We have exited out of Titan Machinery (NAS:TITN). It is down 15% from the time we initiated our position in July 2023 (report here). We stated that TITN had upside potential of 30% and since then, the below factor has influenced our decision to sell.

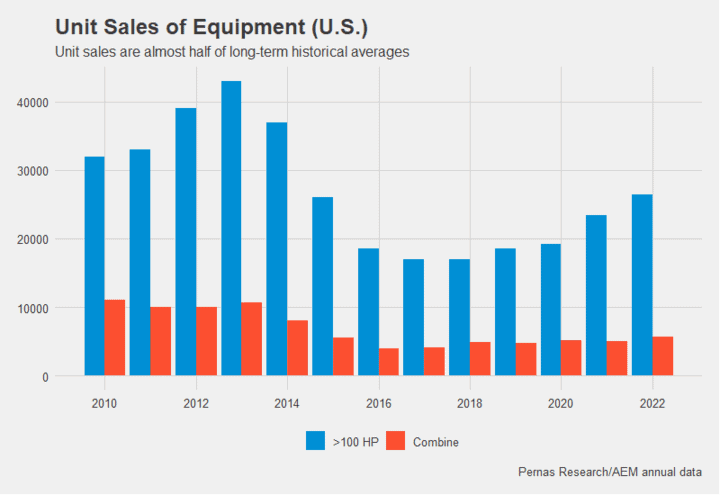

The complexity of their business operations has proven to be more significant than we initially anticipated. We believed that TITN’s operational changes over the last several years, which aimed to increase efficiencies and cashflows, were more sustainable. However, the environment from rapidly changing corn and soybean prices to OEM supply chain issues seem to be reversing the operational improvements that TITN has exhibited previously. Inventory turnover has decreased to less than 2 from its peak of 3.5, and inventory levels are now at a record $1.3 billion. With further declines in crop prices, TITN would likely see a decrease in gross margins due to reduced demand from farmers. This is because farmers opt to extend the lifespan of their equipment instead of purchasing new equipment or doing trade-ins. This scenario is probable given projections indicating that net farm income will be below the 20-year average this year.

The nature of the agricultural dealership business is one with high fixed costs and low net margins. TITN has net margins of 4% and gross margins of 20%. A small swing in gross margins falls right through to the bottom line and has an outsized impact on profitability. These businesses require significant conviction underwriting future cash flows and given the rise in complexity, we do not possess that with respect to TITN.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.