| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | -4.32% | .36% | 24.6% |

| S&P 500 | 4.28% | 15.22% | 14.6% |

| Russell 2000 | -3.35% | 1.57% | 7.0% |

| DJ Industrial Average | -1.25% | 4.69% | 11.8% |

The Pernas Portfolio underperformed equity markets in what was a volatile quarter for several of our Core Positions. Our UK names, Burberry and Doc Martens, were down 24% and 15% respectively, as both companies continued to report category-related challenges. The weakness in these categories (boots & luxury) was more pronounced than we anticipated given our entry into these names came after recession fears that had taken ahold and pandemic fueled spending had completely dropped off. We remain convinced that both companies have enduring brands and growth opportunities that will ultimately translate to improving fundamentals but will require more patience. The consumer shift towards value-seeking has been strong, with our Consumer Discretionary exposure at roughly 20% of the portfolio, nearly 40% of which is in Card Factory (a value-seeking brand), providing a good counterbalance to the higher-end offerings of Burberry and Doc Martens.

In contrast, another main detractor, Remitly (NAS:RELY), saw a price drop of 42% in the quarter despite strengthening fundamentals and guidance. The market simply does not believe that Remitly’s future is one of high levels of continued growth and scale. We continue to believe strongly that the market is wrong and that we will soon see a large rerating in the name.

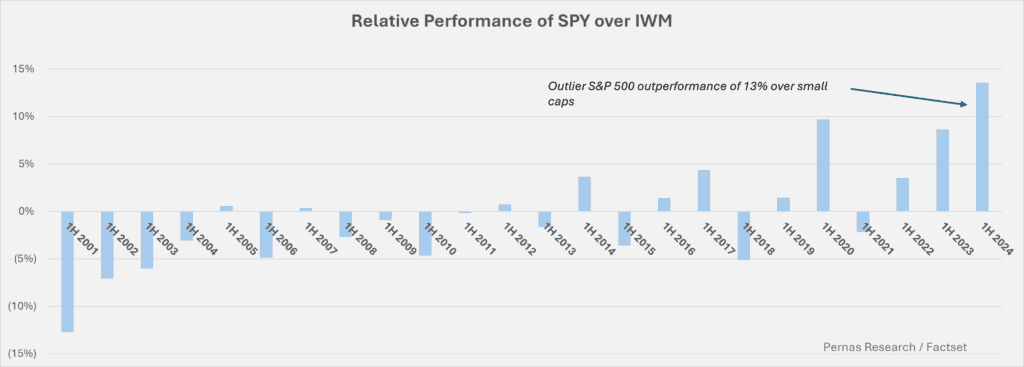

Large Caps vs. Small Caps

To demonstrate the anti-index nature of our portfolio, two main contributors this year, which have buoyed our performance, have been outsized gains from ARQ and TSSI, both small caps that are up well over 100%. This is in the face of the largest outperformance of large caps relative to small caps in recent history.

As we write this several weeks into Q3, small caps have seen a snapback in performance, surging 11.5% in five days. This is likely due to the overextension of large caps relative to small and more clarity over Fed cuts. We have been highlighting disinflation for a long time (first write-up about it in 2022 here) and continue to assert that sustained inflation is impossible with growing real economic output, stable money supply, and stable velocity of money. The only uncertainty is the rate of decline, but the general direction has always been clear. With labor markets starting to exhibit softness in Q3, it is becoming consensus that the Fed will cut in September, which could be a boon to small caps, particularly those in our portfolio that benefit disproportionately from their variable rate indebtedness.

Distribution + Proprietary Data + Tech Culture = AI Winner

We remain heavily focused on AI trends and believe we are in the early stages of what will likely be one of the most consequential technological moments for humankind. A single leap forward in AI capabilities will have profound impacts on companies. In the interim period over the next 12-36 months, we believe the big AI winners will be those at the application layer with a robust tech culture, proprietary data, and strong distribution, even if they do not currently have advanced AI capabilities. These companies will realize the potential of underutilized proprietary data, resulting in improved offerings, new upgrade cycles, and increased competitive advantages. Remitly and Xometry (detailed below) are positioned to benefit significantly from this trend. Alongside the application layer, we are also examining hardware AI companies such as data center service providers (e.g., TSSI) and energy producers. See here for our Generative AI analyses.

New Position: Xometry

We believe Xometry (NAS: XMTR) is the leading disruptor in digital manufacturing and is in the early innings of a significant secular growth story. Xometry connects businesses needing custom parts with a global network of manufacturers capable of producing them, offering a one-stop solution for processes like CNC machining, sheet metal fabrication, prototyping, low-volume injection molding, 3D printing, and tubing. Despite the industry’s slow adaptation to change, digital marketplaces like Xometry are gaining respect and recognition for their resilience. We expect this transition to be gradual but inevitable, as digital marketplaces enhance traceability, quality, and efficiency. Xometry is at the forefront, utilizing AI and machine learning for pricing, leveraging their industry-leading data sets to train their models. Full write-up here.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.