| Price (8/1/2024) | $11.69 | Estimated Upside | — |

| Market Cap (mm) | 6,711 | EV/EBITDA (trailing) | NA |

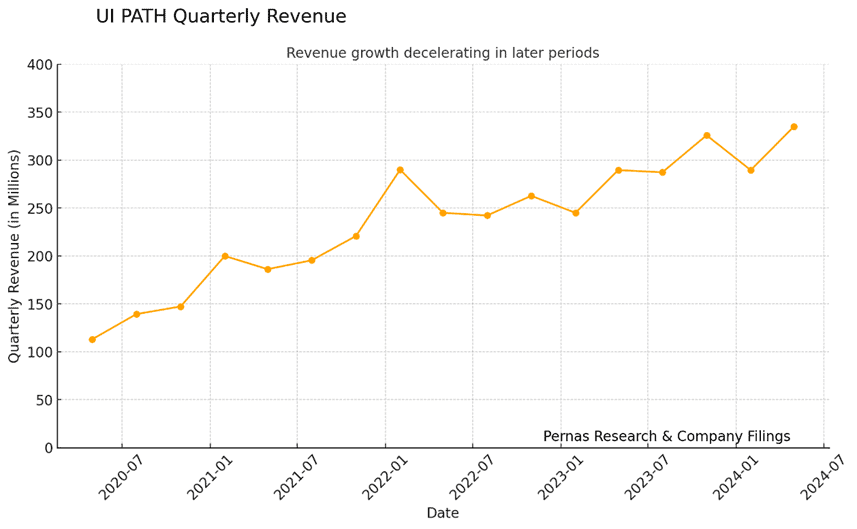

| 12-month perf (%) | -51% | EV/Sales | 4.1 |

| 30-Day Avg. Volume | 11,400,150 | Cash Burn | 0 |

| 3-Yr Rev Cagr | 15% | Cash & equivalents (mm) | $2,100 |

| LT Debt (mm) | 0 | Adj. ROIC | NA |

| Insider Ownership % | 7% | Adj. FCF Yield | NA |

Neutral rating on UI PATH (NYSE:PATH) this month. Through extensive research, analyses, and speaking with IR, our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

PATH specializes in developing automated workflow systems for companies, serving a diverse range of industries and marquee clients such as Adobe, Applied Materials, Chevron, and Uber. Since its IPO in 2021, PATH has experienced an approximate 80% decline, driven by a slowdown in enterprise spending and a growing perception that Generative AI is a superior alternative to traditional automation workflows. While PATH has strong potential for long-term growth, the current uncertainty surrounding its business leads us to adopt a cautious stance. The company has yet to formulate a coherent strategy for integrating Generative AI into its automation solutions and appears to be in a state of limbo. With the previous CEO’s resignation, announced layoffs, and the founder’s return to leadership, PATH is at a juncture. We believe that with the right strategy, Generative AI can enhance PATH’s prospects by leveraging its existing enterprise relationships to significantly expand the economies of scope of its solutions. We will await a clearer strategy and evidence of successful execution before considering initiating a position.

Background

PATH was founded in 2005 by Daniel Dines, a Romanian entrepreneur who still retains 88% voting power of the company. PATH’s mission is to automate repetitive workflows in white-collar jobs. Just as repetitive and laborious tasks in the blue-collar industry have been automated by robots, Robotic Process Automations (RPAs) (more below) aim to eliminate the equivalent tasks in white-collar roles. RPAs integrate UI, API, and low-code development, enabling anyone to create and deploy them. It is likely that the automation layer will eventually sit above the application layer in the enterprise stack.

Although initially getting a company to adopt RPAs can be challenging, once implemented, companies rapidly expand their usage. For instance, PATH saw a 57x ARR increase in their 2016 cohort, an astounding growth metric. Despite this strong growth and PATH’s reputation as the gold standard for RPAs, its growth has slowed over the past few years due to reduced enterprise spending and the rise of generative AI. Companies are now reassessing whether RPAs are the optimal tool for their needs.

What is an RPA?

An RPA is computer software that can perform tasks such as opening emails, scraping data, connecting to APIs, loading web and enterprise applications, and moving/copying/pasting files—essentially any non-value-added tasks that employees handle. The purpose of RPAs is to automate standard and repetitive workflows, thereby increasing the speed of business operations or internal ‘clock speed.’ These workflows can span various departments, including IT, HR, and customer service. Examples include moving data from one application to another after cleaning it, processing customer orders, reimbursing payments, and managing legacy systems without API integration. Automating these tasks has saved customers millions of man-hours.

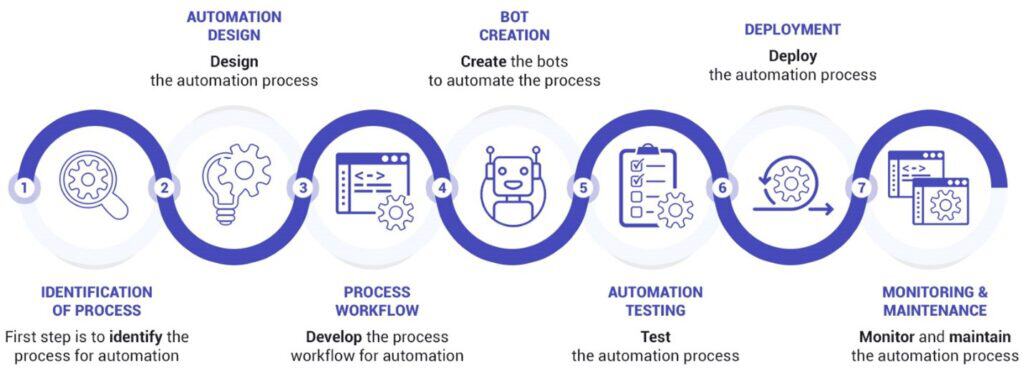

So, how does a company begin implementing RPAs? The process involves several steps, starting with process mining. PATH deploys machine vision to detect the automated steps users perform in their daily operations. This allows enterprises to identify repetitive tasks across a permitted list of applications. PATH then aggregates the anonymized and recorded processes to distill tasks that can be automated. Once deployed, measuring the performance of RPAs is crucial, as businesses need to see process improvements to justify the costs. PATH’s UI, named Orchestrator, is the core of automation management. It provides businesses with the tools to deploy, monitor, and measure the operation of RPAs. Orchestrator tracks and logs robot activity, along with human interactions, ensuring strict compliance and governance through dashboards and visualization tools. This system of records is essential for maintaining operational efficiency and transparency.

Source: Terranoha

Go To Market

Given the enterprise-scale change in user behavior required to create and implement RPAs, the right go-to-market strategy is critical. PATH employs a land-and-expand business model centered around products that are easy to adopt and provide a quick time to value, such as their ‘Read PDF Text’ feature, which converts PDFs into corresponding Excel sheets. PATH utilizes both a direct sales force and a partner network, including the largest consulting firms, to drive sales and change corporate employee behavior. Additionally, PATH has partnerships with leading CRM and ERP companies, including Microsoft Corporation, Oracle Corporation, Salesforce, and SAP. Notably, SAP has started selling pre-built PATH workflows to help customers automate back-end functions and upgrade to SAP HANA.

Competitive Landscape

The industry is competitive, with existing players now vying to become the de facto enterprise automation platform. The largest player in the space is ServiceNow, with smaller competitors including Appian and Automation Anywhere. There are also specialized players such as Guidewire and Duck Creek, which focus primarily on the insurance sector. There is significant lock-in with customers once an enterprise rollout occurs, with revenue retention rates exceeding 100%.

As Gen AI has expanded the scope of automation, previously partitioned companies are vertically integrating as both the number of automatable workflows expands and the ease of creating automated workflows increases. For example, ServiceNow historically targeted IT departments and complemented PATH, with the two workflows integrating seamlessly. However, CEO McDermott has recently been making significant efforts to expand ServiceNow’s business to other enterprise workflows.

PATH is approaching the industry from the opposite end of the spectrum. It started as a more generalized automation tool that any employee could utilize. In an industry of specialists, PATH stands out as the generalist. PATH also differentiates itself with more international exposure than competitors. Only about 30% of PATH’s revenue is from the USA. When automating workflows across enterprises that span the globe, this geographic footprint is a large advantage.

Opportunities

Gen AI expands the scope of automation (demand side) and the ease of creating them (supply side)

Automation capabilities have been significantly expanded due to generative AI, which is analogous to the invention of the microchip that made physical robots possible. For instance, RAG-based research can now automate workflows involving the retrieval of procedural information, a task previously done manually by humans. The ability to automate has also expanded on the supply side. Historically, individuals without significant coding experience were excluded from creating RPAs. However, with the proliferation of text-to-program prompts, this barrier has been significantly reduced

A centralized repository that acts as a system of record will be needed as LLMs and Agents proliferate

Although the proliferation of large language models (LLMs) and Agents will lead to productivity gains for companies, it will simultaneously create governance and compliance challenges. A system of records and checks and balances will need to be installed to ensure that proprietary data is not leaked. This centralization adds value to an automation platform that can serve as the repository of workflows and records. Such a platform will ensure the security, governance, and audit capability required for more autonomous workflows.

Robots will become Agents

In the future, robots will evolve to become Agents. These Agents will function as subject matter experts, capable of creating best practices within an organization and effectively utilizing the appropriate system applications to facilitate these tasks. PATH has significant training data across industries from its access to computer screens and application data, positioning it well for this evolution.

Risks

Microsoft may begin to evolve from a complement to a competitor

Throughout PATH’s operating history, Microsoft (MSFT) has been a vital partner. This ‘co-opetition’ relationship has significantly driven PATH’s growth, leveraging Microsoft’s distribution capabilities. However, it is likely that Microsoft will position itself more aggressively in the future with its ‘Power Automate’ offering. Although currently focused on personal automation, Microsoft will likely make a more concerted effort to expand into the enterprise sector. This development will not spell the end for PATH but will significantly handicap its growth rates.

Lack of coherent strategy to be seen as a leader in Gen AI workflows

PATH has stumbled over the past year as the new CEO has floundered. Growth rates have declined from 50% year-over-year to 15%. While some of this slowdown can be attributed to the broader market, it appears that the product-market fit has been changing with the advent of generative AI. There is yet to be a well-defined strategy for driving the next phase of growth, which is partly why Founder Daniel Dines is back at the helm. PATH has recently announced layoffs of ten percent of its workforce.

Conclusion

With the right strategy, PATH has significant long-term potential. However, the current price combined with the state of the business, keeps us on the sidelines for now. We will wait for PATH’s strategy to further coalesce and for the industry landscape to develop. We are optimistic that Dines has the right framework, and with the proper execution, PATH could become a long-term compounder. Additionally, PATH has a $2 billion war chest and no debt—its capital allocation decisions will be crucial in setting the future trajectory of the company.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.