| Price (9/1/2023) | $12.59 |

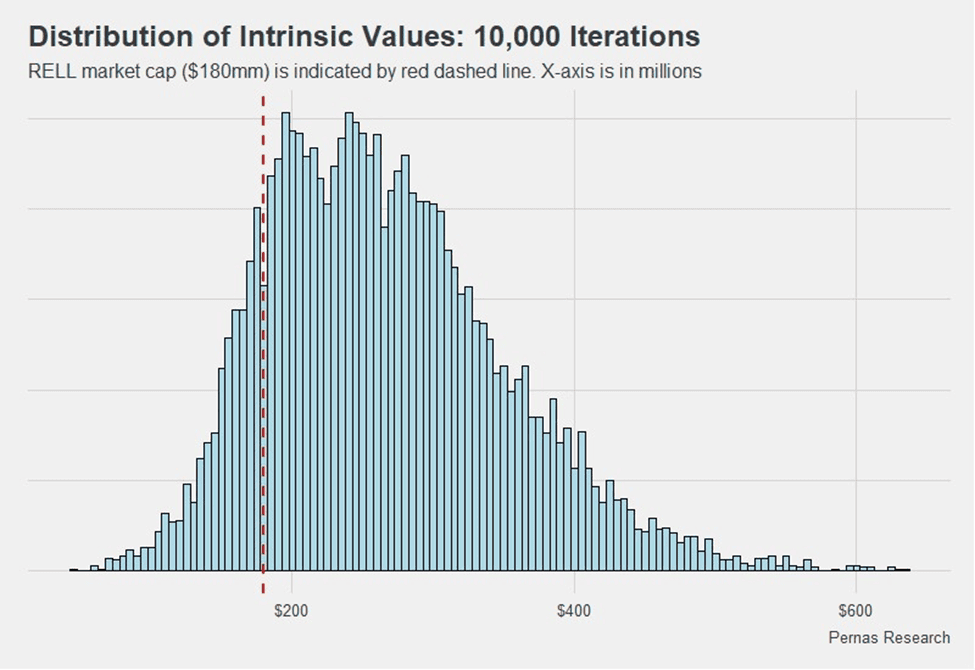

| Market Cap | 179mm |

| 30-Day Avg. Volume | 193k |

| 12-month perf | -18% |

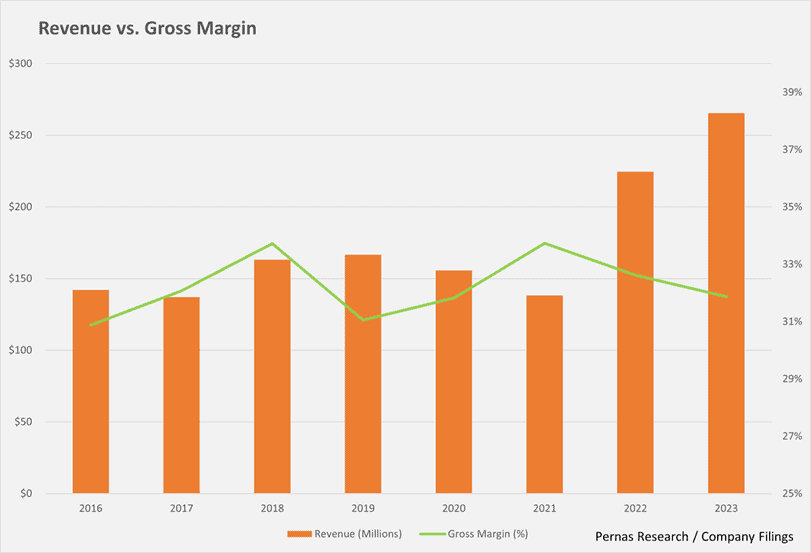

| Gross Margin % (latest) | 31% |

| P/E Ratio (trailing) | 7.7 |

| LT Debt (mm) | 0 |

Thesis

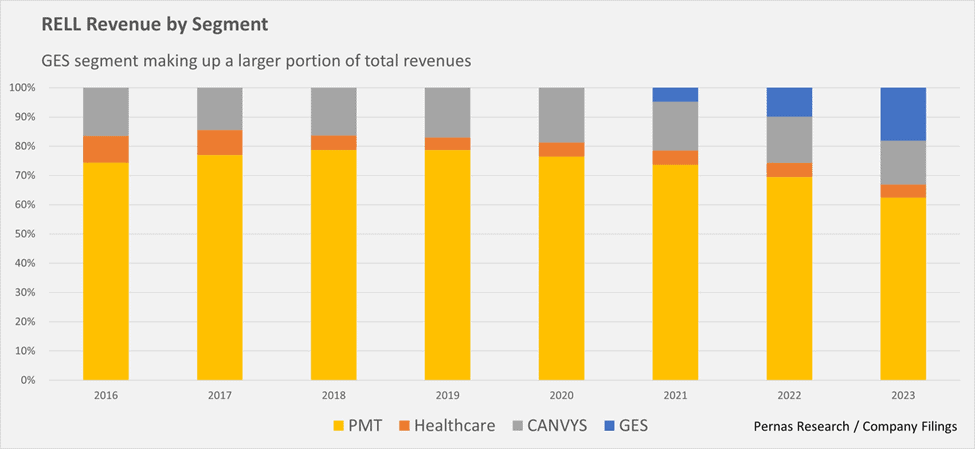

Richardson Electronics (‘RELL’) is a distributor that provides engineering solutions through systems integration, prototype design, and manufacturing. It is a distributor that acts as an extension of both a company’s salesforce and engineering force. In the last couple of years, RELL has seen rapid success with its new Green Energy solutions with offerings such as power management for ultracapacitors and electric train batteries. This segment has gone from $10mm to $50mm in the span of 3 years, representing 20% of revenues. The long-term trends of green energy should continue to benefit RELL as the number of relevant niches expand due to government funding and mandates. Given RELL’s integrated distribution capabilities, we believe RELL has at least 50% upside from today’s levels.

Background

For the last decade, RELL’s primary business has been in the vacuum tube industry, in which it has about 50% market share. A vacuum tube is a device used to control/amplify the flow of electric current using a vacuum sealed container (think a light bulb with additional circuitry). RELL sells tubes to about 20,000 customers with about 80% of these revenues coming from maintenance and repairs, making it a highly predictable revenue stream. Vacuum tubes have been in secular decline since the invention of the transistor. However, the several industries that compose the last bastion for vacuum tubes keep using them as they are superior in applications that involve high-power amplification or exposure to radiation. RELL also mitigates any volume declines with price increases or by offering replacement technologies to their customers. Surprisingly, RELL’s tube revenues have increased by approximately 20% over the last decade.

About ten percent of RELL’s revenue comes from Lam Research, a leading semiconductor equipment manufacturer. RELL provides equipment which helps clean etching and deposition tools. This adds an element of cyclicality to RELL’s top line given semiconductor industry dynamics. RELL’s two other legacy businesses are Canvys and Healthcare. Canvys is a steadily growing specialized display manufacturer for a range of industries from pharmaceutical to aviation. Customers are blue chip OEMs such as Medtronic and Siemens. Revenues have grown at around an 8% CAGR for the last seven years, generating about $40mm in revenue in FY 2023. RELL’s healthcare segment is selling low-cost X-ray tubes to hospitals. This segment has seen little growth as OEM incumbents such as Phillips have remained entrenched due to warranty coverage and breadth of offering. In aggregate, RELL has sunk about $50mm into this segment with little headway and currently loses about $4mm a year in this segment on a revenue stream of $8mm.

A primer on distribution

RELL historically has partnered with small unique suppliers. These smaller manufacturers benefit from RELL’s extensive distribution and engineering assistance, and RELL benefits by having exclusivity. The tradeoff RELL makes is forgoing larger and more commoditized markets for smaller markets with higher customization. This is why RELL has more than twice the gross margin of large electronic distributors like Arrow and Avnet (30% vs 15%). This higher margin is offset by a lower inventory turnover. These large distributors act as middlemen between the original component manufacturers and end customer manufacturers.

We believe that new and emerging markets (next section) are beneficial to more vertically integrated players due to speed and reliability. These markets are also not big enough to attract the larger distributors.

Green Energy Solutions

RELL’s Green Energy Solutions (‘GES’) segment is composed of power management solutions for ultracapacitors (a battery that can charge and discharge rapidly), electric train batteries, and devices that create synthetic diamonds. This segment has gone from about $10mm about three years ago to almost $50mm today. This growth stems from RELL’s long-standing expertise in ultracapacitors and niche technologies.

RELL was a distributor for Maxwell Technologies prior to them getting acquired by Tesla. Here is what a VP at Maxwell said about choosing RELL as a distributor back in 2017:

“Richardson’s strong sales organization, established industry relationships and specialized engineering, design and manufacturing capabilities make it a highly complementary addition to our existing direct and indirect sales and distribution channel network,” said Alain Riedo, Maxwell Senior Vice President. “Richardson’s ability to prototype and produce specialized ultracapacitor-based solutions will add a new dimension to Maxwell’s ultracapacitor technology delivery capabilities, and provide enhanced service and product range for market segments where our products currently have limited penetration.”

After Tesla acquired Maxwell and closed its ultracapacitor unit, RELL partnered with LS Materials signing an exclusive North America agreement with them. When NextEra, an operator of about 11k GE wind turbines in the United States, went to LS Materials to find a supplier of ultracapacitors to replace lead acid batteries, they were referred to RELL. Ultracapacitors are replacing lead acid batteries due to longer run times and better reliability. For the last couple of years, RELL worked with NextEra to design a plug-in module (integrated circuit) to replace the lead acid batteries in GE wind turbines. These modules were then tested for thousands of hours before being rolled out to other turbines. RELL is now the exclusive supplier of ultracapacitor pitch modules to the top three GE wind turbine operators: NextEra, Embro Energy, and Enel. The module that replaces the lead acid battery in a wind turbine costs about $10k and GE alone has over 30k turbines in the USA, with there being another 40k wind turbines with 3k wind turbines being installed in the USA per year. RELL is also working with European turbine operators to expand internationally. RELL’s ultracapacitor modules totaled $11mm in revenue in FY 23.

Another significant market for RELL is retrofitting short-run diesel trains (primarily for mining applications) to become electric due to decarbonization trends and government subsidies. RELL has partnered with Amogreentech and Caterpillar to supply the circuity and fire suppression mechanisms for the lithium iron phosphate batteries. The cost of each one of these modules is about $1-3mm per train, with there being 65k of these locomotives in the USA. RELL’s locomotive revenues totaled almost $22mm in FY 23.

Ignoring numerous ancillary solutions RELL is working on with customers reducing carbon emissions, the above two applications alone have enormous TAMs. The combination of developing engineering solutions, having an extensive distribution network, and assuredness of supply makes RELL a strong strategic partner to customers looking for novel plug-in solutions.

Capital allocation

A peak into RELL’s capital allocation can be seen with how RELL applied the $200mm windfall of cash it received when it sold off its electronics division to Arrow Electronics in 2011. Over the last decade, RELL returned $80mm to shareholders via share repurchases and dividends, spent $50mm in starting and expanding its healthcare segment, and spent nearly $20 million in acquisitions. RELL has also funded numerous smaller projects that cost around $1mm such as power management solution for ultracapacitors. Takeways from this are management favors organic growth and is very conservative with acquisitions. There were numerous occasions when RELL backed away from acquisition targets when the asking price was above what management thought was a fair price. Although RELL spent about 25% of its cash on its healthcare segment, that business has not had much traction and still loses roughly $4mm dollars per year. Management believes they can break even by Q4 2024 however the track record does not paint a rosy picture. Management is considerate of shareholder interests, takes a conservative view towards large cash expenditures, however given a large opportunity set will be aggressive.

Why RELL is mispriced

Trading at 7x earnings, the market is not ascribing value to RELL’s growth potential due to anchoring and improperly valuing the growing Green Energy Segment. RELL’s historical performance has been roughly flat for the last decade with only recently there being an uptick. Along with it being easy to conclude RELL is a COVID play and will revert back to normalized revenues and earnings, RELL’s business is also cyclical due to semiconductor exposure (these revenues got cut in half as the CHIPS Act has curtailed business to China). The combination of flat historical performance with operating volatility is obscuring the strength of secular Green Energy trends, which we believe has structurally changed RELL’s earnings generation potential.

Risks

- Along with execution risk, if the GES segment grows to be a large revenue stream, these larger blue chip customers will possess significant purchasing power and thus this segment will likely trend to lower margins than RELL’s legacy businesses.

- CEO Richardson has super-voting rights through Class B shares. The biggest risk is improper capital allocation with the healthcare segment being an example of this. His track record shows an able and honest CEO which eliminates significant tail risks.

- RELL currently has the majority of its assets tied up in inventory. Normally, RELL stocks much lower inventory levels (their internal target is about 3x inventory turn) however given its new business and the lumpiness of these large projects, it now carries inventory of about $120mm. With inventory there is always obsolescence risk or customer risk however RELL has low liability given stock rotation on most components, and matching payment terms with their GES customers. Over the last decade, RELL has had less than $10mm in inventory write-downs. We believe as business normalizes, about thirty percent of inventory will be released as cash.

Valuation

There are headwinds over the next two quarters due to semiconductor exposure, however we believe RELL’s GES segment will be able make up this short fall in the latter half of the year. RELL stands poised to benefit from multiple niche expansions due to the deluge of money spurring green energy growth. From ultracapacitors to electric trains and EV charging stations, the list is endless. We conservatively estimate that RELL can reach $280mm in revenue by year 3 with eleven percent operating margins ( RELL currently generates $260mm and has 10% operating margins). With no debt, $20mm in cash, and a portion of inventory that will be released as cash in the near term, we believe RELL has at least 50% upside from today’s levels.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.