| Price (10/1/2023) | $25.22 |

| Market Cap | $4.57B |

| 30-Day Avg. Volume | 1,418,000 |

| 12-month perf | 128% |

| Gross Margin % (latest) | 53% |

| P/E Ratio (trailing) | NA |

| LT Debt | $34mm |

Thesis

Remitly is poised to become the global leader in cross-border digital remittances. While consistently gaining market share from traditional players like Western Union and MoneyGram, the ongoing shift from cash-to-cash remittances to digital transactions provides a significant tailwind. Although the company is only recently projecting positive cash flows, scale economics for digital remittances are attractive. As their volumes grow, they will continue to renegotiate lower variable costs and spread their fixed costs over a much larger customer base. Their digital solution, infrastructure, and fraud detection capabilities are expected to maintain their best-in-class status, assisting to double their market share within three to five years. The market underestimates Remitly’s large growth potential and the stock is currently undervalued, with the potential for a 100% upside from its present levels.

Company Background

Short History

The company was founded in 2011 with the purpose of improving the sending and receiving of cross-border remittances. The Remitly app enables a migrant (typically in a developed country) to initiate a funds transfer to a recipient (usually in a developing country), who can receive the transfer through various methods such as cash, mobile wallets, and bank account transfers. The company generates revenue through transaction fees and currency exchange spreads, which, based on their most recent filing, averages an all-in take rate of 2.4%. Annualized principal volume sent is now 60% greater than when the company went public in 2021. Remitly has achieved this growth by capturing market share from competitors, thanks to its superior digital offering and lower-cost remittance fees.

Global Cash Distribution Network

Although all of Remitly’s remittances are initiated digitally, a significant portion of their cross-border transfers (estimated at nearly 40%) are received in cash. Many market observers find it surprising that the number of “cash pick-ups” is so substantial, considering that 95% of the global population has access to mobile broadband. The primary reason for this phenomenon is that a considerable portion of the global population remains unbanked — according to the World Bank, 1.4 billion adults do not have a bank account. Therefore, having a vast global distribution network for cash pick-ups is crucial for being a global cross-border remittance provider. This is the primary reason why legacy players like Western Union and MoneyGram have historically dominated the space, despite charging high fees. Both companies maintain several hundred thousand cash pick-up locations worldwide, and until recently, their extensive cash distribution networks were not easily replicable

Fortunately for Remitly, recent advancements in global payments connectivity have allowed the company to successfully establish a large global cash distribution network, a feat that took legacy players three decades to achieve. Companies like Thunes offer open-access cross-border payments infrastructure, enabling payment companies to connect without the need for direct relationships. As transaction volumes increase, payment companies can then develop direct integrations with local payment partners, allowing for the scaling of variable costs. Remitly’s Founder & CEO, Matt Oppenheimer, summarized their scaling strategy during the Q1 2023 Earnings Call:

“Often, when we initially enter a market, we collaborate with global aggregators to gain rapid access to local disbursement methods, such as specific banks or cash pickup locations. As our volumes grow, we shift our focus towards establishing direct integrations with local payment partners to provide a superior customer experience and a more efficient cost structure.”

Competitive Advantages

Focus

Currently, Remitly operates in 30 sender markets and 140 receiver countries. Sender markets tend to be more developed, while receiver markets are often in the developing stage. Each sender market has distinct customer profiles, payment acceptance procedures, and compliance requirements. Similarly, each receiver market presents a unique mix of unbanked customers and varying preferences for receiving funds, whether through banks, cash, or different mobile wallets. When you consider that each corridor, defined as a route between two countries, has its own set of characteristics, the complexity multiplies significantly when the number of corridor combinations reaches into the thousands. The remittance market is inherently intricate, and companies that lack a steadfast commitment to focused specialization will struggle to remain competitive.

Remitly’s greatest strength lies in their unwavering focus on global digital cross-border remittances for migrants. For nearly every other competitor, digital remittances are just one facet of a broader array of services. Companies like Western Union (within their digital division), Xoom, and Ria all operate under a larger umbrella, which doesn’t afford them the same level of focus, vision, and execution as Remitly.

Best-in-Class Digital Experience

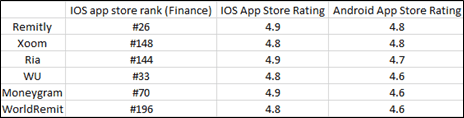

Remitly’s dedication to the digital realm and its focused approach have catapulted it to the top-rated position on both iOS and Android platforms (as shown in the table below). Even in the face of substantial investments by legacy competitors to enhance their digital offerings, Remitly continues to deliver a frictionless and superior overall customer experience with fewer obstacles.

Opportunities

1. Weak competition

Remitly faces its primary competition from non-digitally-native giants such as Western Union and MoneyGram. These companies have long held dominance in the cash-to-cash remittance market. Historically, migrants seeking to fund quick transfers with cash had few alternatives, allowing these companies to charge high fees. While both Western Union and MoneyGram offer digital solutions, concerns about cannibalization have led them to price their digital offerings at uncompetitive levels. Remitly capitalized on this by entering the market with competitive pricing and an improved customer experience, rapidly gaining market share.

Digitally-native competition hasn’t fared much better, likely due to early scaling challenges and ongoing difficulties in running a global remittance business. PayPal has almost entirely stopped discussing XOOM in its calls, and WorldRemit has encountered repeated management issues during its scaling efforts. While some consider Wise a competitor, Wise’s transfer amounts are typically much higher, and they lack a cash distribution network, making them less of a remittance provider for migrants. It’s worth noting that, looking forward, the emergence of more “me too” competitors is unlikely due to the high cost of capital and the extended runway required to overcome initial scaling difficulties.

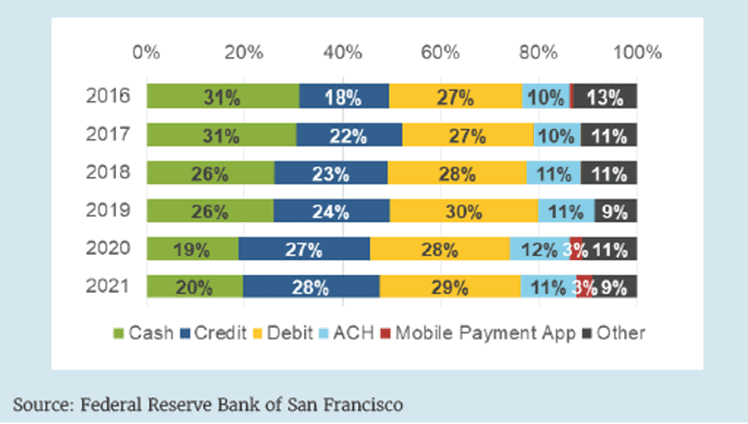

2. Electronification of cash

Cash-to-cash transfers account for a substantial segment of the global remittance market, but the use of cash as a funding source has been on the decline. The adoption of electronic payment methods has steadily increased among consumers, with the COVID-19 pandemic further accelerating this shift towards electronification. While cash will continue to hold its place in transactions, the proportion of employees and consumers relying on cash for payments is expected to diminish over time. This shift is advantageous for Remitly, as an increasing number of consumers begin to explore alternatives to cash as their primary choice for payments and transfers.

3. Remittance market continues to grow

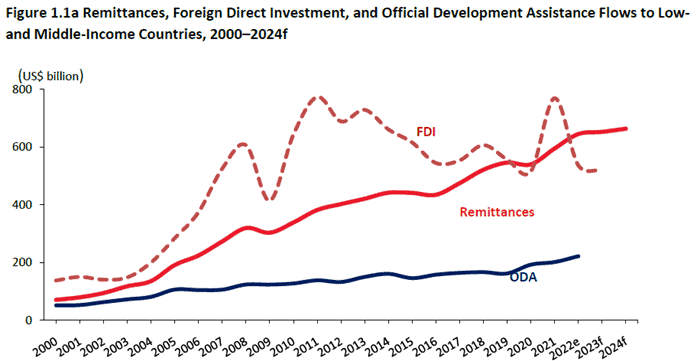

The remittance market has grown at over a 5% CAGR since 2015 and now represents a greater amount of cash inflows to low and middle income countries than FDI.

Risks

1. Intense Price Competition: There’s a risk of intense price competition, particularly from competitors like Western Union, which could escalate into a price war, potentially reducing profitability.

Mitigating Factor: Remitly’s primary digital competitor is Western Union, and a costly price war initiated by Western Union would face opposition from public markets. Western Union investors primarily prioritize operating margins and dividend sustainability.

2. Low Cash Balance: Remitly current cash balance of 220mm is roughly half of their 2021 cash levels. Although management claims that they will be able to internally finance growth, a cash infusion may be needed to support growth plans.

Mitigating Factor: A company with the promise of Remitly is likely to find multiple avenues to raise cash. It’s possible that they may seek financing through private debt markets or consider issuing convertible debt with a high strike price. Shareholders are generally not opposed to these possibilities.

3. Declining Volume of Global Remittances: A potential risk is a decline in the volume of global remittances due to a global economic slowdown.

Mitigating Factor: Historically, global remittances have demonstrated resilience during global slowdowns, as most remittances are needs-based. Additionally, Remitly’s increased market penetration would likely exhibit revenue growth even in the face of a potential slowdown.

Valuation

While the market already perceives Remitly as a growth stock, we believe that its growth potential remains underappreciated. With a steadily expanding remittance market and consistent market share gains, Remitly is poised to more than double its revenue and market share over the next five years. Leveraging the scale dynamics inherent in the digital remittance industry, they are likely to achieve a mature margin profile of approximately 20%. Assuming a mature revenue profile post-year 5, our estimate places Remitly’s intrinsic value slightly above $9 billion, indicating a 100% upside from today’s levels.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.