| Price (9/1/2024) | $9.64 | Estimated Upside | 70% |

| Market Cap | $1.27B | EV/EBITDA (trailing) | 18 |

| 12-month perf (%) | -36% | P/E (trailing) | 18 |

| 30-Day Avg. Volume | 2.98mm | Adj. FCF Yield* | 6% |

| 3-Yr Rev Cagr | 22.6% | NA | |

| LT Debt | $357mm | NA | |

| Insider Ownership % | 10% | NA |

Thesis

Upwork (UPWK) is a global leader in the online freelance marketplace, offering a platform for businesses and independent professionals (aka freelancers) to connect and collaborate. The stock has declined by ~85% from its highs, due to concerns over slowing growth and fears of AI disruption. However, our analysis shows that these concerns are misplaced. The slowdown in growth is driven by temporary cyclical factors, and the long-term trend of businesses increasingly relying on skilled freelancers is set to continue. The market perception is that the business case for Upwork is weakening when in fact it is strengthening. We believe Upwork has a 70% upside potential from current levels and is a compelling long-term investment opportunity.

Company Background

Upwork was formed through the merger of Elance and oDesk in 2013, two of the largest platforms in the freelance marketplace at the time. This merger brought together a significant portion of the global freelancing market under one brand, with the new entity named Upwork. The company went public in 2018, driven by the vision that the future of work would be fundamentally different from the prevailing full time employment model. Upwork’s recognized that the knowledge economy, coupled with advancing technology like improved broadband and video conferencing, would enable people to work from anywhere in the world, effectively decoupling talent from geographic location.

Upwork marketplace connects millions of freelancers with 870k active buyers needing support across various verticals. While tech related services like mobile and web development dominate the platform (~40%) creative design, marketing and customer support are popular verticals. Other verticals include:

- Marketing

- Customer Support

- Accounting & Consulting

- Sales & Business Development

- Administrative Support

Upwork’s marketplace platform not only supports these categories but also provides essential services such as dispute resolution, escrow, and tax management tools, ensuring that both freelancers and clients have a seamless and secure experience.

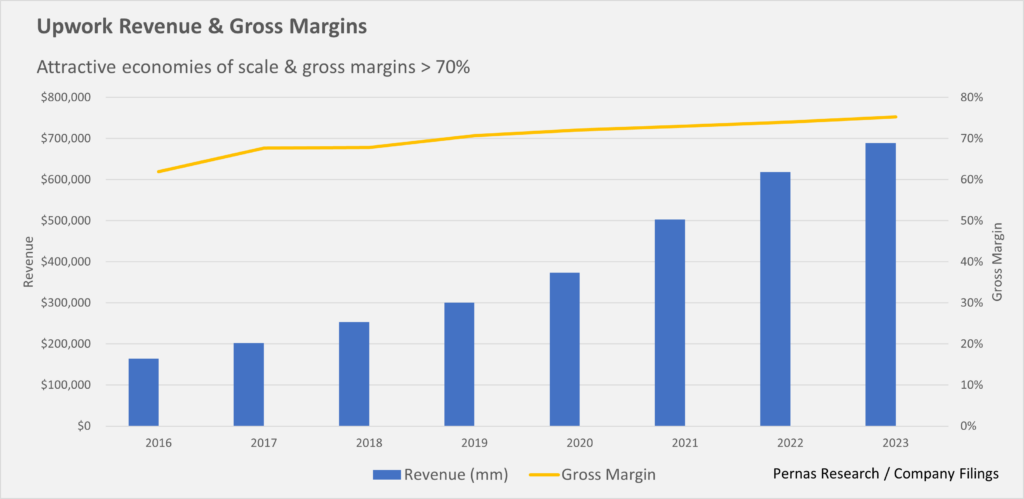

The platform’s reach is truly global, encompassing over 90 categories, 10,000+ skills, and freelancers from 180 countries. However, weighted by revenue the platform is significantly U.S. leaning with 74% of revenue generated from U.S. based customers (the US is also the leading freelancer country). Upwork’s revenue has increased over 170% since the company went public while enjoying increasing economies of scale.

What is a Freelancer?

The definition of a freelancer and what qualifies as freelancing have evolved significantly over the years. Historically, freelancers were often perceived as temporary employees or individuals who turned to freelancing because they couldn’t secure traditional employment. This perception has shifted dramatically, with freelancing now being seen as an aspirational and strategic career choice. A growing number of highly skilled professionals are choosing to offer their expertise as freelancers, attracted by the flexibility, autonomy, and diverse opportunities that freelancing provides.

Given the lack of comprehensive data from the Bureau of Labor Statistics regarding freelancing in the U.S., Upwork has co-commissioned annual studies to better understand this segment of the workforce. Some of the key findings from their 2023 study:

- Freelancers contributed $1.27 trillion to the U.S. economy in 2023.

- Nearly 64 million Americans freelance, making up 38% of the workforce.

- Freelancers are 2.2 times more likely to regularly use generative AI than non-freelancers.

- 47% of freelancers provide knowledge services (e.g., programming, consulting).

- 23% of freelancers create influencer-style content.

- 52% of Gen Z and 44% of Millennial professionals freelance.

- Over 85% of freelancers believe the best days for freelancing are ahead.

Upwork practices what it preaches by being a large employer of freelancers. The company views the freelancers they engage with as “independent team members” who play a critical role in their globally distributed workforce. Upwork eschews terms like “gigs” and “outsourcing,” instead treating freelancers as integral members of their team. Roughly two-thirds of Upwork’s workforce consists of freelancers hired through their platform, many of them have worked with Upwork for over a decade. This model enables Upwork to dynamically scale its workforce in response to business needs, maintaining flexibility while ensuring access to top talent across the globe. It is no surprise that Upwork considers its model of employment to be the future of work for all enterprises.

Two Business Segments: Self-Serve Marketplace & Enterprise

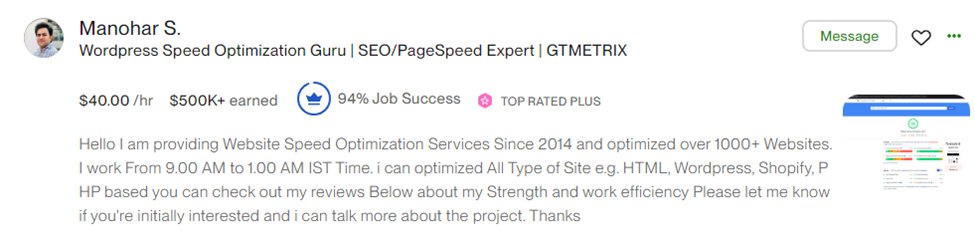

Self-Serve Marketplace: In 2023, ~85% of Upwork’s revenue was derived from its self-serve marketplace. This segment allows small businesses to easily create and post job listings. Unlike traditional hiring, where it takes an average of 30 days in the United States, the time to secure a freelancers on the platform is less than a day on average. This efficiency is largely due to the platform’s streamlined process, where customers can quickly review freelancer profiles (see below), assess ratings, and make informed hiring decisions. Upon the completion of the project, Upwork charges a $4.95 contact initiation fee and a 5% contract fee to the customer, while freelancers are charged a 10% fee on the contract amount.

Similar to other marketplace models, Freelancers have access to customer profiles. For example, we (Pernas Research LLC) have been consistent users of Upwork over the past 24 months, our profile (see below) allows freelancers to see our job history, feedback, and other relevant details.

Circumvention, where customers and freelancers take their business off-platform to avoid fees, is a common concern of Upwork’s business model. However, in our experience across 13 jobs, 21 hires and discussions with over 50 freelancers only two freelancers have ever suggested moving the project off-platform. Upwork’s value proposition—resolving disputes, performing escrow services, and ensuring contract completion—coupled with tools for invoicing and tax management, makes it an integral part of the freelancing process (most likely the largest value add for freelancers is never having to hunt down invoices). While circumvention does occur, as long as Upwork’s fees stay reasonable the value-add services they provide ensure that a substantial amount of the value remains within their ecosystem. Given our talks with other Upwork customers, we believe our experience on the platform is representative.

Enterprise Segment: The other 15% of Upwork’s revenue is derived from their Enterprise segment. This segment caters to larger companies (>100 employees) with complex hiring needs. Upwork offers a range of services, from acting as a third-party recruiting firm that handles classification risk and invoicing to integrating into a client’s systems for a seamless, commercialized experience. Enterprise has been a significant focus for Upwork, although growth has been slow, largely due to cyclical factors, bureaucracy of large enterprises, and tighter corporate budgets. Fees for the enterprise segment are levied in a similar way as the self-serve segment or negotiated on a custom basis for larger contracts.

Competitive Advantages

As many readers are aware, marketplace businesses like Upwork are highly attractive due to their inherent network effects, which create sustainable competitive advantages that are incredibly difficult to replicate.

No other online platform offers the same combination of flexibility, breadth of talent, and scale of customer base that Upwork does. On top of this, Upwork also has the lowest take rate when compared to competitors (more on this below). Upwork allows both customers and freelancers to engage in various types of work arrangements, from one-time projects to ongoing contracts. Some freelancers on Upwork work full-time for a single client, while others manage multiple contracts simultaneously. This diversity attracts a large and varied customer base, which in turn attracts more freelancers, creating a virtuous cycle, or “flywheel effect,” that continues to strengthen the platform.

Competition

Marketplace Competitors: Fiverr and Others

Fiverr operates a large marketplace for online freelancing, but its platform primarily follows a “service as a product” model. For instance, if someone needs a logo, Fiverr allows them to click a button and choose from freelancers offering to create that logo for a set price, such as $50. This model is excellent for quick, straightforward tasks but falls short for more complex, nuanced work. Upwork, on the other hand, offers a more sophisticated system where clients create a detailed project brief, post the job, and receive proposals from freelancers within minutes. Upwork is four times larger by gross service volume (GSV), and the average annual spend from an Upwork customer is over $4,000 compared to Fiverr’s average of about $250.

In addition to Fiverr, Upwork faces competition from vertical-specific platforms such as Contently, Rocket Lawyer, and GitHub. These platforms specialize in specific areas—Contently for content creation, Rocket Lawyer for legal services, and GitHub for software development. However, Upwork’s competitive advantage lies in its ability to provide access to high-quality talent across a wide range of industries and disciplines within a single platform. This breadth of offerings makes Upwork a one-stop shop for clients needing diverse skills, unlike vertical competitors that are limited to specific niches.

Enterprise Competitor: Toptal

Toptal has experienced rapid growth, with 2023 revenue reaching approximately $200 million (~75% smaller than Upwork). Toptal positions itself as a curator of top-tier talent, claiming to provide access to the “top 3%” of freelancers. They are Upwork’s largest online competitor in the enterprise business, where both companies vie for contracts with large corporations. Although Toptal’s growth is undoubtedly impressive and worth monitoring, we believe Upwork’s model scales more efficiently. Upwork’s marketplace requires less intermediation, allowing for faster and broader scaling, particularly as enterprises increasingly seek flexibility and a wider range of talents. While Toptal manually vets freelancers to maintain its high standards, Upwork’s open marketplace model enables more rapid expansion. We are keen to observe whether Toptal encounters scaling difficulties as it continues to grow.

Opportunities

Growth of Freelancing & Enterprise

Large companies are gradually softening their stance towards hiring freelancers. Currently, the penetration rate of freelancers within large enterprises remains low as a percentage of the total workforce, but this is expected to increase over time. As more companies recognize the value and flexibility that freelancers provide, Upwork is well-positioned to benefit from this shift, particularly as it continues to develop solutions tailored to enterprise needs.

Monetization opportunities

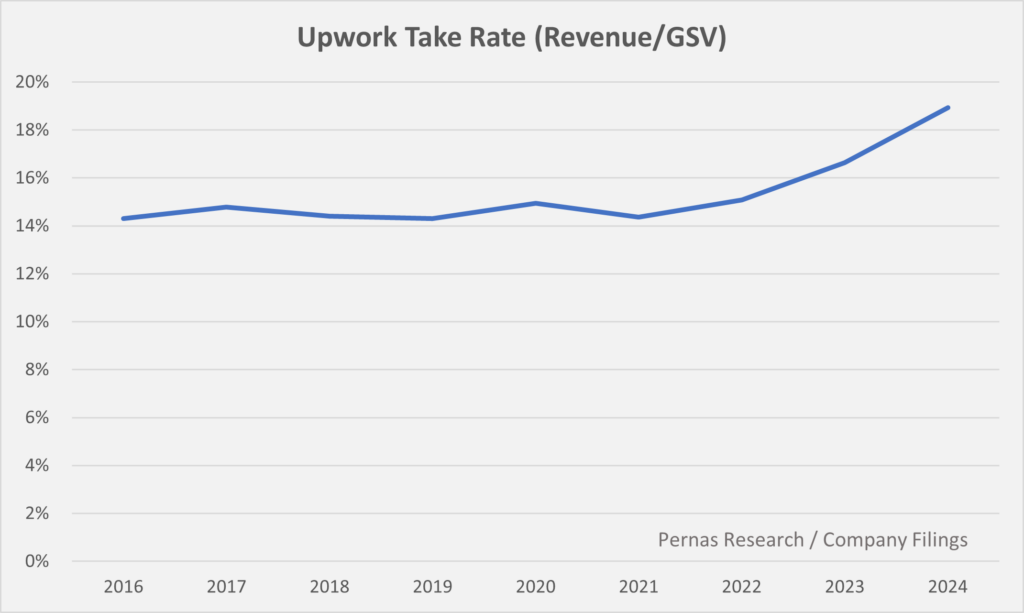

Upwork has streamlined its monetization strategy, implementing a flat 10% take rate for freelancers in 2023, replacing the previous tiered structure. This change increased take rates yet Upwork’s 18% take rate (Revenue/GSV) is still significantly lower than competitors like Fiverr (~30%) and Toptal (well over 20%).

While the commission rate that Upwork charges both customers and freelancers (~15%) is expected to remain stable, the company has other avenues to drive revenue growth. These include growing ads for freelancers (as of Q2 2024 ad monetization was up 75% yoy), offering premium tools, and adding value-added services that enhance the user experience for both freelancers and clients.

Temporary Growth Slowdown and AI Fears

The market has lost confidence in the quality of Upwork’s business. This primarily a result of a 4% decline in average ticket sales which has lead GSV volumes remaining roughly flat since 2022 despite a 13% increase active buyers. In our view, the GSV slowdown is attributed to cyclical factors and a more cautious approach by businesses regarding their budgets. The pandemic period was an exceptionally strong time for Upwork, with significant growth likely being pulled forward. As such, some moderation in growth is to be expected as the market normalized.

Despite these challenges, it’s important highlight that Upwork managed to grow its active user base even as platforms like Fiverr have experienced declines in active users. The market’s concern that this slowdown signals deeper issues or potential disruption from AI is misplaced. (More on this below).

Risks

1. AI Threat: The potential impact of AI is perceived as the biggest risk to Upwork. The concern is that many jobs currently performed by freelancers on the platform could be replaced by AI tools, allowing customers to handle tasks themselves without hiring a freelancer.

Mitigating Factor: We strongly believe that Upwork’s freelancer pool is highly skilled, dynamic and resilient, capable of adapting and finding new ways to add value in an AI-driven world. 85% of their more than 4 Billion in GSV is derived from longer and more complex engagements – not small gigs. For every job like transcription or translation that might be displaced on the platform by AI, new opportunities in areas such as mobile app development, AI consulting, or high-end creative design will emerge (as of Q2 2024, this is already happening with some of the AI related categories growing 67% yoy).

Skilled freelancing, particularly in complex and creative fields, will continue to grow. Upwork’s horizontal marketplace model allows for a dynamic rebalancing of categories based on supply and demand, ensuring that the platform adapts to changing market conditions. Upwork’s strength lies in its ability to evolve and stay ahead of customer needs.

In our view, fears of AI disrupting Upwork’s business are significantly overblown. This contrasts with a platform like Fiverr, which is more vulnerable due to its focus on simpler, low-cost “gig” work.

2. Competition: Upwork faces increasing competition from platforms like Toptal and Fiverr, both of which have achieved significant scale.

Mitigating Factor: All platforms, including Upwork, can continue to grow by capturing market share from traditional third-party staffing firms (e.g. Robert Half, Allegis) while also benefiting from the broader trend toward freelancing.

3. Recession Risk: It is often said that freelancers are hired on a FIFO basis (First In, First Out), making them more vulnerable during economic downturns. A recession would likely lead to reduced business activity across the board, impacting the utilization of freelancers.

Mitigating Factor: While freelancers are sensitive to economic cycles, Upwork’s pool of skilled freelancers is somewhat less vulnerable. Freelancers may be the first to lose work during a downturn, but they are also often the first to be rehired. In challenging economic climates, businesses may realize the need to increase reliance on lower cost freelancers to maintain operations while controlling expenses.

Valuation

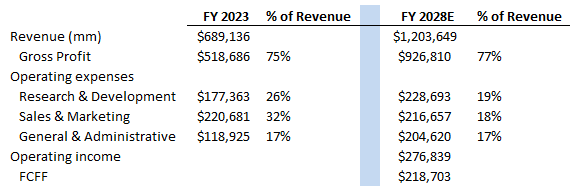

We expect Upwork’s GSV volumes to consolidate in the next 12-24 months before resuming mid-single-digit growth. With Upwork’s scalable cost structure, economies of scale, and monetization opportunities, we foresee revenue growth rates of 10-14% in the intermediate term and substantial growth in free cash flow. We project gross margins to expand to 77% by FY 2028E, with operating efficiencies leading to improved profitability. While management targets a 35% EBITDA margin, even with a more conservative estimate, we project FCFF of $219 million by FY 2028. Adding $250 million of net cash and accounting for $260 million of NOLs (and SBC dilution), we estimate 70% upside from the current market price.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.