| Price (7/1/2024) | $11.33 | Estimated Upside | 60% |

| Market Cap (mm) | $554 | EV/EBITDA (trailing) | NA |

| 12-month perf (%) | -46% | EV/Sales (trailing) | 1.1 |

| 30-Day Avg. Volume | 614,000 | Cash Burn (mm) | $30 |

| 3-Yr Rev Cagr | 50% | Cash & equivalents (mm) | $300 |

| LT Debt (mm) | $283 | ROIC | NA |

| Insider Ownership % | 16% | FCF Yield | NA |

Thesis

Xometry (NAS:XMTR) is the leading disruptor in digital manufacturing, connecting businesses needing custom parts with a global network of manufacturers capable of producing those parts. Their platform reduces high search costs, long lead times, and quoting frictions typically associated with hiring smaller (non-contract) manufacturers. Like most class of ’21 IPOs, Xometry came to market too early and at too high a price, which has contributed to a near 85% sell-off since highs. Sentiment has soured, and the market is being overly punitive regarding Xometry’s business fluctuations and even mischaracterizing its business model. Market participants are missing the fact that Xometry is a major lever on the massive digital transformation silently underway in non-contract manufacturing. Xometry will continue to scale and exhibit operating leverage as it grows revenues, and we anticipate 60% upside from current levels. We intend to maintain an ownership position in this business for a long time to come.

Company Background

Market Opportunity

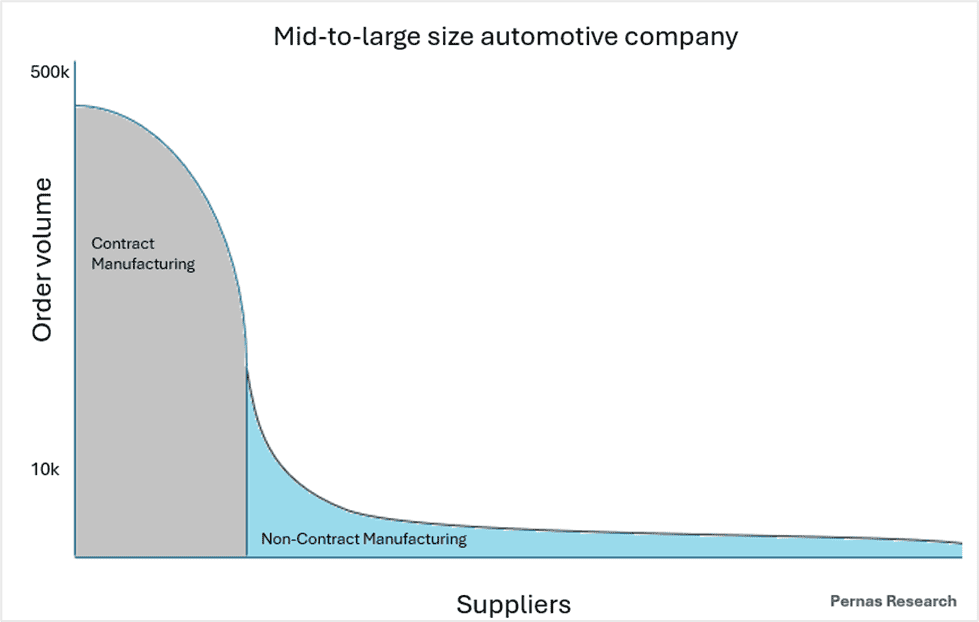

Xometry is focused on the market for non-contract manufacturing. To understand non-contract manufacturing, it’s helpful to first discuss contract manufacturing.

Contract manufacturing entails negotiated contracts and highly relational interactions. For instance, a company partners with a large production manufacturer—often located in Asia—to produce goods on their behalf. The production process typically involves techniques like injection molding and casting, where molten materials are injected into molds to produce large volumes of products, usually in “runs” of greater than 10,000 units.

Non-contract manufacturing, in contrast, involves local relationships with smaller manufacturers and entails lower volume runs—anything from a single prototype to a few thousand units. This type of manufacturing focuses on custom parts, ranging from convenience parts to specialized end-use parts and prototypes. (Non-contract manufacturing, the market for custom parts, and low-volume manufacturing are used interchangeably). Processes include CNC machining, sheet metal fabrication, prototyping, low-volume injection molding, 3D printing, tubing, and others. Thomasnet—a popular directory acquired by Xometry—lists over 500,000 of these smaller manufacturers in North America, with 75% having fewer than 20 employees.

Non-Contract Manufacturing is Ripe for Digitization

This market involves a long tail of small and local suppliers that, for example, large automotive manufacturers, aerospace manufacturers, and OEMs must manage, often dealing with hundreds or even thousands of smaller specialized suppliers.

Xometry CEO Randy Altschuler:

“When you think about manufacturing, you’ve got contract manufacturing companies that are making millions of parts (contract-manufacturing), and that’s a big industry. But then, you’ve also got custom manufacturing (non-contract manufacturing), which is also a giant industry, heavily fragmented and hadn’t been touched by technology before.”

Traditionally, customers spend significant time searching for local manufacturing shops with the capacity, expertise, and willingness to produce custom parts. The startup costs for producing custom parts are high, yet marginal costs for additional runs are very low, so local shops often require production runs to make costs viable. As a result, even after back-and-forth quoting, customers may not get a competitive price if they opt for smaller runs of custom orders. In addition, and what is perhaps the biggest pain point, the industry faces highly volatile capacity utilization. Machines may be fully occupied at times, causing lead times to exceed well over 30 days, while at other times, they may be idle, leaving suppliers starved of revenue. Consistency in costs, lead times, and capacity is rare, making the process challenging for both customers and suppliers.

To fully assess whether digital feasibility is attainable in this space, it is worth examining the logistics process involved in producing a part. To produce a custom part, the production shop receives a CAD file (Computer Aided Design – similar to a 3D model) and “prints” (essentially drawings that provide further specifications) from an engineer at the customer firm. This provides the production shop with 100% of the information they need to produce the part to exact specifications. After production, parts undergo inspection by the shop and are then delivered to the buyer. There is no need for the supplier and the customer to interact beyond the initiation of the transaction, which can be done through an intermediary. There are no structural impediments to digitization, only habits and industry conventions.

Xometry’s Business Model

Protolabs, a vertically integrated competitor to Xometry that IPO’d in 2012, emerged as the 1.0 digital disruptor by bringing extensive 3D printing and machining equipment in-house and using digital quoting technology to provide expedited (although not instant) quotes based on 3D digital twins (CAD files). By maintaining manufacturing equipment in-house, they aimed to be an on-demand manufacturer of custom parts. However, using their own equipment limited them in terms of types of materials, geometric shapes, lead times, and cost options.

This created an opportunity for disruptor 2.0, Xometry, to enter the market. Xometry leverages a global network of over 55,000 active buyers and 3,400 active small-to-medium-sized manufacturers. With the strength of this network, Xometry’s breadth and depth of offerings greatly exceed that of Protolabs.

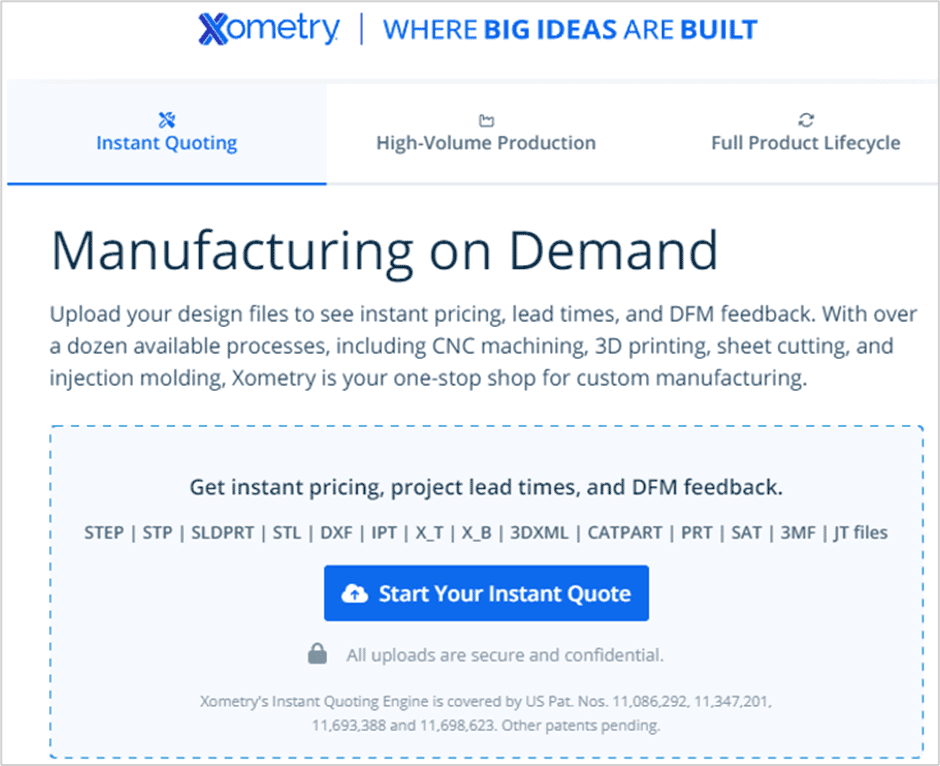

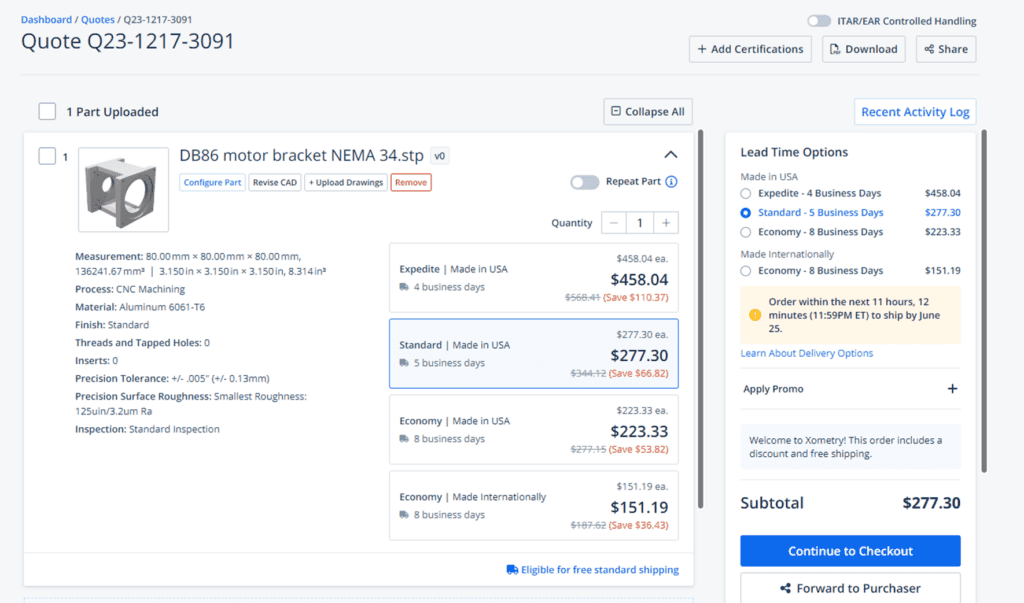

At the heart of Xometry’s offering is its pioneering instant quoting engine, which sets Xometry apart by providing reliable, instantaneous quotes for custom parts based on 3D designs. Customers upload their 3D models and select from a variety of materials, processes, and certifications. Xometry’s engine then generates an instant quote, presenting multiple pricing and lead time options. This feature significantly reduces the time and effort traditionally required for obtaining quotes, allowing engineers to focus more on design and less on logistics. Once an order is placed, Xometry’s sophisticated order fulfillment system kicks in, tapping into its extensive network of vetted suppliers to find the best match for the job. The “cost discovery curve” mechanism ensures competitive pricing and optimal resource utilization, incrementally increasing the price until a supplier agrees to take on the task.

Xometry guarantees the quality of the parts, intervening to resolve any issues either by working with the original supplier or sourcing a replacement. This ensures a seamless experience for the customer, who benefits from a frictionless process without the need for direct communication with the suppliers. This also improves the experience for the supplier, who now spends less time marketing and has a better opportunity to utilize excess capacity during business slowdowns.

Xometry’s revenue model is built on the margin between what the customer pays Xometry for being the official manufacturer of record and what Xometry pays the supplier. This gross margin represents Xometry’s profit on each transaction (more on this under the “critiques” section). A notable aspect of Xometry’s business strategy is its focus on larger enterprise customers, who now account for a significant portion of its revenue. The top ~2% of accounts alone make up close to 50% of Xometry’s U.S1. marketplace revenue. Xometry’s ultimate aim is to become the customer’s go-to platform for all non-contract manufacturing needs.

Competition

Although there are several other small network competitors, the primary two are Protolabs and Fictiv. (Fictiv, though much smaller than Protolabs and Xometry, has raised $200 million in private markets and has a post-money valuation of over $300 million after its latest funding round). Protolabs purchased the supplier network 3D Hubs in 2021 to compete with Xometry and has done a decent job integrating network options with their in-house manufacturing–they no longer have to turn business away that doesn’t fit their in-house capabilities. Multiple players now provide instant quoting engines; however, Xometry still has a superior quoting engine (more on this below).

The non-contract manufacturing market is vast and can accommodate multiple players, provided they each carve out different sub-segments of the overall TAM. Protolabs remains the leader in on-demand manufacturing for speed due and Fictiv focuses on larger enterprise accounts and provides customers increased back-office support. Neither can currently match Xometry’s range of capabilities, quoting engine efficiency, or low price options.

Competitive Advantages

Competitive Advantages

Competitive Advantage #1: The Top Instant Quoting Engine

Xometry’s primary competitive advantage lies in its network effects and instant quoting engine, which is built on its extensive data set. Continuous data model optimization allows Xometry to offer competitive pricing and efficient job matching. One of the primary risks of instant quoting is the potential mispricing of parts – if a supplier cannot be found at a price less than the price quoted for the customer, then the platform has to bear the cost. However, Xometry’s superior pricing engine mitigates this risk through highly optimized pricing regardless of material, process, certification, traceability, or any of the hundreds of features selected by the customer.

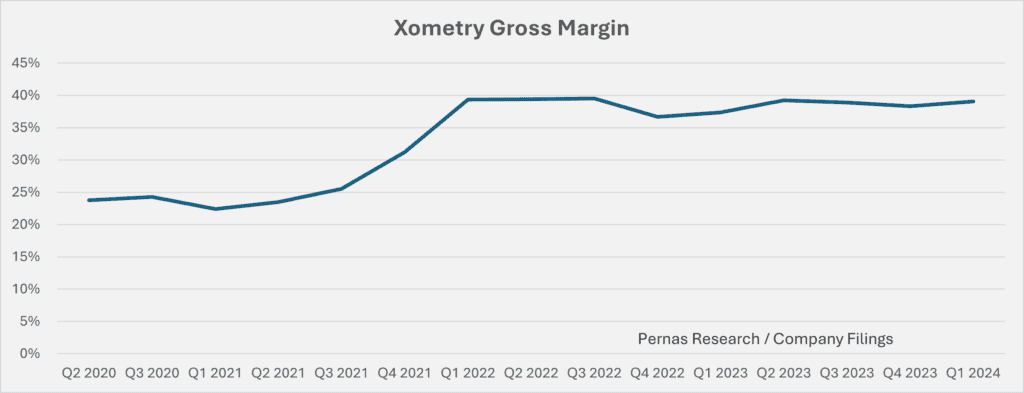

Given the complexity, competitor instant quoting engines will often have manual review on standby. Xometry’s advanced machine learning modeling has given them a significant head start in providing the most accurate pricing in the industry. The below expanding gross margins is an indicator that Xometry is becoming more efficient at pricing.

Competitive Advantage #2: Trusted Low-Cost Provider

Xometry’s brand is increasingly perceived as the low-cost, trusted one-stop-shop platform. While brand awareness is growing on the customer side, most U.S.-based suppliers are already familiar with Xometry, and a significant number of suppliers even use Xometry to absorb overflow work.

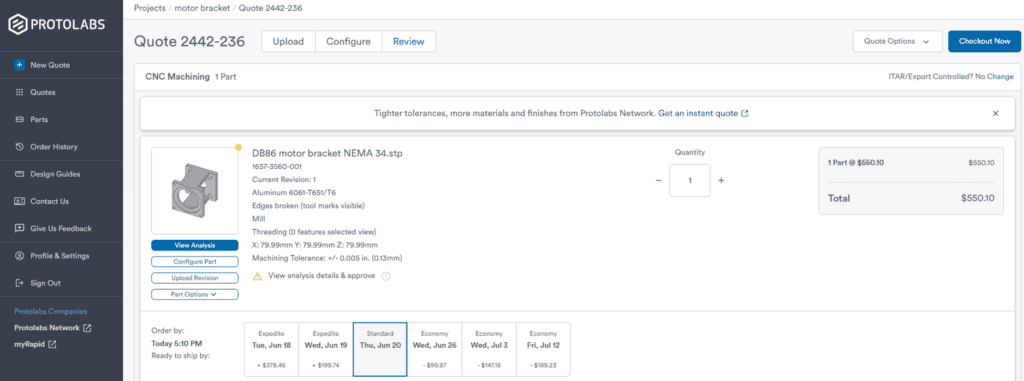

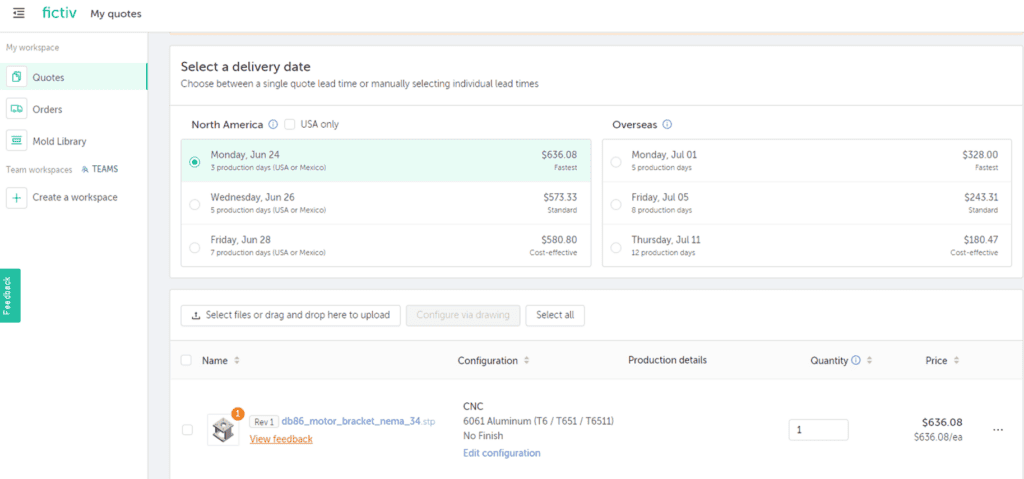

Below are quotes from a custom aluminum part we uploaded into Xometry, Protolabs, and Fictiv. We can see that Xometry provides the cheapest options both in the U.S. and abroad. If we were to increase the number of runs for this part, the price disparity widens even more in Xometry’s favor.

Xometry standard pricing: $277

Protolabs standard pricing: $550

Fictiv standard pricing: $636

Competitive Advantage #3: Largest Supplier Network

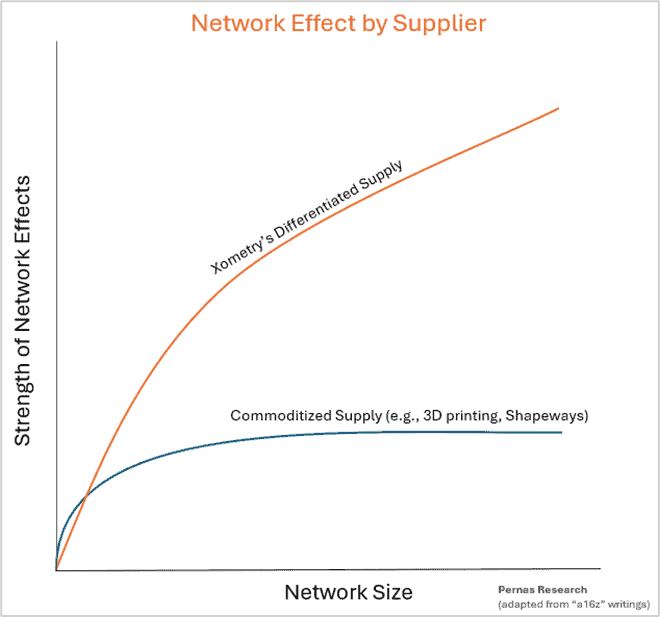

Xometry boasts the largest breadth and depth of suppliers of any marketplace, with a substantial network that strengthens with increased inventory (over 3,400 active suppliers). This network effect is particularly valuable in processes like CNC machining (the majority of Xometry’s business), which is more art than science and requires highly skilled machinists and a spectrum of specialized equipment. Even simple machining parts require precise pre-programming and setup by skilled machinists. This is in contrast with 3D printing, which is more commoditized, generally much cheaper, and almost entirely automated. The complexity in the process provides increased benefit to adding differentiated supply.

The below illustrates the network effects by user/inventory, supporting the importance of Xometry’s large supplier network.

Critiques of Xometry’s Business Model

(Since Xometry is a controversial name—see Cupler Research’s short report here—we have decided to address common criticisms below.)

Critique #1: “Xometry is not a true marketplace”

Critics argue that Xometry does not function as a traditional marketplace. Typically, marketplaces act as platforms where buyers and sellers transact directly, with the marketplace taking a small fee (aka take rate) of the gross merchandise value (GMV). In contrast, Xometry’s revenue equals the GMV since they are the official manufacturer of record. Instead of a bidding process, Xometry prices the product and then allows suppliers to take the job.

Xometry’s business model draws a wide range of opinions regarding its proper classification—market maker, distributor, outsourcer, etc. While Xometry’s model may not fit the traditional marketplace definition, we argue it benefits from the same network effects. The addition of more suppliers enhances the platform’s value, providing better pricing, lead times, and quality for buyers, which, in turn, attracts more buyers and subsequently more suppliers. This virtuous cycle is characteristic of successful marketplaces.

Critique #2: “TAM is hard to estimate and likely much smaller than management suggests”

Another critique centers on the difficulty in estimating Xometry’s TAM. Xometry claims that the global TAM for non-contract manufacturing is around $2 trillion. However, critics argue that this figure is inflated by over 20x and that Xometry’s actual market is limited to low-value prototyping and convenience parts, which are typically small runs of one or two units. While this critique may have held water in Xometry’s early years, it is now demonstrably false. Xometry has clearly “broken the procurement barrier,” with its largest accounts spending millions annually through their platform.

Critique #3: “LTV/CAC doesn’t seem to pencil”

Critics also question Xometry’s customer acquisition cost (CAC) relative to the lifetime value (LTV) of its customers. They argue Xometry is spending too much to acquire customers. As Xometry aims to capture a large TAM, it has heavily invested in marketing. The company has not yet reached maturity in customer segmentation and understanding optimal CAC because LTV is still evolving. Each cohort on Xometry’s platform continues to increase in spend, and the company is likely far from reaching peak wallet share, even with older cohorts. Therefore, it is premature to assess Xometry’s performance based on LTV/CAC extrapolated from backward-looking data. This metric is more suitable for mature companies with easily measurable recurring revenue. Given the lumpiness of customer spend and the need for several business cycles to fully understand customer value, using LTV/CAC to gauge Xometry’s performance is not appropriate at this stage. As Xometry continues to evolve its marketing spend and refines its enterprise partnerships, both CAC and LTV will improve.

Critique #4: “Xometry provides value but it doesn’t accrue to them”

Some argue that while Xometry offers significant value, this does not necessarily accrue to them. The concern is that Xometry provides free instant quoting, which customers can use to shop around for better prices with local suppliers. However, this risk is mitigated by several factors. Although some customers might value face-to-face interactions with local shops, the convenience and efficiency of Xometry’s digital platform often outweigh this preference. Moreover, the competitive pricing offered by Xometry typically undercuts local suppliers, making it difficult for them to match Xometry’s quotes. This competitive edge ensures that the value provided by Xometry’s platform remains largely within their ecosystem.

Opportunities

Opportunity #1: Large Digital Transformation Trend in Non-Contract Manufacturing

Manufacturers traditionally manage numerous supplier relationships, and while the industry has been slow to adapt to change, our conversations with veteran machinists and other industry experts confirm that digital marketplaces like Xometry are beginning to gain respect and recognition for their staying power. We anticipate this change will be gradual but inevitable, as digital marketplaces continue to grow stronger with enhanced traceability, quality, and efficiency. Digital penetration in manufacturing is still in its early days. Estimates of the TAM for non-contract manufacturing range from $100 billion to several trillion, yet revenue from all digital marketplaces combined is less than two billion. While the industry is accustomed to face-to-face supplier relationships, we foresee a radical shift over the next decade.

Opportunity #2: Market Misunderstanding of Xometry’s Business

Xometry’s unique positioning suggests it can evolve into a great business despite not fitting into traditional categories. The mischaracterization of Xometry’s business model as “not a marketplace” even though it enjoys network effects is a contributing factor to its mispricing.

Opportunity #3: AI and Machine Learning

Xometry leads the industry in using AI and machine learning for pricing, leveraging the largest data sets to train its models. Soon, Xometry will be able to price from prints through imaging. The company has the tools and data to develop a quoting engine that is 10x better than competitors. Xometry’s partnership with Google’s AI platform is a significant step in this direction.

Risks

Risk #1: Low Switching Costs

Switching costs are low, and it is likely that buyers and suppliers will be incentivized to multi-tenant, using platforms like Fictiv, Protolabs, and other digital marketplaces (this is already occurring in some cases). The likelihood of increased digitally native competition and low switching costs is Xometry’s largest risk. While Xometry has the largest set of transactional data and a superior quoting system, competitors like Fictiv and Protolabs are closing the gap on Xometry’s advantage. Xometry must continue to invest resources into growth while increasing stickiness with suppliers and customers.

Mitigating Factor: Xometry’s management is highly strategic and aware of this problem. They continue to develop ways to integrate into both suppliers’ and customers’ workflows and ERP systems. We expect Xometry to continue to find ways to deepen integration into the operational processes of their partners, making switching less attractive.

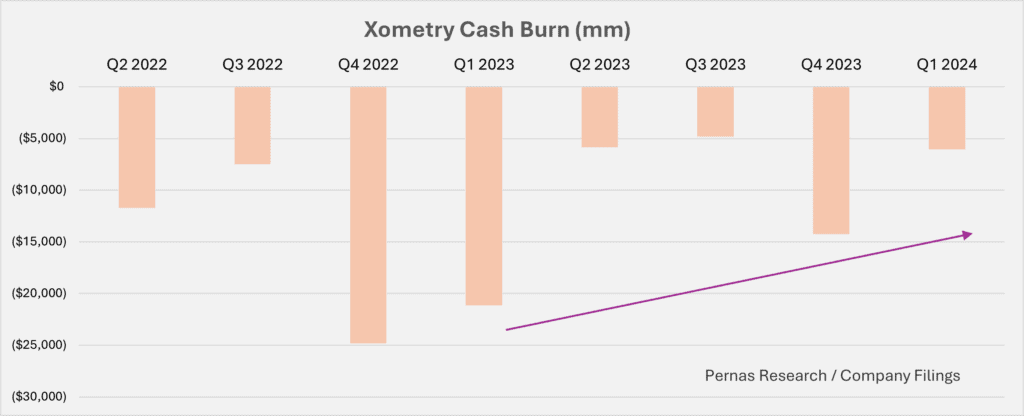

Risk #2: Xometry is burning cash, which may impede its ability to internally fund growth

Mitigating Factor: Xometry has $300 million of balance sheet liquidity and an improving cash burn profile. We expect Xometry to be cash flow positive in 2025 and to continue improving its operating leverage. With its improved profitability profile and strong liquidity, we expect Xometry to have plenty of runway to continue to fund growth and be well-positioned to refinance its $282 million of debt coming due in February of 2027

Risk #3: Manufacturing is cyclical and vulnerable to recessions

Mitigating Factor: Digital platforms are underpenetrated, and we expect Xometry to grow revenues even in a garden variety recession. Additionally, a recession could act as a catalyst for XMTR to rapidly increase market share in a value-seeking environment, given that they are viewed as a low-cost, trusted supplier.

Valuation

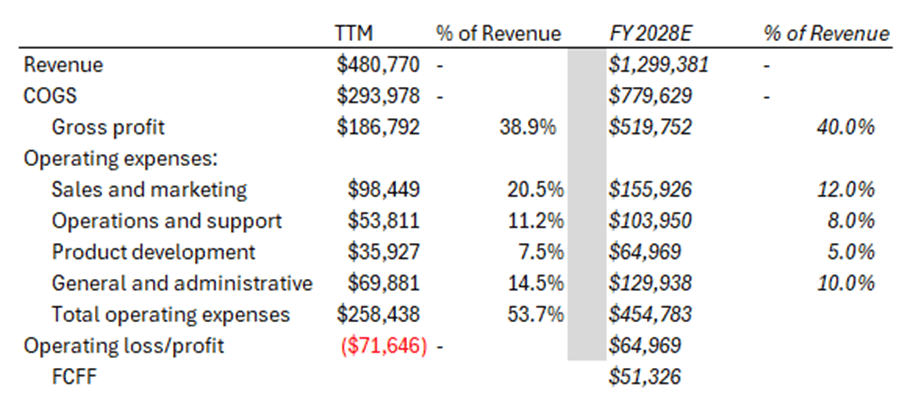

Given Xometry’s competitive positioning and the early stages of digital transformation underway in the manufacturing industry, we expect high durability in Xometry’s long-term revenue growth profile. Despite revenue growth expected to slow in 2024 to 18% due to customers being more price sensitive and Xometry adding more lower cost supplier options to its platform we expect this growth to pick up in years 2025 and we model a 22% CAGR over the next five years and expect Xometry to achieve a free cash flow margin profile of roughly 4% by year five.

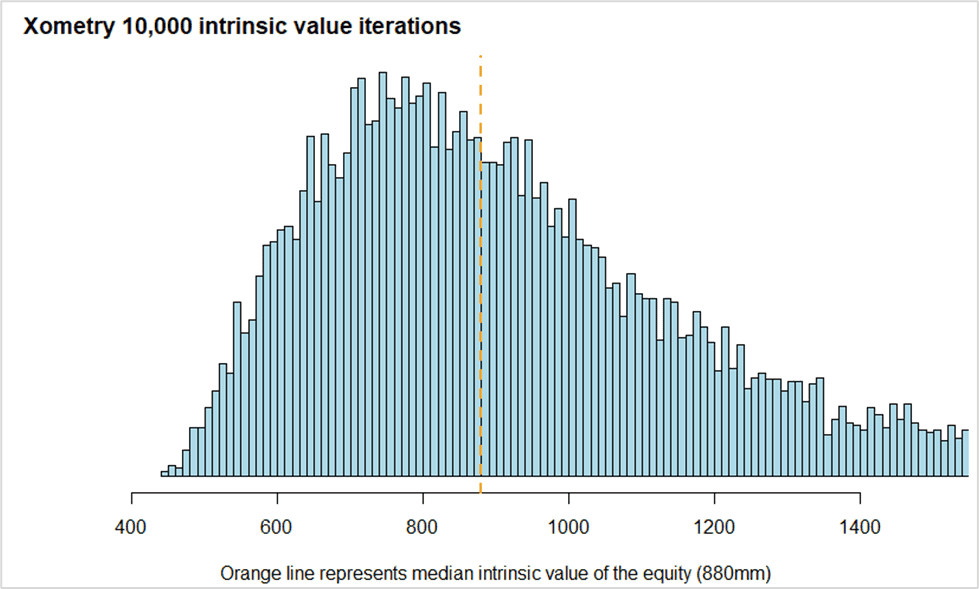

While we model growth to slow slightly after year five, we expect Xometry to continue having a long runway of growth opportunities. Using a range of discount and growth rates after year five, we estimate a 60% upside.

1Pernas Research internal estimates

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.