| Price (8/1/2023) | $12.18 |

| Market Cap ($) | 4.56B |

| 30-Day Avg. Volume | 5mm |

| 12-month perf (%) | -28% |

| Gross Margin % (latest) | 40% |

| P/E Ratio (trailing) | 6.18 |

| LT Debt ($) | 2.1B |

Neutral rating on Western Union this month. Through extensive research, analysis, and insider talks, it became apparent that our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

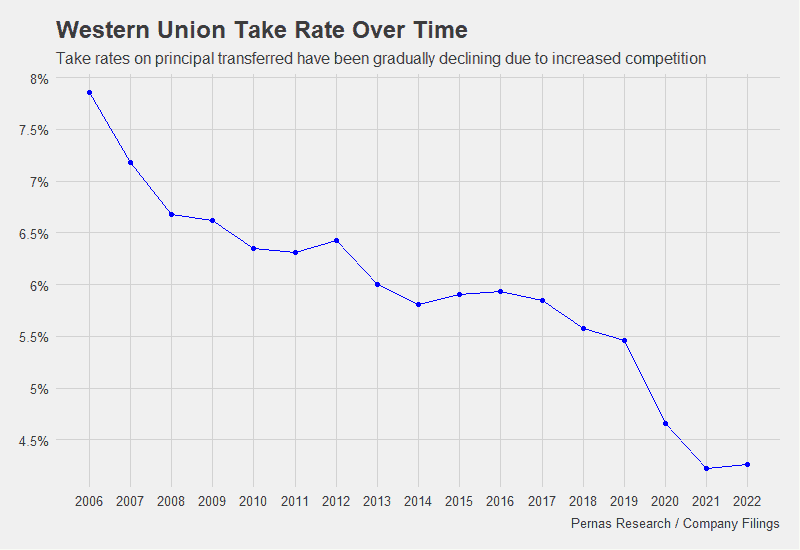

Our research into Western Union initially sparked excitement due to its globally recognized brand and recent ~50% decline in stock value due to increased pessimism surrounding its longevity. Our gut feeling was that their sizeable digital offering was overlooked and disruption fears were overblown creating a potential opportunity for long-term oriented investors. Additionally, it seemed likely that actions Western Union had taken to reduce fees due to competition had passed its inflection point. However, upon conducting a thorough analysis, we realized that predicting Western Union’s market share over the intermediate to long term is fraught with uncertainty. While some cost advantages remain, digitally native competitors have successfully replicated Western Union’s legacy core advantage – its retail distribution footprint. Though the company remains a major player in cash-to-cash transfers, this market is gradually declining. Given these factors, we believe that Western Union’s valuation warrants a neutral stock rating and we conclude the discussion on the uncomfortable decisions Western Union would have to make to remain competitive.

Background

Founded in 1851 as a provider of telegraph services Western Union is now the world’s largest cross-border remittance provider (Remittances are typically migrants sending money from a developed country to friends and family in developing countries). They transferred over 93 billion in principle across 290 million transactions in 2022.

They boast the largest retail spanning over 200 countries and territories. WU generates revenue from transaction fees and taking a spread on foreign exchange conversions. Their top 40 agent partners (large grocery chains, convenience stores, post offices) generated nearly 60% of consumer-to-consumer revenues in 2022. Western Union provides central operating functions such as transaction processing settlement and customer service. Although the business is highly scalable in terms of volume the variable costs are significant as agents are paid a percentage of every sale ~ roughly 30-40% of revenues.

Despite a growing portion of consumer revenues being attributable to their digital offering (~20%), the majority of Western Union’s revenue (~80%) is attributable to cash-to-cash transfers. This preference for cash among migrants persists even in the digital age, as many remain underbanked and receive cash payments from employers. Even among those with bank accounts, around 70% of digital transfers still require recipients to receive cash due to structural barriers. Notably, the World Bank estimates that approximately 850 million people worldwide lack identification, and 1.4 billion do not have a bank account, further limiting the adoption of digital transfers. As a result, cross-border cash-to-cash transfers continue to be a duopoly primarily dominated by Western Union and Moneygram, offering both companies a high-margin advantage.

The average transaction amount for Western Union hovers around $300. In response to increasing competition in the remittance space, the company has had to make significant price concessions. Digital remittances typically incur fees of approximately 3% of the transfer amount, while cash-to-cash transfers average around 5%. This spread in fees has deterred Western Union from aggressively expanding its digital offering, as it risks cannibalizing sales from the higher-margin cash channel.

New Management’s Strategy

Western Union is under new management beginning this year, and there has been a strong shift in strategy, which we believe is the right one, albeit a little too late. Management has disposed of its B2B segments and made a full focus on its consumer remittance segment. It is prioritizing remittances versus previous management teams that allowed avoidance behavior to steer them toward too many non-core activities. New management is moving from a transactional approach to its customers to taking a more relational approach; using terms like LTV and CAC and focusing on more competitive and promotional pricing. We welcome this focus and welcome new management shedding light on the core issue, one that has been deflected by previous management—that Western Union has been a share donor for quite some time. Sunlight is often the best disinfectant, and this open approach to dealing with difficulties is better than in years past.

What we like less about the new management’s strategy is their goal to become a pseudo-digital bank for the unbanked. Providing card services and ultimately helping migrants and their receivers “spend, send, and save.” Although digital banking for the unbanked is an untapped need, this will not be a revenue driver for a while, and the market for digital banking and remittances does not always overlap. Remitly exited their digital banking business (Passbook) for this reason. We feel management should be doing everything it can to stabilize and grow share in remittances and leave digital banking in the aspirational category.

Too Many Challenges

1. Increased Digital Competition

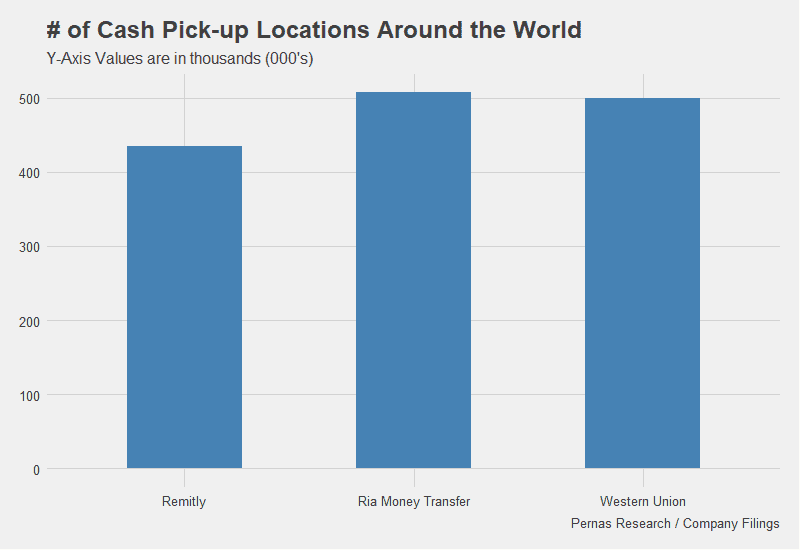

Over the last decade, competition from digital players has ramped up considerably. Companies like Paypal, Wise, Remitly, World Remit, and Ria, along with several regional players, have intensified the competition. Western Union’s defensive pricing techniques have allowed competitors to gain footholds in key corridors, eroding its main competitive advantage – its vast retail network of over 500,000 locations. Instead of adopting a more aggressive pricing approach to protect and grow market share, Western Union’s previous management traded high margins for lower share, enabling competitors to replicate their retail network rapidly. Competitors like Remitly and Ria Money Transfer (parent company Euronet), use global aggregators like Thunes to access countries’ payment networks, enabling them to scale rapidly and negotiate better pricing with financial institutions.

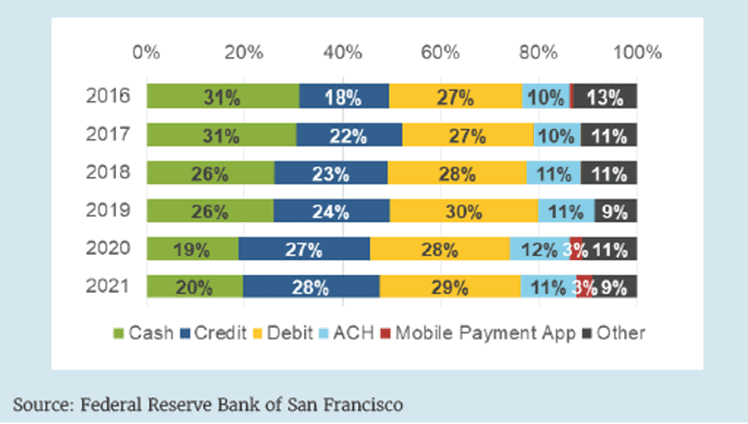

2. Electronification of cash

Cash-to-cash transfers (“walk-in transfers”) account for a larger portion of Western Union’s revenue (~80%), but cash as a source of funding and payments has been declining. The use of cash has been decreasing as consumers increasingly adopt electronic payment methods. The COVID-19 pandemic has further accelerated the trend towards electronification. While cash will always have its place, the proportion of employees and consumers relying on cash for transactions is expected to decrease over time.

3. Brand and Agent Network

Given the management’s strategy to position Western Union as a more relational brand, it remains unclear how much of an advantage the company’s brand will provide. While Western Union is widely familiar, some people view it as a high-priced transactional provider. There is a general perception of negative goodwill, suggesting that Western Union has taken advantage of its competitive positioning in pricing. The evidence for this claim is primarily anecdotal (based on sampled customer reviews and feedback) highlighting the lack of clarity in Western Union’s brand transition towards becoming more customer-centric.

This duality also extends to their agent network. On one hand, their agent network operations offer more convenience than competitor retail locations since they operate outside of bank branch hours (supermarkets, post offices, etc.). However, this also presents more opportunities for fraudulent behavior. In 2017, Western Union had to pay $586 million due to joint investigations by the FTC and the Department of Justice (DOJ), which exposed cases of aiding and abetting wire fraud. The company had to undergo significant compliance overhaul, resulting in added frictions to the money receiving and sending processes, leading to customer frustration. The overall advantage or hindrance of the agent network remains to be seen.

Valuation

Despite market concerns of Western Union’s imminent demise, it should be noted that the company possesses a competitive digital solution. While cash-to-cash transfers may not have a bright future, they are expected to remain a significant part of Western Union’s business. However, the company is not a growth story. As Western Union contends with digital competition and a shift in revenue mix towards digital, we project margins to compress from 20% to 15% by the year 2032. Based on this analysis, Western Union’s valuation is estimated to be around $4.3 billion, approximately where it is currently trading.

Alternate Reality?

There exists another potential reality for Western Union. Leveraging its scale advantages resulting from higher volume and the high-margin cash segment, the company could strategically offer lower-cost digital transfers. This approach would enable Western Union to become the cheapest digital option for migrant workers to send funds to their families using any funding source. However, this drastic change in strategy would necessitate aggressive pricing resulting in immediate and marked margin reduction. While this scenario could enable Western Union to maintain and gain market share and reverse its higher-cost branding image, it would likely face challenges from public markets. Such a transformational strategy might require the company to go private, as public markets do not readily support such significant and rapid changes.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.