| Price (5/1/2024)* | £1.08 | Estimated Upside | 50% |

| Market Cap (mm) | £372 | EV/EBITDA (trailing) | 4 |

| 12-month perf (%) | -2.99% | P/E (trailing) | 7.6 |

| 30-Day Avg. Volume | 1,004,428 | Maint. Capex (mm) | £12 |

| 5-Yr Rev Cagr | 3.3% | Growth Capex (mm) | £16 |

| Net Debt (mm) | £34 | Adj. ROIC** | 20% |

| Insider Ownership % | 6% | Adj. FCF Yield** | 15% |

Thesis

Card Factory, a leading UK-based, vertically integrated retailer of greeting cards and a significant seller of celebration essentials and gifts (balloons, party supplies, picture frames, stuffed toys, etc.), has cultivated a strong brand identity by excelling in value, quality, and selection. Despite competitors possibly matching them on two of these dimensions, it’s highly unlikely any can surpass Card Factory across all three. Card Factory is in a position to earn high returns on capital for many years to come. Volumes of the greeting card market are set to remain flat or be in slight decline, and the market is viewing Card Factory as a member of a declining market when, in fact, Card Factory is poised to continue to gain market share in greeting cards and grow share in the growing market of celebration essentials and gifts. Like most of the companies we look for, with Card Factory trading at only ~7.5x EV-to-normalized-free-cash-flow, the market perception is that Card Factory is getting weaker when it is, in fact, getting stronger. We expect Card Factory’s free cash flow to grow at low teens over the next five years and the cash flow generation over this period will be greater than the current enterprise value of the firm. We believe this company has comfortably greater than 50% upside.

UK Greeting Card Industry

The sending and receiving of greeting cards is an especially British phenomenon, deeply embedded in the culture. Britons engage in this tradition at a rate 2-3 times higher per capita compared to the United States, where greeting card sales are generally in a secular decline of about 2-3% annually. In contrast, the UK market experiences a slower decline in volume, around 1% per year. Sharon Little from the UK Greeting Card Association encapsulated this cultural significance in 2015, stating, “No other country has such a tradition of card sending or card display in the home. The sending and receiving of cards is an important part of our (British) culture…we don’t write many letters anymore – so it’s actually cards that are the last bastion of handwriting.”

In the U.S., the greeting card market is heavily dominated by Hallmark and American Greetings, which control over 90% of the market. These companies provide comprehensive turnkey solutions to retail merchants, handling everything from inventory management to refreshing cards, presentation, and pricing. The merchant’s role is solely to decide how much space to allocate for the displays. This model simplifies operations for retailers but results in less flexibility in how products are marketed and priced.

Conversely, in the UK, even though Hallmark and American Greetings (aka UK Greetings) have a similarly strong presence, the market dynamics are different. UK merchants take a more hands-on approach, particularly in pricing and product selection. From insider discussions, it is common for supermarkets, for example, to set price constraints or express preferences for certain categories. This is likely due to the greater cultural importance of greeting cards in the UK and the presence of Card Factory, which dominates the value-end of the market. Competitors are acutely aware of Card Factory’s low-priced model and have attempted to introduce similar value offerings to remain competitive.

More broadly, the competitive categories for the UK greeting card market include specialty retailers (Card Factory, Clintons, Paperchase, or online platforms like Moonpig), grocers like ASDA and Tesco, as well as general merchandise stores such as Wilko and Home Bargains. Although Card Factory controls ~30% of the UK greeting card market by volume, market share by value is roughly divided into thirds among these three channels.

Company Background

Beginnings

Founded in 1997 by Yorkshireman Danny Hoyle, Card Factory set out with a clear vision: to deliver the same quality of greeting cards as the leading UK specialty retailer at the time, Clintons, but at a third of the price. The strategy quickly gained traction, and as the store count grew throughout the early 2000s, Card Factory began facing pressure from competitors who urged major supplier Hallmark to coerce Card Factory into raising its prices (he stated they threatened him with ending their supply contracts).

Determined to steer his own course, Danny Hoyle initiated a strategic move towards vertical integration, aiming to control every aspect of the greeting card supply chain from publishing to design. This shift began with the acquisitions of design studios Card Concepts and Excelsior Graphics in 2006 and was further solidified by acquiring Printcraft in 2010, which brought printing operations in-house. This vertical integration was the foundation of Card Factory’s resilience and competitiveness, enabling the company to maintain quality while controlling costs. By focusing on offering high-quality products at compelling price points—with cards starting as low as 29p—the company carved out a strong niche in the budget sector of the market.

Danny Hoyle sold the company to the private equity firm Charterhouse in 2012 for £350 million, and Card Factory went public in 2014. During its IPO debut, Card Factory boasted a 16-year streak of consecutive same-store sales growth and an extensive network of 700 stores, 99% of which were profitable. This impressive growth was supported by a diversification strategy that saw non-card items like celebration essentials and gifts increasingly contributing to revenue, accounting for one-third of total sales at the time of the IPO. Since then, Card Factory has successfully maintained its image as a budget brand, with the average selling price (ASP) of its cards modestly increasing from 87 pence at the time of the IPO to 1.11 pounds today, reflecting both inflation and the enhanced value offered through product diversification and quality improvements.

Post-IPO

The company continued to expand its store count, currently reaching over 1,000 locations primarily clustered in city center high streets across the UK and Ireland. Despite this growth, Card Factory’s perfect record of 23 years of uninterrupted same-store sales growth was disrupted in FY 2019. This was due in large part to intensified competition from grocery chains like ASDA, which leveraged their scale to negotiate agreements with suppliers enabling them to introduce greeting cards with an even lower opening price point of 28p (1p below Card Factory). Additionally, although an upmarket brand, the strong online competitor Moonpig became the far and away dominant online greeting card retailer in the UK and began to siphon off some market share from traditional retail channels. (Moonpig’s growth and the online channel, while initially disruptive, has reached maturity and slowed down significantly. The dependence on postal services for delivery presented a disadvantage against in-store purchases, especially for minor card transactions aimed at avoiding shipping costs.) The increased competitive environment meant Card Factory could no longer rest on its laurels and would need a refresh of strategic thinking and capital allocation.

COVID-19 Impact and new management

The COVID-19 pandemic dealt a severe blow to Card Factory, forcing the closure of all stores and shifting consumer traffic largely to supermarkets. Despite initial market skepticism about consumer loyalty, Card Factory witnessed a robust resurgence in customer traffic and sales upon reopening, with revenues surpassing pre-pandemic levels—a testament to the brand’s strength.

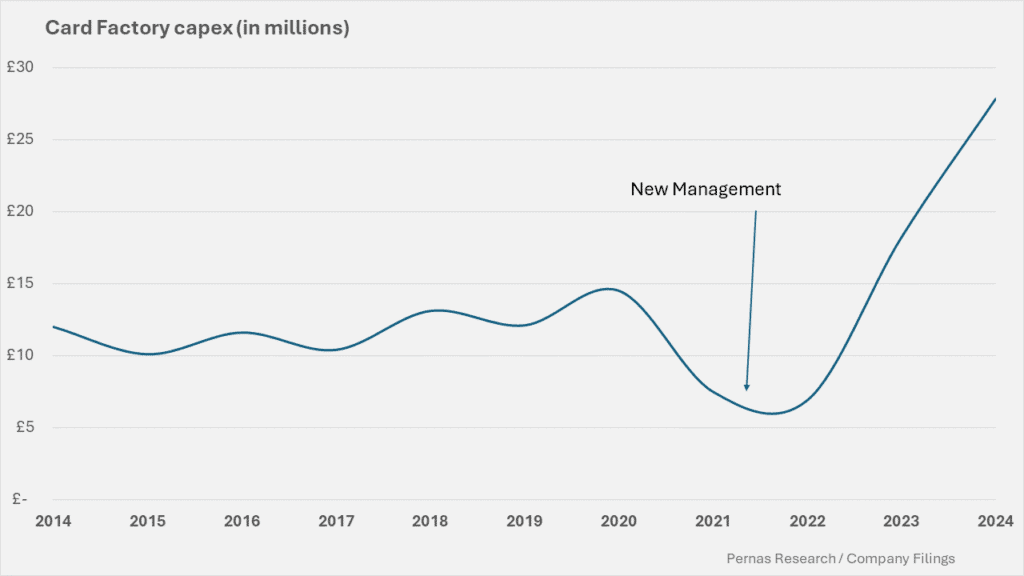

In response to the aforementioned competitive challenges, new management led by former CEO of Costcutter Supermarkets Group, Darcy Willson-Rymer, undertook a new cycle of growth investments—the first since the company’s IPO (see below). This includes significant capital expenditures targeted at enhancing the online customer experience and expanding its product offerings. They reconfigured the store layouts by reducing the space allotted to greeting cards by 7% and strategically placed them around the perimeter of the store, making room for celebration essentials and gifts at the center. This shift not only optimized the use of retail space but also aligned with broader consumer trends towards one-stop shopping experiences. They are transitioning Card Factory from being a store-led card retailer into a market-leading, omnichannel retailer of cards, gifts, and celebration essentials.

Tangible evidence is already apparent that reflects new management’s success. Non-card items (celebration essentials and gifts), now ~51% of revenue versus pre-COVID penetration of 44%. These items, although lower in margin due to being predominantly sourced from Asian manufacturers, have successfully broadened Card Factory’s market appeal and positioned their revenue stream towards a much larger market with unit growth. More importantly, new management has also driven a return of same-store sales growth of 7.6% in FY 2024 (this is off a solid FY 2023 comp).

Competitive Advantage

Vertical integration

As the only vertically integrated brick-and-mortar greeting card retailer in the UK, Card Factory holds a unique position in the market. With over 1,000 stores nationwide, the company leverages the scale of its extensive retail network to effectively spread the capital costs of its in-house production facilities across its operations.

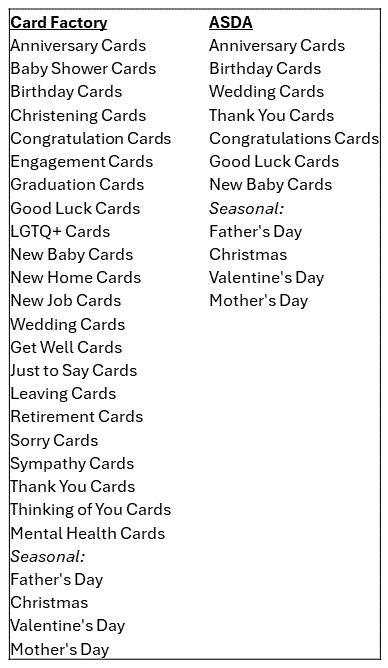

Card Factory’s vertical integration provides a robust competitive edge, allowing comprehensive control from design to distribution. This model enables quick adaptation to market trends, exemplified by their popular pet-themed cards, showcasing agility and responsiveness. Additionally, Card Factory efficiently manages the inherent complexity of the greeting card industry, characterized by extensive SKU diversity. This focused approach supports a broad product range and meets diverse consumer preferences effectively. Unlike general retailers dependent on suppliers like Hallmark, Card Factory’s specialization ensures higher quality and greater product variety. Below is a comparison of the categories of card greetings offered by Card Factory and a large competitor in the budget space, ASDA supermarkets.

Management’s competency

While it’s generally challenging for us to base an investment thesis largely on the quality of management (people we will never know personally), the current CEO and CFO of Card Factory bring formidable backgrounds and qualifications that are well-suited for leading a value-oriented retailer. Their previous experiences and the tangible results they have produced so far suggest they are capable of elevating Card Factory’s market position.

Opportunities

Market misconceptions

Market participants view Card Factory’s business model as in decline given the broader volume declines of cards. Despite small declines in UK card volumes, Card Factory has witnessed an increase in revenue from card sales. We do not view the slight volume decline as detrimental given the company continues to show evidence it can expand market share in cards and use this dominant market position to offer additional complementary products.

Non-card growth

The most significant growth potential lies in non-card products. The new management is strategically reducing the floor space dedicated to greeting cards to increase the visibility and accessibility of gifts and other products. Currently, only 17% of Card Factory’s customers purchase gifts along with their cards, while the industry average stands at about 70%. This indicates a substantial opportunity to boost sales through better store layout and presentation, which management is currently executing on.

Partnerships?

Management has made a push to increase international partnerships with Matalan in the UAE, The Reject Shop in Australia, and S.A. Greetings in South Africa. We believe the opportunity here is less concrete than other growth avenues. If they meet their target of ~80mm in partnership revenue by FY 2027, it is uncertain to us what the profit picture of this segment will be. Greeting cards are a unique market, and expanding beyond UK borders—where Card Factory maintains all its infrastructure—is likely to pose challenges (of course, as shareholders, we would be happy to be proven wrong…to be clear, we are still very bullish despite our reservations on this small segment).

Risks

1. Dependency on Zero-Hour Contracts: Card Factory’s business model is significantly influenced by seasonal peaks, with major holidays like Christmas, Mother’s Day, Valentine’s Day, and Father’s Day (we estimate driving over 50% of annual revenues). To manage these peaks efficiently, Card Factory relies heavily on zero-hour contract employees, which offer flexibility without guaranteed hours. However, this reliance poses a risk if regulatory changes were to impose restrictions or additional complexities on the use of such contracts.

Mitigating Factor: At present, there are no indications of impending legislative changes affecting zero-hour contracts.

2. Recession Risks: Economic downturns pose a general risk to retail sales, and Card Factory could experience a decline in sales during significant economic slowdowns. While greeting cards have historically shown resilience as a low-cost, sentimental purchase during recessions, the increasing share of gifts in Card Factory’s revenue mix could introduce greater vulnerability.

Mitigating factor: Card Factory was able to grow same store sales through 2008 & 2009 even with significant exposure to non-card sales.

3. Volume declines of greeting cards accelerate: The risk is that volumes decline faster than Card Factory anticipates.

Mitigating factor: British culture strongly supports the sending and receiving of greeting cards. Furthermore, surveys of 16-24 y/o cohort in the UK indicate an increase in number of cards purchased per buyer.

Valuation

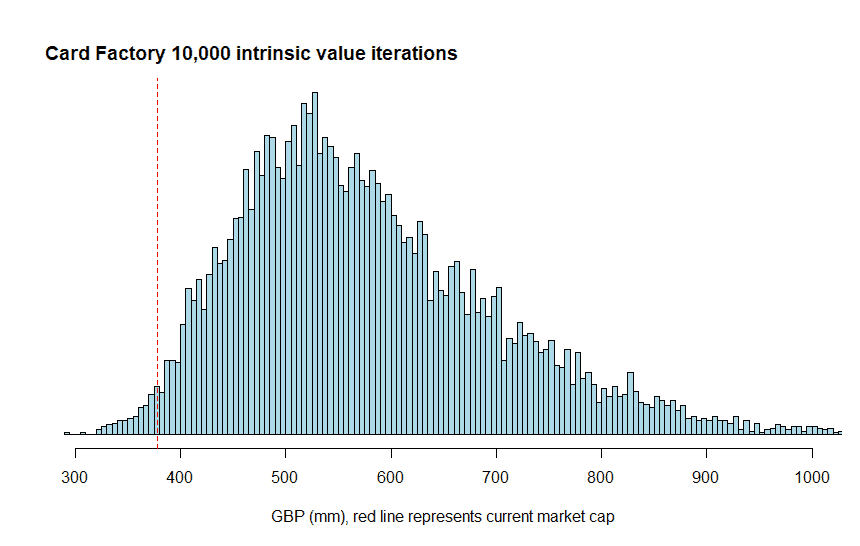

We believe that Card Factory will be able to grow revenues by ~7% in the intermediary period and we estimate normalized free cash flow of ~£62mm for FY 2025. Given Card Factory’s operating leverage, non-variable expenses will grow sub-linearly, and we estimate FCFF growth at low teens for the intermediary period. Applying a range of discount rates to future cash flows and netting out net debt, we arrive at an intrinsic value of the equity at £565mm, signifying greater than 50% upside from current levels.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.