| Price | $41.50 |

| Market Cap (mm) | $5,217 |

| 30-Day Avg. Volume | 2.071mm |

| 12-month perf (%) | -15.25% |

| Gross Margin % (latest) | 67.5% |

| P/E Ratio (trailing) | 7.19 |

| LT Debt (mm) | $1,521 |

Neutral rating on Capri Holdings this month. Through extensive research, analysis, and insider talks, it became apparent that our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

Capri Holdings is a fashion company that owns brands Michael Kors, Versace, and Jimmy Choo. Capri Holdings began as Michael Kors which exploded onto the accessible luxury scene in the early 2000s, rapidly taking share from incumbents such as Coach. However, Michael Kors expanded into retail and wholesale channels too rapidly resulting in brand dilution. Long-time CEO John Idol is committed to restoring Michael Kors to a more premium brand by using a similar playbook executed by peer fashion brand Coach: increasing quality and marketing spend, reducing store footprints, and subsequently increasing prices. Although Michael Kors is in the later innings of this brand elevation and the group trades at a reasonable 10x EV/FCF, it is too opaque to have conviction in forecasting revenues and margins and we will wait for more clarity before taking a position.

About 70% of CPRI’s revenue and 85% of FCF is generated by the Michael Kors brand. Versace and Jimmy Choo generate the other 30% of revenues and 15% of FCF. Because of this, this write-up is focused on where conviction is more difficult to ascertain and where the future health of Capri Holdings will be determined, Michael Kors.

Background

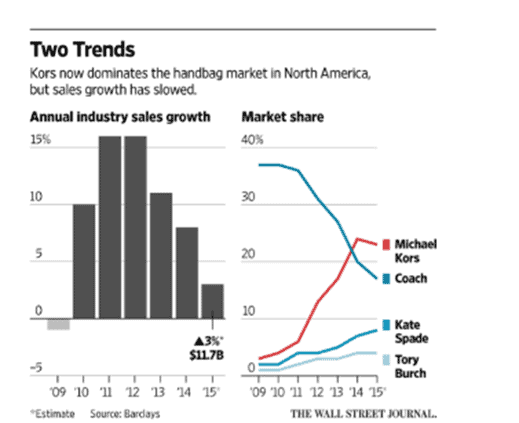

Michael Kors (MK) is one of the more ubiquitous names in fashion. It was founded by Michael Kors in 1981 and has seen meteoric growth that very few brands experience. MK IPOd in 2012 to consumers and investors delight and grew revenues almost four hundred percent in four years. During this time, MK benefited from widespread free marketing from the hit show ‘Project Runway’ on which Michael Kors was a judge from 2009 until 2018. MK expanded its total store square footage by almost 100%, and sold into the wholesale channel aggressively, taking significant share from incumbent brands such as Coach. MK reached its apogee in 2016 with revenues reaching almost $5B when the first cracks began to appear. It was losing its luster as its ubiquity increased; clothes bins at TJ Maxx and Marshalls stuffed with MK bags were a common occurrence. Coupled with heavy promotional cadences, consumers took notice and MK has been trying to regain its footing as a more premium brand since.

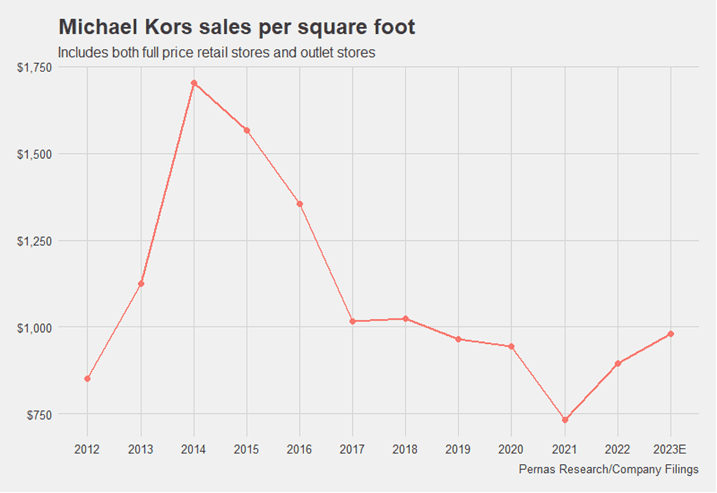

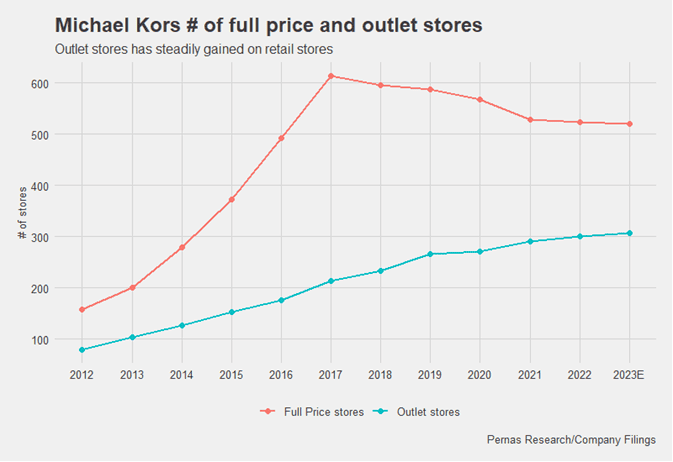

After revenue from MK peaked at $4.7B in 2016, it has since declined to $3.8B. The drawdown was due to a combination of shuttering 30% of their wholesale business along with a decline in sales per square foot from $1600/sqft to about $950/sqft today (this decline in sales per square foot was mitigated by an increase in aggregate square footage of 60%). High end brands such as Hermes have sales per square foot of $5k.

Being an accessible or “expressive” luxury brand is paradoxical given that luxury by its nature implies exclusivity, and accessible implies commonplace. The standard way brands try to work around this dilemma is by creating both a high-end premium brand and another lower end brand, aptly named in the industry a ‘diffusion line’. MK has two main lines: the MK Collection line, which is their premium line worn by celebrities and shown on runways, and the Michael Michael Kors Lifestyle, which is their diffusion line. Accessible luxury is a proverbial tightrope for brands and those that can successfully achieve this balancing act are rare. MK, Coach, Kate Spade and even LVMH have all tried to capitalize on diffusion lines with mixed success. LVMH owned a stake in MK in early 2000s and exited prior to the rapid growth MK went on to. Upon seeing the success that MK had, LVMH tried replicating it with Marc Jacobs.

“We look at what Michael Kors did, and today, Michael Kors — much to everyone’s surprise — is worth $15 billion on the stock market. If we can do something along those lines, or even half that, I’m sure everyone will be happy. It’s an objective. I’m not saying we will get there; we will see.”

LVMH CFO Guiony, 2014

DTC & Wholesale Segments

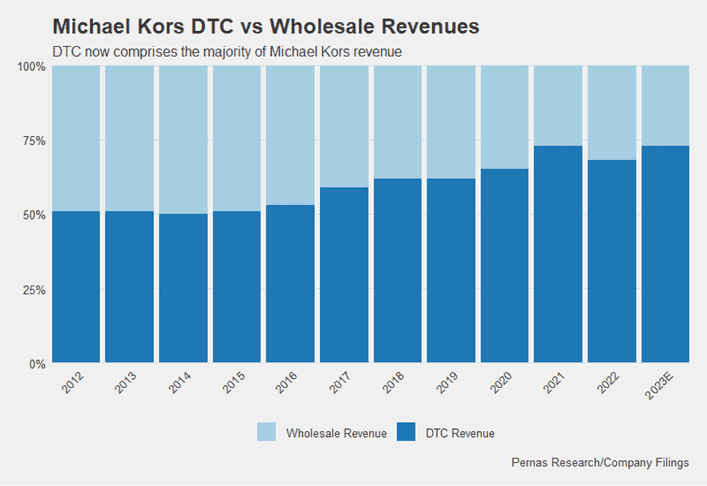

Michael Kors has three mechanisms of distribution: owned stores (full price retail stores and outlets), wholesale (department stores and distributors who sell to specialty stores), and various license agreements with manufacturers who make brand extensions such as watches, perfumes, and sunglasses. MK began selling merchandise primarily through wholesale and since then has been transitioning to DTC. DTC currently comprises the majority of their business at almost 75% of revenues.

MK’s DTC segment is comprised of full-price retails stores and outlet stores. Full-price retail stores carry the newest fashion designs with hardly any promotions/sales whereas outlet stores carry lower quality products designed specifically for a lower-income consumer. Although MK started out with a significantly higher proportion of full-price stores, outlet stores have gained on full-price retail stores.

MK’s wholesale segment consists of merchandise sold to department stores and specialty stores. Department stores have been in secular decline due to e-commerce with the amount of department stores having declined by almost 35% since 2011. This has caused department stores to increasingly become more promotional to promote foot traffic which in turn has caused increasing tension between brands and retailers. Along with department stores reducing working capital needs such as inventory, MK wholesale revenue has dropped almost 30% over the last five years, with the last quarter resulting in a precipitous 25% drop as MK has restricted selling into the channel due to weak wholesale POS and to avoid brand dilution. Interestingly, MK’s DTC segment has seen same stores sales grow mid-single digits. We believe this is due to an increase in marketing spend and events that MK can better target customers with along with better visual merchandising. Advertising spend across the group has gone from a long-term average of 3% to almost 6% of revenue in FY 2022. Peer Tapestry spends about 8% of revenues on advertising and has spent $1B more over the last decade than CPRI. We expect CPRI will increase advertising spend as a percent of revenue to regain brand relevancy.

Wholesale makes up 25% of MK’s revenue with roughly the same operating margins as DTC (around 25%). It is difficult to determine if this is the appropriate level for the MK brand although management has been affirming this is the ratio split they believe is suitable for the longevity of the brand. Looking across the landscape of accessible luxury brands, there is no hard and fast rule for the right DTC to wholesale ratio: Coach has 90% revenue from DTC, RL has 50%, and Burberry has 75%. Wholesale revenue will likely keep falling in proportion with industry decline, providing a headwind to the brand that DTC will have to mitigate.

Opportunities

A growth avenue that is largely untapped is Asia. Asia will provide a long runway for all three of CPRI’s brands and with revenue attribution of 17% they are under-indexed relative to other luxury brands. With a growing middle class with an appetite for luxury goods, Capri Holdings stands to gain significantly from its plan to expand its presence there to 30-40% of revenues.

Risks and Headwinds

There is recession risk to CPRI given its discretionary nature. Although MK has grown revenues through past recessions, given the different maturity and status of the brand, we would expect a high single-digit to low double-digit decline in revenues.

There is key man/woman risk with designers Michael Kors, Donatella Versace, and Sandra Choi. These designers have been the founders/creative directors since the inception of the brands and losing any one of them would likely harm brand image.

The continued secular decline of department stores will likely result in MK wholesale revenue decline. Department store consolidation will eventually occur halting the decline.

CPRI generates about 4% of revenues from licensing revenue. Given the high profitability of this segment, it makes up 15% of FCF. A decline in this business (similar to what happened to MK watches from 2013 to 2016) will fall directly to the bottom line. It is difficult to assess the durability of this segment.

Valuation

Although CPRI is trading at 10x EV/FCF, forecasting MK revenues and margins is difficult and for now, CPRI goes in the “too hard” bucket. In the interim, MK will be reducing wholesale and DTC footprint while increasing both quality of its merchandise and marketing spend. If CPRI can stay committed to this positioning, the longevity of the MK brand is likely assured as it transitions to more DTC. As far as what the new baseline will be for MK, it is hard to assess but we think MK can likely stabilize revenues around $3B before growing at a much more measured pace by primarily taking price gains as opposed to volume ones.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.