, the company has sustained success over four decades. The recent decline in earnings, which is common for operationally leveraged retail businesses, should not raise long-term concerns. Improved earnings fundamentals are expected within the next 12 to 24 months, with an estimated 70% upside.

Our letter to Zumiez Board of Directors here: https://pernasresearch.com/zumiez-activist-letter/

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.