| Price (6/1/2023) | $16.07 |

| Market Cap (mm) | $317 |

| 30-Day Avg. Volume | 315,422 |

| 12-month perf (%) | -51% |

| Gross Margin % (latest) | 35% |

| P/E Ratio (trailing) | 14.84 |

| LT Debt (mm) | $0 |

Thesis Summary

Zumiez is a lifestyle retailer that has sold off 70% from 2021 highs due to recessionary fears surrounding discretionary companies and small caps. Despite facing several short-term macro and micro challenges, such as recessionary pressures and competition aggressively discounting bloated inventories, Zumiez has a proven track record of surviving and thriving through business cycles. They achieve this by selling exclusive apparel that customers want, managing inventory effectively, employing minimal to no leverage, and negotiating intelligent leases. The company has successfully executed these strategies for over 40 years and has the management in place to continue doing so. The sharp decrease in earnings observed in recent quarters is an inherent characteristic of operationally leveraged retail businesses and should not be a cause for long-term concern. The earnings fundamentals are expected to improve significantly in the next ~12-24 months, with a potential upside of 70%.

Company Background

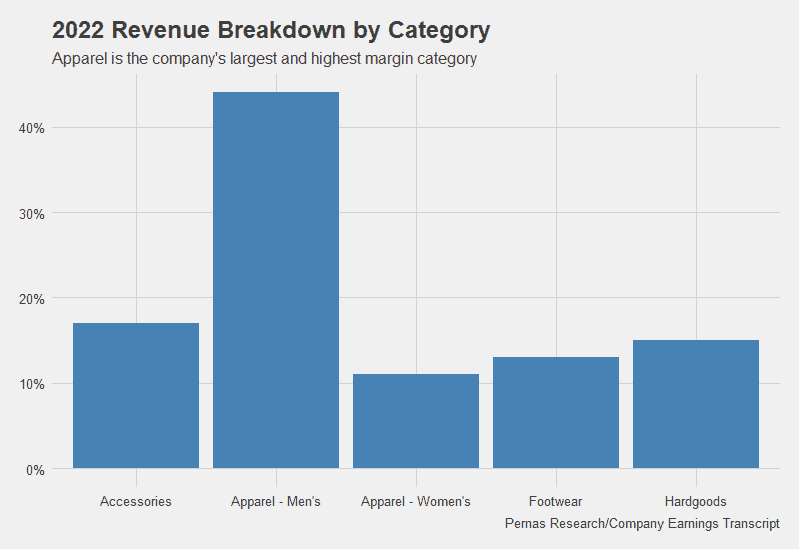

Zumiez is an in-mall specialty retailer that focuses on selling apparel, accessories, footwear, and hardgoods (skateboards and snowboards), primarily targeting males in the 14-24 age range. The company’s customer base consists of non-mainstream individuals with edgy and skate-oriented preferences (think skatewear merged with Hot Topic). Competitors like Tillys and Urban Outfitters in the alternative apparel space are considered “uncool” by Zumiez customers. In the North American market, Zumiez’s store fleet has reached maturity with 659 stores, while the company continues to grow in Europe and Australia with 78 and 21 stores respectively.

The distinctive culture of Zumiez plays a crucial role in attracting and retaining employees. They hold an annual sales event called the “100k,” where entertainers are hired, and brand ambassadors are invited to celebrate the top sales personnel of the year. The company takes pride in hiring employees who are also Zumiez customers themselves, believing that this provides valuable insights into their consumer base and assists their buying team in selecting well-positioned brands. As a result, Zumiez has fewer “trend holes” compared to its competitors. Below is a picture of Zumiez employees:

Competitive Advantages

Brand relationships

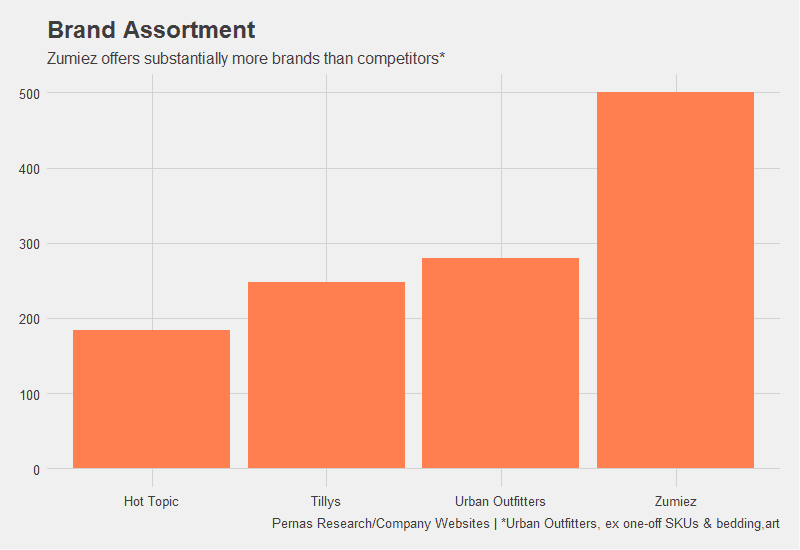

Individuation is a trend centered around self-expression, where an increasing number of consumers seek ways to differentiate themselves in their lifestyles and attire. To leverage this trend, Zumiez offers a wide assortment of brands that have minimal overlap with competitors.

For many of the brands, Zumiez accounts for a significant portion of the brands’ revenue, ranging from 60% to 70%. This allows Zumiez to become the exclusive retailer for select lines of apparel. Their top 20 brands (based on sales) experience notable turnover, typically around 20% to 30% per annum, as consumer preferences change. Underperforming brands that lack potential are regularly culled and brands with sales gains are introduced into more stores. Zumiez’s global store fleet, which consists of 758 stores, is an appealing factor for smaller brands aiming to expand. By partnering with Zumiez, these brands can accelerate and expand their success much faster than if they were to independently build the necessary infrastructure or work with another retailer.

Zumiez recognizes that their core advantage lies in their unique and diverse brand assortment, and they are committed to maintaining strong brand relationships by avoiding heavy merchandise discounting. They prioritize supporting and nurturing these brand relationships more than any other retailer we have studied. In 2022, the CFO emphasized their approach to discounting, stating, “We sell brands that are full price brands. And our game has never been discounting or marking off the entire store. Our strategy has been let’s bring in really cool unique brands that can sell at full price and let’s support them in what they’re doing so their brand equity stays high.”

When consumer preferences shift towards value, as observed this year, Zumiez’s strategy involves initially discounting their private label brands. Private label sales account for 15-20% of their total sales. Unlike other retailers who actively increase their private label penetration to boost margins, Zumiez is mindful of the tradeoff between private label and brand assortment. They recognize that while private label may provide higher margins, it comes at the expense of a wider brand selection. Zumiez will continue to view private label as a part of their offering that allows for greater pricing flexibility but will not actively seek to expand it.

Management

The company has proven its resilience and growth during multiple market downturns. The current CEO and CFO have been leading the company for 23 and 11 years respectively, and co-founder Tom Campion, who still possesses a strong passion for the business, serves as the Chairman. Their exceptional management track record greatly contributes to our confidence in the company.

Zumiez maintains a strong belief in maintaining a robust balance sheet and minimizing debt utilization, with their current debt level at zero. This principle has positioned them favorably to pursue more aggressive expansion during recessions. In the 2008 and 2009 downturn, they successfully added 40% more stores, achieving the highest return on investment for those stores to date. They have presence in A/B and C malls and are indifferent to the location “as long as the lease is favorable and our customers are there.”

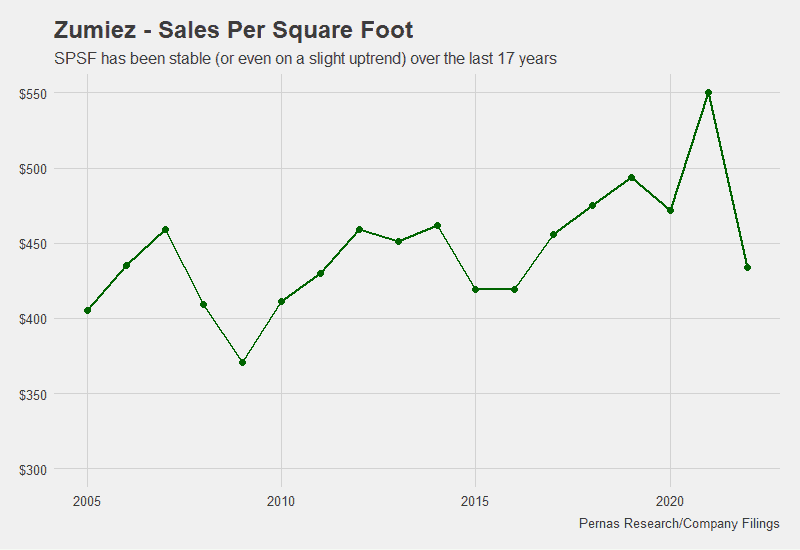

The company is poised to navigate potential disruptions in retail well and is flexible when it comes to their store fleet footprint. They actively shutter underperforming stores and actively look to open stores in locations with favorable fundamentals. Their sales per square foot have remained well above $400 for the last 17 years.

Profitability takes precedence over square footage for Zumiez, and they are willing to pass on leases that do not align with their pricing criteria. With their minimal use of leverage, prudent lease policies, and counter-cyclical expansion strategies, Zumiez is poised to outlast and outmaneuver competitors across various business cycles.

Growth Opportunities

Zumiez will only consider expanding if they can justify the unit economics of each new store. According to our discussions with management, the cost of building and outfitting a single additional store is approximately $400,000, with an additional $500,000 required for inventory. They anticipate a 25-30% contribution margin from each new store after it reaches maturity, with an average sales figure of $1 million per store. Assuming no increase in corporate expenses, the payback period for each new store is estimated to be around 4-5 years.

Currently, Zumiez is expanding in Europe and Australia on a net basis. Europe, in particular, has presented challenges and has not yet achieved profitability, although it is close to breaking even. Over the past 12 months, there has been a loss of approximately $3 million in Europe due to additional corporate expenses and recent macro challenges. However, these short-term macro challenges have also created an advantageous lease environment, which presents an opportunity for long-term investors to benefit from potential operational leverage through further expansion.

Risks

1. The U.S. is over-malled and mall traffic is vulnerable

Mitigating factor: They have previously outperformed during challenging times, such as “The Great Retail Apocalypse of 2017,” and have experience with mall closures. Additionally, their lease structure allows them to exit 75% of the bottom 20% of stores within three years.

Malls have demonstrated the ability to adapt and remain relevant. While certain malls may be at risk, overall vacancy rates are low, and sales per square foot remain high. In the event of select mall closures, Zumiez is well-positioned to navigate the situation effectively.

2. Recession on the horizon

Mitigating factor: Recessionary periods typically last for about a year and Zumiez maintains a strong balance sheet to withstand macro headwinds. Considering that Zumiez faced a challenging year in 2022, we believe this risk is already factored into the company’s valuation. During recessions, Zumiez has historically taken advantage of the situation to optimize and expand their store fleet. For example, they were able to achieve a 7% revenue growth in 2009.

Valuation

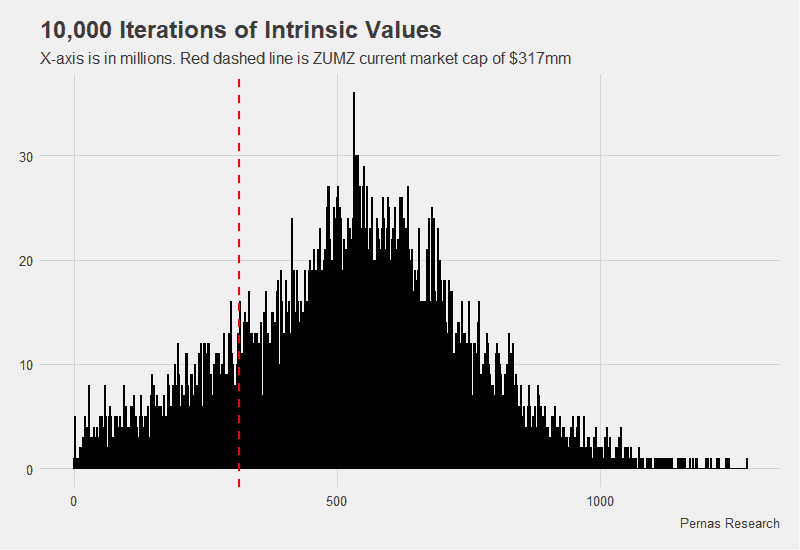

We believe Zumiez’s current store fleet and online properties will generate annual normalized cash flows of ~$40 million within the next 12-24 months. Operational leverage from growth opportunities will potentially add $5-$10 million to cash flows. Our assumptions use an operating margin of 8-9%, annual reinvestment rate of $25-30mm and tax rate of 25%. After we add balance sheet cash (net of working capital) we arrive at a valuation of $540mm giving us ~70% upside from the current market price. Below are results from the monte carlo that allows for sensitivity for all our point estimates:

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.