| Price (6/1/2024) | $70.63 | Estimated Upside | — |

| Market Cap (mm) | $942 | EV/EBITDA (trailing) | 11 |

| 12-month perf (%) | 73% | P/E (trailing) | 23 |

| 30-Day Avg. Volume | 97k | Maint. Capex (mm) | 3 |

| 3-Yr Rev Cagr | 11% | Growth Capex (mm) | 5 |

| LT Debt (mm) | 0 | Adj. ROIC | 12% |

| Insider Ownership % | 6 | Adj. FCF Yield | 6% |

Neutral rating on Argan Inc this month. Through extensive research, analyses, and speaking with IR, our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

Argan, Inc. is a prominent engineering, procurement, and construction (EPC) company, primarily operating through its subsidiary, Gemma Power Systems, which specializes in designing and constructing natural gas power plants. Clients engage Argan, Inc. to deliver turnkey services, encompassing the entire process from design to procurement and construction of these plants. Currently, natural gas plants account for approximately 43% of the United States’ energy production, a significant increase from 30% a decade ago. Despite the growth in natural gas usage, its future in the U.S. remains uncertain due to the rising adoption of renewable energy sources such as solar and wind. Although there might be a temporary increase in demand, we consider estimating the extent to which Argan, Inc. will benefit to be uncertain at the moment and prefer to wait for a more substantial margin of safety.

Company Background

Argan, Inc. (AGX) comprises three primary holdings: Gemma Power Systems, Atlantic Projects (AP), and Roberts Company (RC). AGX acquired the latter two in 2015. AP is an international power subcontractor, while Roberts Company specializes in industrial fabrication. Although there is minimal overlap between Gemma and AP due to their operations on different continents, our focus will primarily be on Gemma, as it is the main source of revenue and profits.

Current management has adopted a more conservative approach towards acquisitions, emphasizing the core business. AGX is engaged by customers, including public utilities and privately owned operators, to design, procure, and construct natural gas power plants. These projects can be either greenfield, involving the construction of entirely new power plants, or brownfield, which entails retrofitting or expanding older plants. The U.S. faces a significant challenge with its aging power plants, both coal and natural gas, many of which will need to be refitted or replaced. Estimates indicate that around 83 GW of planned retirements are scheduled over the next decade, equivalent to approximately 70-100 power plants.

Argan, Inc. (AGX) competes against larger companies such as Bechtel and Kiewit. AGX maintains a leaner overhead cost structure and hires labor from the surrounding area of each project. Although this approach is logistically challenging, it provides cost and political advantages. Management upholds strict cost discipline with their fixed-price contract bids, a crucial ability that sets AGX apart. Their precise cost estimation with a significant margin of safety has enabled AGX to avoid losing money on a contract for 16 years, demonstrating their discipline and reliability.Recently, AGX completed the construction of the Guernsey Power Station, one of the largest natural gas plants with a nameplate capacity of 1.8 GW, showcasing their strong industry reputation.

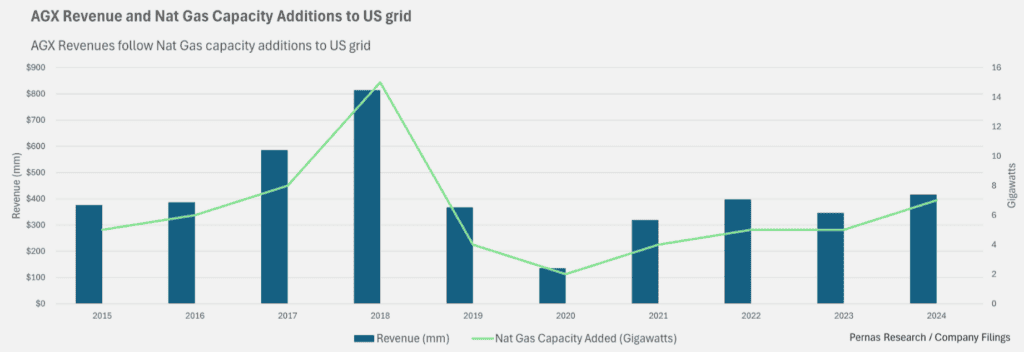

AGX’s revenues are variable and generally follow the pattern of natural gas plant additions in the USA, as discussed in the following section. Over the past decade, revenues peaked at $800 million in 2018 and are now about half of that. AGX’s peak backlog was also approximately twice its current level ($1.4 billion vs. $800 million). Natural gas capacity additions are decided about three years in advance by regional electricity transmission organizations in the United States (e.g., PJM, ERCOT, MISO), which conduct annual auctions to ensure sufficient power generation capacity to meet forecasted demands. The 2023 auctions have been lackluster, with both demand and prices lower than in 2022. About 20 new natural gas-fired power plants are expected to come online in the U.S. in 2024 and 2025.

Power in the USA

The future of Argan, Inc. (AGX) is closely tied to the demand for natural gas. It is crucial to understand how this industry will evolve over time. Currently, natural gas accounts for about 40% of U.S. energy consumption, which totals approximately 4,500 terawatt-hours annually. Other sources of energy generation include coal, renewables, and nuclear energy. Historically, natural gas has been considered a “bridge fuel” due to its lower greenhouse gas emissions compared to coal, yet it remains a fossil fuel and serves as an intermediate step towards greener energy solutions.

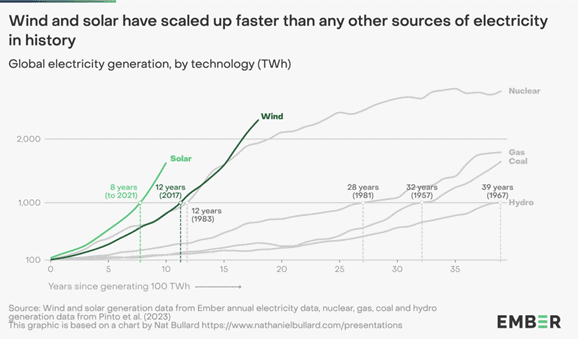

Although natural gas consumption has doubled over the last twenty years, the future energy landscape in the U.S. is expected to change significantly. Wind and solar energy penetration have accelerated faster than any other energy source in history. Solar energy costs have decreased substantially over the past decade, and with the sun providing an infinite energy source of approximately 175,000 terawatts continuously, solar energy is poised to become a major driver of future energy production.

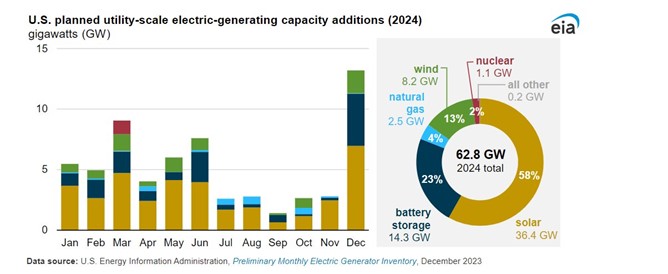

Regulatory restrictions on fossil fuels, combined with subsidies and tax credits for renewable energy, will drive the decline of fossil fuels and the rise of renewables. By 2050, the U.S. Energy Information Administration (EIA) predicts that the share of natural gas-fired electricity generation will decrease from 43% in 2023 to approximately 22%. Energy generated from other fossil fuels, such as thermal coal, is expected to become negligible. Today, most new additions to the grid are solar and wind. However, this dynamic could change if U.S. energy demand increases significantly.

Source: U.S. Energy Information Administration

Future energy demand

Over the last two decades, U.S. energy consumption has remained relatively flat despite a 16% increase in population. The energy offset to population growth can be attributed to energy efficiency initiatives and the outsourcing of manufacturing. However, the near future might present a different scenario. Several factors are converging to potentially increase energy demand: the penetration of electric vehicles (EVs), the onshoring of manufacturing, the development of carbon sequestration technologies, and, notably, the rise of AI data centers. Given these trends, it is conceivable that by 2030, U.S. energy consumption could be at least ten percent higher than today.

To meet this increased demand, there would need to be a significant rise in both natural gas plants and renewable energy sources, which would greatly benefit AGX. This anticipated surge in energy demand also explains the development of new technologies such as modular nuclear reactors. Sam Altman, CEO of OpenAI, is also leading Oklo, a company focused on nuclear modular reactors, reflecting the growing interest in innovative energy solution for unprecedented energy demand.

Opportunities

Surge in Energy Demand

Increased energy demand in the interim could significantly outpace even the most optimistic forecasts. The convergence of AI and EV adoption could mark a turning point in U.S. energy demand, with EV adoption alone potentially increasing electrical energy demand by 15%. The U.S. will need to add roughly 200 GW to 350 GW of capacity to the grid by 2030, given that the current grid capacity is about 1,160 GW.

Renewable Technologies

AGX is making a push into other renewable technologies to be seen as a technology-agnostic provider in the energy sector. In addition to natural gas plants, they are constructing solar plants, wind farms, biomass projects, and waste-to-energy facilities.

Trade Wars

Trade wars with China will increase the costs of solar and wind energy due to higher tariffs on imported components, which China supplies in large quantities. These tariffs would elevate production costs for solar and wind projects in the U.S., as companies would either pay more for Chinese imports or incur expenses to source or manufacture alternatives domestically. This situation could give a significant boost to natural gas plant demand.

Risks

Renewables will continue to take energy share

Renewable energy sources will supplant natural gas. This is more a question of when rather than if. If energy needs increase gradually, they will likely be met with renewable energy sources or newer technologies such as modular nuclear reactors. Solar energy is now more cost-effective than natural gas, and it is likely that it will continue to become cheaper.

Prohibitive Regulation

Regulation could further inhibit the expansion of natural gas plants, as it dictates where gas pipelines can and cannot be built. Without a pipeline, natural gas plants cannot function. The effects of this can be seen in states such as California and New York, where regulatory restrictions have impacted natural gas infrastructure development.

Conclusion

Although AGX is managed by a capable and shareholder-aligned team, the future of natural gas demand is currently difficult to ascertain due to regulatory hurdles. AGX’s business is closely linked to natural gas, which is why the company has been expanding into the renewable energy space. Demand for natural gas could potentially shift due to large-scale energy demands that cannot be met by new solar and wind capacity additions, political changes driven by Republicans, or trade wars. Given this future volatility, we believe there will likely be more opportunistic moments to initiate a position in the future.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.