| Estimated Upside | 50% |

| Price (2/1/2024) | £13.43 |

| Market Cap (mm) | £4,800 |

| 30-Day Avg. Volume | 2,300,150 |

| 12-month perf (%) | -45% |

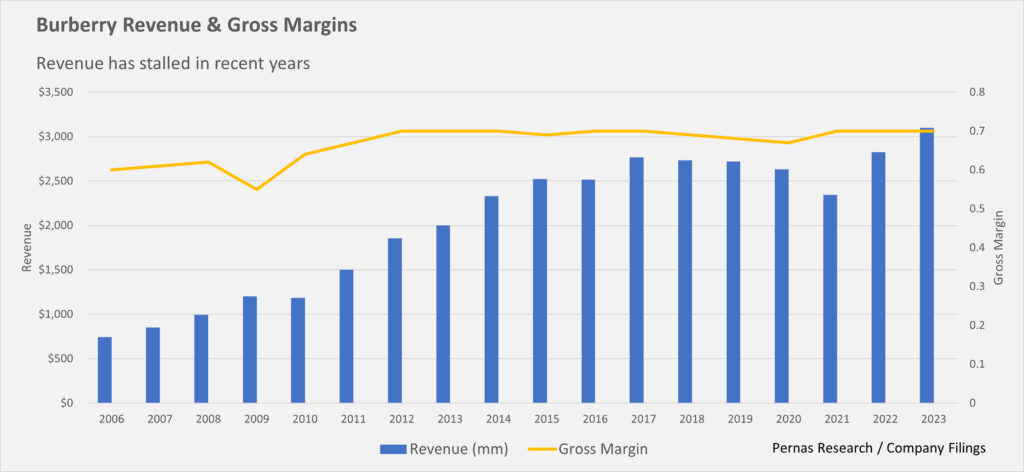

| Gross Margin % (latest) | 70% |

| P/E (trailing) | 12 |

| EV/EBITDA (trailing) | 6.5 |

| LT Debt (mm) | 0 |

Thesis

There are only a few luxury brands globally recognized for their enduring appeal: Burberry is one of these select few, having existed for over 168 years. Instances where such brands trade at a significant discount to their intrinsic value are rare. This occurs when the brand has some design mishaps or is undergoing some controversy. Fortunately, luxury heritage brands are very durable and can survive mismanagement. Burberry has been in the midst of a seven-year transformation aimed at elevating the brand and revamping its product offerings. These restructurings started with the previous CEO Marco Gobbetti in 2017 and continue with the present-day CEO Jonathon Akeroyd. Although elevating a brand is not riskless (Previous companies that attempted this and failed were Mulberry which tried to make this leap with the ex-CEO of Hermes at the helm and quickly had to roll back prices when customers revolted) we believe Burberry has the heritage and the strategy to warrant a position. The current valuation presents an attractive entry point and the stock has 50% potential upside.

A Brief History of Burberry

Burberry, established in 1856 by Thomas Burberry, is renowned for its legacy of innovation. Thomas Burberry’s pioneering invention, gabardine fabric, revolutionized the industry by offering weatherproof, lightweight, breathable, and durable materials for coats. The brand’s storied history is deeply rooted in crafting coats for British troops during World War I. These coats, distinguished by their exceptional quality, gained widespread popularity, becoming a symbol of reliability in the trenches.

A century later, the trench coat is still Burberry’s most iconic piece. It is still considered the ultra-premium trench. It takes almost one year for specialist tailors to master the stitching on the collar, the most intricate part of the coat’s construction. The trench coat became a global phenomenon, symbolizing both style and substance. It has served as an anchor for the brand, enabling continuous cross-selling opportunities whenever a customer enters a store to purchase a coat.

1955-2006

Burberry was acquired by Great Universal Stores, a diversified holding company, in 1955. In the subsequent decades, the brand underwent extensive licensing across various countries. Coupled with a gradual loss of control over licensees, Burberry faced significant disparities between markets, encompassing aspects such as design, pricing, and quality. This context ultimately led future CEO Christopher Bailey to remark, ‘We were a licensed heritage brand, not a fashion company

Beginning in the late 90s under the leadership of Rose Bravo, BRBY began to reposition the brand, standardize product offerings across markets, eliminate parallel distribution, and expand its retail footprint. When BRBY IPOd on the London Stock Exchange in 2002, about 30% of revenues were DTC.

2007-2014 Expansion

Angela Anherdt assumed the role of CEO at BRBY in 2006, and under her leadership, along with Christopher Bailey as the Chief Creative Officer, a diverse range of transformative initiatives were implemented. They expanded distribution and product strategies and bought their fragrance and beauty lines in-house. Burberry was restructured into three brands (Burberry Brit, Burberry London, and Burberry Prorsum) to provide a more accessible price point and facilitate wholesale channel sales. Additionally, BRBY emerged as one of the pioneering luxury fashion brands to embrace social media, effectively connecting with the millennial demographic.

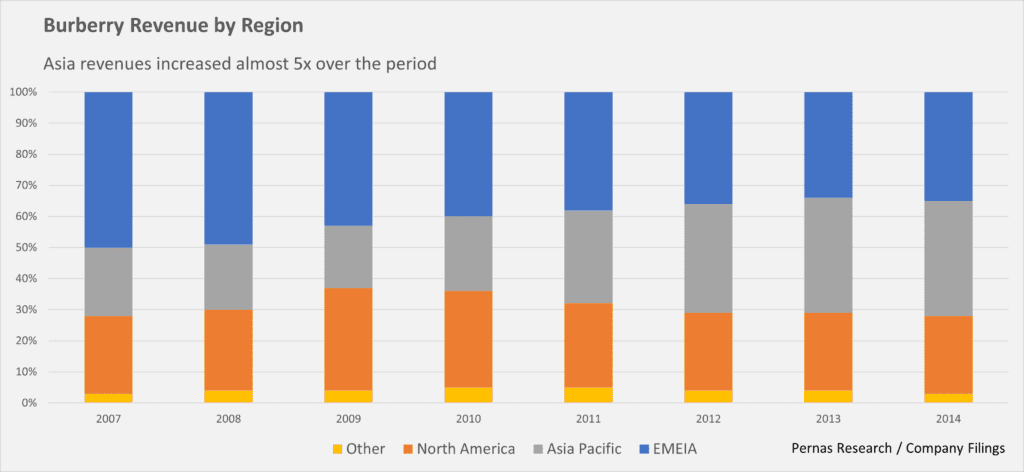

This growth was aided by the rise of emerging market consumers, particularly Asia. Asian revenues went from 23% to 37% of total revenues. Overall, revenues increased by over 200% and the number of DTC stores (direct, concession, and outlets) increased by roughly 100% from a store base of 260 to 500.

2015-2016 Stagnation

During this period, there was a noticeable shift towards a more restrained luxury growth environment. BRBY encountered initial challenges stemming from its rapid expansion, which ultimately resulted in the reduction of its core trench coat prices in 2015. This was a clear indication of the brand’s overly hasty expansion across various markets, regions, and product lines.

Christopher Bailey, who assumed both CEO and CCO roles following Anherdt’s departure in 2014, initiated efforts to stabilize the business. This included the closure of underperforming stores and the discontinuation of significant licensee operations in Spain and Japan. These licensee agreements, while generating over a billion dollars in combined revenue, were adversely impacting the brand. In 2017, Christopher Bailey stepped down from his CEO position to concentrate on design.

2017-2021: 1st Turnaround Stage: Brand Elevation

Marco Gobbetti assumed the role of CEO in 2017, and he was later joined by Riccardo Tisci, Chief Creative Officer, in 2018. A substantial portion of their efforts were spent rolling back some of the changes of previous management. They began by simplifying the product lines from three back to one, reducing SKUs by 30%. The three labels had confused customers and had increased fixed costs. Additionally, they undertook the reduction of their wholesale segment, closing approximately 60% of wholesale outlets in the United States. Concession stores were also scaled back by around 30%.

Management brought a renewed focus on the core strengths of the brand. BRBY made the strategic decision to discontinue non-core product lines such as fragrance and beauty, entering into license agreements with Coty instead. Another alteration was a focus on the pricing architecture of accessories. Around this time, BRBY generally had purses around £600. Compared to the trench coats that retailed above £2000, the pricing disparity was large between BRBY’s offerings. To address this, management started by raising prices on their polos from £150 to approximately £340, and accessories such as purses went from £600 to £1500 over the next four years. Quality was also increased. BRBY brought more production to Italy and Scotland. They acquired CF&P, a manufacturer of Italian leather goods increasing their manufacturing know-how, especially in the accessory segment.

While these measures successfully elevated the brand, the management team encountered challenges in the design department. Tisci joined in March 2018, had his first runway show in September 2018, and by January 2020 his designs made up 75% BRBY’s offerings. Although Ricci had some success with certain male accessories and engaged a younger demographic, his approach led the brand to deviate significantly from its traditional British roots. Changes such as altering the monogram to the TB logo, intended to refresh the brand and attract new customers, ultimately had the effect of diluting Burberry’s heritage and distancing the existing customer base. Gobbetti unexpectedly resigned in 2022 to lead Ferragamo and Tisci soon followed.

2022-Present Day 2nd Turnaround Stage: Return to British Roots

Akeroyd became CEO in 2022. His prior experience includes a five-year tenure as the CEO of Versace and serving as the CEO of Alexander McQueen. He is widely recognized for his success in orchestrating brand turnarounds at these esteemed fashion houses. As his predecessor had already taken the necessary steps to elevate the brand, Akeroyd’s strategy for BRBY centers on a renewed focus on its core differentiator: its British heritage. To accomplish this, Akeroyd hired Daniel Lee as Chief Creative Officer. Daniel Lee came from Bottega Veneta where he launched massive successes such as the cassette bag which played an enormous role in reviving the Bottega brand. Lee is aligned with the ‘return to British roots’ vision being British himself and having grown up in Bradford, near where Burberry’s trench coats are made.

Akeroyd has also demonstrated a prudent approach to capital allocation. He prioritizes organic growth by directing capital expenditures toward store renovations and IT upgrades. Acquisitions are pursued to enhance the quality of BRBY’s offerings, as exemplified by the recent acquisition of Pattern SpA, their Italian supplier. This strategic move not only strengthened their outerwear capabilities but also afforded them increased control over product quality. Lastly, management is committed to shareholders, having returned £600 million in the past year through dividends and share buybacks.

Opportunities

1. Final innings of brand elevation

We believe BRBY is in the later innings of its turnaround in terms of design, elevation, merchandising, and marketing. Given the brand changes undergone over the years from design overhauls to pricing, customers now need to be presented with a clear vision of what Burberry stands for. One notable advantage of being a global brand is the capacity to allocate substantial resources to marketing efforts. In line with this, Burberry is strategically increasing its marketing expenditure to a level approaching high single digits of its revenue. This approach is consistent with industry benchmarks, as luxury brands such as LVMH and others typically allocate approximately 9-13% of their revenues to advertising and promotional activities. The objective behind this increased investment is to present customers with a more unified and distinctive brand identity.

2. Long Accessory Runway

Lee specializes in accessories and has a track record of success in this department. In an interview, he shared his perspective on how accessories serve as an effective means for customers to engage with the brand.

“What people respond to is a singular object. My role is really to distill the essence of the brand into that object, and I find often with accessories, you can do that in a stronger way. Taking that spirit into the shoe meant making heels that are not too delicate, things that are easy to walk in outside, things that feel a little bit chunkier, a little bit more protective, not too precious; leathers that are meant to look like they could withstand time and the elements. For me, the use of metal, the zips, the hardware always give an element of punk, this kind of London DIY edge.”

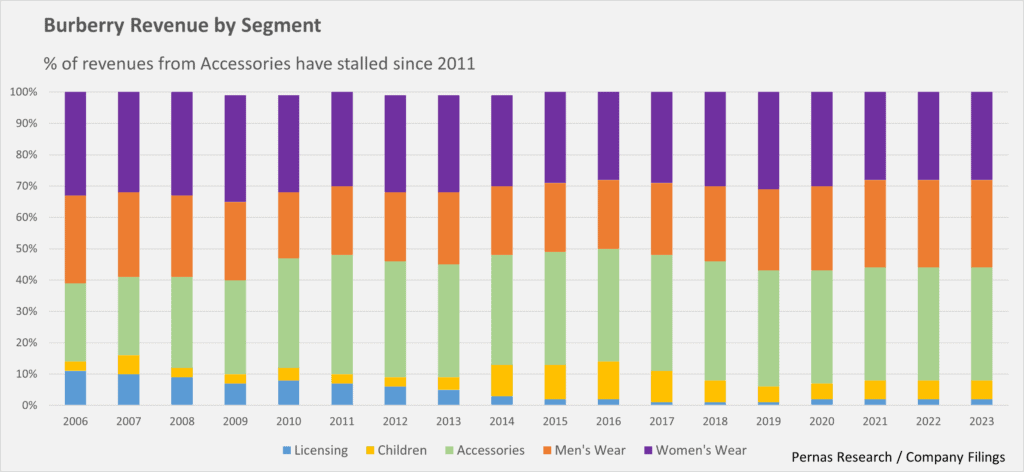

Across luxury brands, profits are generally derived from accessories such as shoes and purses. In 2023, BRBY generated about 36% of its revenue from accessories while peer brands generated 50% plus of their revenues from this segment. As can be seen from the graph below, accessories have stalled out since 2011.

Daniel Lee has orchestrated a series of runway shows that garnered favorable reviews and acclaim for their reconnection with British heritage. Among Lee’s initial design innovations was the reintroduction of the Knight emblem and the introduction of a line of handbags to reinforce this theme. In the luxury industry, new designs require time to achieve market penetration, and we hold the belief that, given Lee’s track record and the brand’s strategic direction, there is a considerable likelihood of him generating substantial demand for Burberry.

Risks

1. China: Luxury brands have seen remarkable returns over the last two decades due to globalization and the rise of developing countries. China in particular stands out as a large driver of luxury demand. Like all luxury brands, Burberry is highly levered to the Chinese consumer who make up close to 40% of global luxury spend. Given heightened geopolitical risks or recessionary scares in China, Burberry would likely suffer.

Mitigating Factor: We ascribe a low likelihood of the collapse of the Chinese consumer. Although luxury brands are penetrated in China, developing countries such as India and Southeast Asia may prove to be the next leg of growth.

2. Design Risk: Should Daniel Lee fail to captivate new customers or estrange the traditional customer base, this would lead to an ongoing stagnation of the Burberry brand. The recruitment of a new designer would become necessary, potentially extending the brand’s elevation timeline by a minimum of a few years, all while offering no guarantee of a successful recovery.

Mitigating Factor: Daniel Lee has been CCO of Burberry for more than a year and has the proper design strategy for Burberry: namely a return to British roots. We believe his prior track record and strategy are the right combination to generate significant demand for Burberry.

3. Regulation: Governments have begun to crack down on the destruction of leftover stock. Traditionally, luxury brands have resorted to incineration of leftover goods to prevent discounting or grey market sales ( estimates put this at approximately 15,000 tons of luxury products destroyed annually). This increased regulatory scrutiny means that brands will either have to be better at matching supply with demand, recycling their goods, or have to liquidate inventory through outlets. The use of outlets will mean discounting of goods which will impair the brand. BRBY was one of the first brands to publicly commit to not burn product in 2018 (that year they burnt roughly $30mm worth). Outlets currently make up about 15% of revenue.

Mitigating Factor: Management has shown the proper framework for their go-to-market strategy. Although they are keeping outlet exposure as they have old inventory (from pre-Daniel Lee), they will look to shutter outlets as time progresses.

4. Demographics: Fast fashion companies such as Zara and Shein have attracted younger generations who can buy the newest fashion for cheap. This has caused a polarization in the market along with driving brands to focus on accessories. For brands that start drifting into the mid-tier accessible range, especially those with a focus on apparel, fast fashion companies will be an existential threat.

Mitigating Factor: Luxury brands will always have an advantage given their heritage, quality, and marketing. As long as Burberry continues to accentuate its USP which is British heritage and couple it with the proper clienteling and marketing, this moat will keep threats such as Zara at bay.

Valuation

While short-term macroeconomic challenges impact the luxury sector, we believe that BRBY presents considerable long-term potential. BRBY finds itself in the advanced stages of its brand elevation journey, currently trading at approximately 12x CY 2023 earnings. Acquiring a venerable luxury brand with 167 years of history at such valuation represents an enticing opportunity. We see a minimum of 50% upside and potentially significantly more if Lee can stimulate robust demand for his British luxury designs.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.