| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 10.8% | -18.4% | 22.2% |

| S&P 500 | 7.6% | -18.1% | 11.4% |

| Russell 2000 | 6.3% | -20.4% | 5.8% |

| DJ Industrial Average | 15.9% | -7.0% | 11.3% |

The Year Behind

This year was challenging from a performance perspective. Despite some of our portfolio wins (SES) and our ongoing de-risking efforts certain names performed poorly (AOUT) and contributed to an aggregate performance of -22%. While down years can be painful, they force us to consider potential mistakes made. Although it may be tempting, reaching too quickly for the first plausible mistake, or too quickly denying that mistakes were made are equally counterproductive. When looking at a period of only twelve months, the quality of the decision-making and the outcome do not have a high correlation. One should acknowledge that mistakes can be made—even in periods of outperformance—while maintaining an acute understanding that, when it comes to investing, drawing the correct lessons from portfolio underperformance can be an exceedingly difficult process. Two things contribute to this difficulty: Randomness and complexity. If an outcome involves a probabilistic element, how can one determine for certain whether the variance in outcome from what was predicted was due to chance or error in prediction? Complexity compounds the difficulty as forecasting a company’s cash flows involves an analysis of a myriad of factors: Was it poor management evaluation, flawed industry analysis, or misunderstanding of competitive positioning? Mistakes are often multivariate so a methodical approach to identifying them is key.

Lessons Learned

Our belief system is constantly evolving as the rigors of the market bring mistakes to light and the correct lessons are distilled. Adroit procurement of new or retooled beliefs and pruning of inferior ones is the fitness test for our success. This year, we strengthened our belief in the importance of intrinsic value estimates that are mainly comprised of earnings power rather than cash or other assets. Our intrinsic value calculation involves discounting a company’s future cash flows, subtracting debt, and adding back cash and other assets. Previously, we paid little attention to the proportion of intrinsic value that is attributable to cash and other assets, but now we realize that this is crucial for two reasons: 1) earnings power is more sustainable than cash, as cash can easily be misused or wasted by even well-meaning management teams; 2) intrinsic value based on other assets or cash may require a catalyst to reach market price, while earnings power acts as its own catalyst. When investing in a business with improving earnings power, a catalyst is not necessary. If we accurately estimate intrinsic value, the improvement in the company’s fundamentals will drive the price toward intrinsic value. This realization also means we place less importance on catalysts than before. Our focus is now on finding companies with improving fundamentals and having conviction in our prediction of their future cash flows. If we get this right, the rest will fall into place.

The Year Ahead

Recession

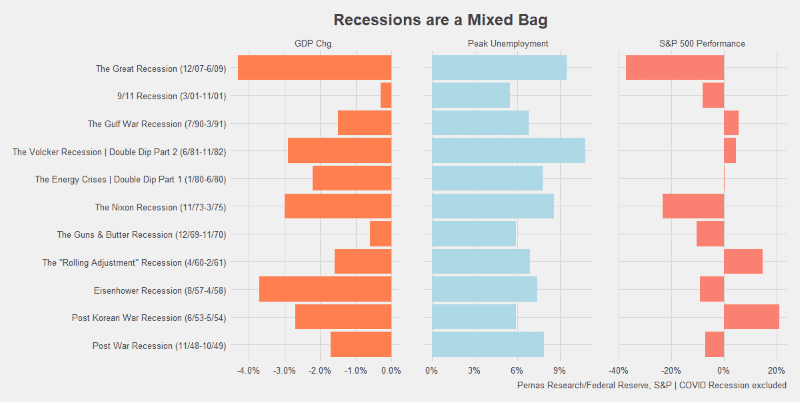

It’s a safe bet to assume that recession and inflation will remain big stories in 2023. While the word “recession” gets a lot of press it’s important to remember the obvious—it’s just a term for the slowdown of business activity. Instead of focusing on when the NBER officially declares a recession, it’s more important to gauge how severe a potential slowdown might be and how it aligns with market expectations. Below is data from all 11 recessions since the post war period (starting 1946).

The purpose of the table is to illustrate the wide range of variability across recessionary periods with respect to market performance, GDP decline, and unemployment level. Most first-year statistics students will know that eleven data points are not nearly enough to draw inferences from—especially when the range of data is so extreme. Averaging across past recessions and using this average as an indication of future recessions is unhelpful and can be dangerously misleading1.

2023 is particularly challenging because it is difficult to gauge what is priced into markets. Most market participants believe at least a mild recession is in the cards however earnings growth forecasts are still positive for 2023. Forward earnings multiples are by no means screening cheap and trading a tad shy of long-term averages of 16.5x. We are in the camp that believes a slowdown in business activity is likely and the slowdown may be greater than most market participants believe. This is because business confidence, the main driver of the business cycle, is trending downwards by every conceivable metric. Inflation presents a challenge, but the added uncertainty it brings is a greater concern. Businesses cannot plan confidently, leading to a slowdown in activity (more on inflation).

Our view is likely to be wrong if disinflation is rapid enough to buoy business confidence and the Fed provides some indication a pivot is underway. In the event this occurs, the injection of confidence will be enough to stave off a cyclical downturn. Like most of our short-term macro views, this stance is quite sensitive to new information so we will quickly update our view when material information comes to light.

Inflation

The monthly changes in the Consumer Price Index (CPI) have remained somewhat stable for the past six months, with the 5-year breakeven inflation rate nearing 2%. We anticipate that core inflation will reach the Fed’s goal of 2% by the end of the year. Disinflation is the single biggest catalyst because markets would be one step closer to continuing their love affair with dovish Fed policy. However, since Powell has repeatedly warned against premature loosening, barring severe economic distress, we anticipate that even with disinflation close to a 2% level by the end of 2023, it is not enough for the Fed to return to a dovish position in short order.

Perhaps this market call betrays a desire for the grotesque love affair that markets have with the Fed’s easy money policies ends. A system that prevents market forces from setting the price of money does so at the cost of its health. Unfortunately, we believe that going into 2024, when inflation is well behind us and a new presidential cycle is underway, the love affair will continue. The Fed, with its ever-expanding toolkit, has been too successful at stimulating market activity to not be pressured by Congress and the public to do so ad nauseam. Inflation has been the unwelcome third wheel that has put the love affair on pause but will be leaving the date party soon.

The Future

Even though we are calling for certain market dynamics to ultimately revert to old patterns, challenges remain. In response to a question about which of the sciences will emerge as the most impactful, Stephen Hawking replied, “the 21st century will be the century of complexity”. From a financial perspective, this certainly rings true. Increasing central bank influence, disruptive technologies, geopolitical concerns, rapidly evolving cultural norms, aging demographics, and climate change will all play competing roles in shaping market forces. We are of the opinion that the world is more complex today than it has ever been. Those that can continually adapt by reaffirming, retooling, and refining their beliefs will thrive in such an environment. We welcome the challenge and look forward to an exciting year to come.

Footnotes

1Even if the data was Gaussian, which it is not, we would still need a minimum of 30 data points to make a reasonable approximation of the range of outcomes. (info from statistics literature)

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.