| Price (3/1/2024) | £.93 | Estimated Upside | 60% |

| Market Cap (mm) | £902 | EV/EBITDA (trailing) | 5.1 |

| 12-month perf (%) | -36% | P/E (trailing) | 9.2 |

| 30-Day Avg. Volume | 2,678,150 | Maint. Capex (mm) | £20 |

| 3-Yr Rev Cagr | 14% | Growth Capex (mm) | £30 |

| LT Debt (mm) | £293 | *Adj. ROIC | 28% |

| Insider Ownership % | 42% | *Adj. FCF Yield | 12% |

Thesis

Doc Martens (DOCS) is a UK-based boot brand that has sold off 80% from its overpriced IPO in January, 2021. The brand has experienced a recent revenue decline driven by several short-term operational and inventory mishaps along with general cyclical challenges in the footwear category. The operational and inventory challenges are now fixed, and it is more likely than not that the footwear category will improve within the next 12 to 24 months. The market is attributing this revenue decline as a possible impairment to the Doc Martens brand but we think this couldn’t be further from the truth. DOCS is a strong brand with an enduring appeal across genders, regions, cultures, and socio-economics. The market is also discounting any growth opportunities DOCS has, of which we think there are several. In sum, this is a company that will grow stronger but is priced for the opposite. Given the pricing opportunity and the underlying resilience of the brand’s strength and growth opportunities, DOCS has a total return potential of more than 60%.

Company Background

Dr. Martens is the largest boot brand in the world, selling over 14 million units in 2023. It stands as an emblem of rebellious self-expression, carving out a distinct niche in the footwear industry with its iconic designs and enduring appeal. After gaining prominence in the UK in the 1960s with the introduction of the legendary eight-holed 1460 boot, the brand was hijacked by countercultural forces to become a symbol of individuality and youth rebelliousness – a far cry from its origins as a sturdy and comfortable work boot. International product expansion during the 70s, 80s, and 90s was largely through distributors. After a series of missteps, the brand almost went bankrupt in 2003 and was forced to relocate the majority of its domestic high-cost manufacturing to low-cost and highly efficient Asian regions. By 2014, the brand had regained significant momentum and was acquired by the private equity firm, Permira to provide strategic capital for its next stage of growth. The company IPO’d in 2021 and has more than doubled revenues in the past six years. Today, DOCS currently sells to over 60 countries, with over 80% of sales deriving from the UK, US, Japan, Germany, Italy, France, and over 80% of manufacturing deriving from Vietnam, China, and Thailand.

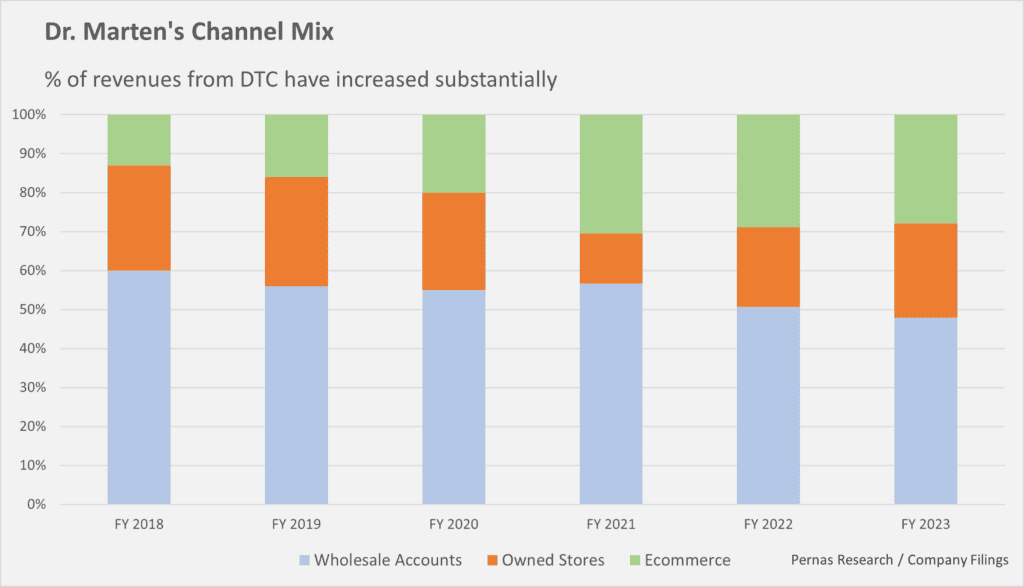

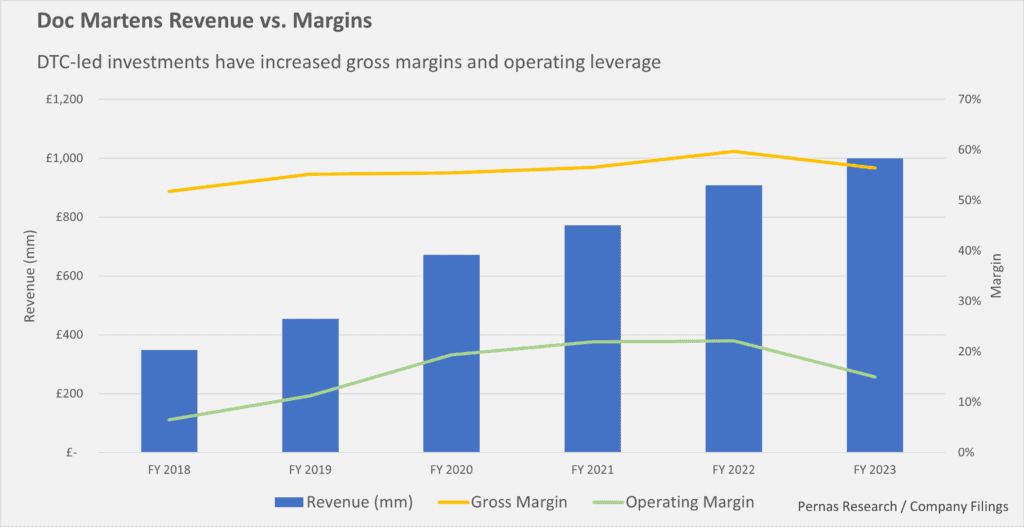

Following its acquisition by Permira in 2014, Dr. Martens underwent a transformative journey marked by strategic investment to transition the brand from a wholesaler-led business to a globally oriented DTC-led brand. The company witnessed a significant overhaul across key areas, including leadership, product strategy, channel distribution, technology infrastructure, supply chain management, and marketing. This involved an investment of over 300 million pounds in FY 2020 to improve products and supply chain services.

Under Permira’s leadership, DOCS was building a foundation where it would have the institutional capabilities to take back control of their brand from distributors in key international markets. This foundation was the key to unlocking its DTC channel strategy.

By selling through owned subsidiaries instead of through distributors, DOCS was now able to control the relationship with the end customer through the designing of its own e-commerce properties and opening owned stores. Additionally, DOCS was able to reorganize relationships with value-add wholesale accounts as part of its more discerning B2B strategy. From FY 2018 to FY 2020, the group replaced 62% of its 1,900 wholesale accounts with higher quality partners. As a result, through a seamless blend of owned stores, e-commerce platforms, and strategic partnerships, the brand cultivates improved brand experiences while enjoying a more resilient channel mix and attractive fundamentals.

Competitive Advantages

Custodian mindset

DOCS has what their management refers to as a “custodian culture” where they ensure they protect the heritage and brand value by focusing on the long term and “doing the right thing.” We see ample evidence that DOCS’ actions are aligned with their custodial credo. At the heart of Dr. Martens’ product strategy lies the preservation of its Originals category, epitomized by the signature 1460 boot. This category serves as the bedrock of the brand’s identity, informing the aesthetics of its diverse footwear offerings. From the grooved sole to the trademarked yellow welt stitch, each Dr. Martens product bears the imprint of authenticity. While DOCS does have an innovative culture and is constantly adjusting styles and colors that speak to the modern aesthetic, they maintain consistency in their Originals line (that accounts for close to 50% of sales) and it is roughly unchanged in appearance since their inception. While other product lines may be discounted, Originals will always sell at full price, serving to protect the brand value for future generations.

Brand strength

The Dr. Martens brand has a base of “fans” who truly love the brand as it speaks to their identity, and the rebellious nature of its appeal gives them a sense of empowerment. From the company’s prospectus:

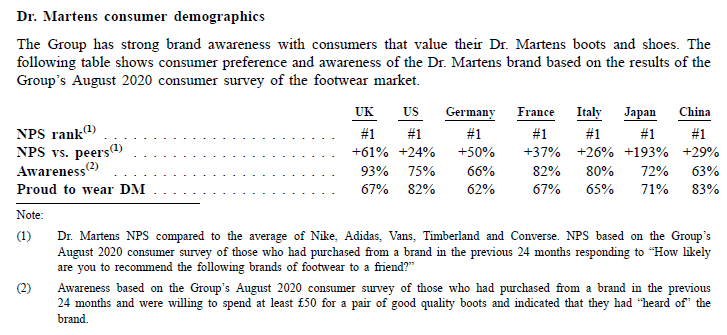

Consumers see the brand as a core part of their lives and are highly engaged with it. Dr. Martens had 2.7 million followers on Instagram (now over 3 million) and enjoyed an engagement level of 13% during the 12 months to 31 March 2020, over twice that of its nearest competitor (Moncler—5%, Converse—6%, Timberland—4%, Ugg—5%, and Vans—5%).

Third-party surveys confirm that NPS scores for Doc Martens score consistently higher than their competitors:

Sales are roughly even split by gender and the brand enjoys multicultural and socioeconomic appeal. Having synthesized hundreds of customer reviews across multiple platforms and periods, it is clear the strong emotional connection the brand has with consumers.

Opportunities

Market myopia

While Dr. Marten’s DTC-led transition has resulted in increased revenue both directly as a result of capturing the distributor margin and indirectly as a result of increased brand cultivation with the consumer, the expansion of the DTC channel requires increased capex and fixed costs in the form of IT infrastructure, e-commerce personnel, and owned-store leases. This has created embedded operating leverage that cuts both ways – DOCS will enjoy increased earnings when revenue is growing and collapsing earnings if revenue deteriorates. Top-line pressures surfaced in FY 2023, and the current CEO, Kenny Wilson, commented below.

The move of our main west coast DC from Portland to LA was poorly implemented. We also made mistakes executing our marketing campaigns, which were too focused on shoes and sandals, which grew well, but not focused enough on boots…..Finally, in hindsight, we ordered too much inventory for America given the tough environment and our poor execution.

The current fiscal year (FY 2024) has continued to be a challenging one for DOCS, with far too much channel inventory. Reverberations from COVID supply chain pressures are still working themselves through retail channels. Brands and retailers have switched from “just in time” inventory to “just in case inventory” and then right back to “just in time” inventory as stimulus-fueled demand quickly faded. However, operational mishaps are now fixed, DOCS’ order book is finally normalized, and we expect the footwear cycle to move upward slowly from current low levels. These temporary pressures have contributed to momentum-driven selling, creating an opportunity for investors.

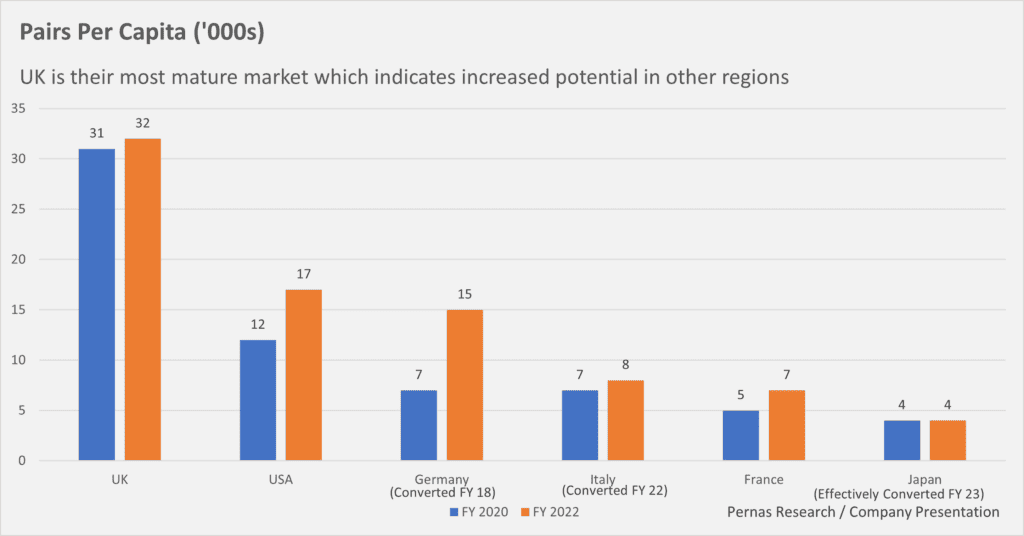

Regional penetration potential

Although DOCS has taken back key distributor markets like Germany & Italy, we believe it has still yet to reap full rewards from the multi-year transformation involved in going from a region that has been distributor-led to a more optimal channel mix that is DTC-led. Directly run markets allow DOCS to work towards full brand potential by promoting both brand awareness and product assortment awareness. Typically, distributor-led markets do not have the same breadth of product diversity, and it takes several years to reach full brand potential. With increased investment and continuing their DTC-led strategy, we believe there is ample headroom to grow in key markets.

Sandals

Sandals are now ~9% of annual sales and represent a significant long-term growth opportunity for DOCS. DOCS will increase marketing spend by a percent of revenue for the next three years, in part to raise brand awareness for their product lines in these other areas. As we have seen in FY 2023, they will need to do this carefully not to detract from their core in boots. DOCS is careful to expand beyond its core, and we expect them to slowly and steadily increase their penetration in this area.

Risks

1. Fashion risk: DOCS may lose its appeal as an enduring brand.

Mitigating factor: Brand engagement is high along social media platforms, along with NPS scores relative to competitors. Management is a trusted custodian of the brand, and ~50% of sales are from Originals that are timeless in style.

2. Recession risk: A rollover in consumer demand will happen as a result of a global recession.

Mitigating factor: Revenue has already taken a double-digit hit from FY 2023, and we could even see revenues go up in a garden-variety recession. Additionally, the Doc Marten brand is quite reasonably priced compared to competitors. The 1460 boot retails for $170, which, given brand studies, still offers value. There is a perception that the boot should be worth more than it sells for.

Valuation

We conservatively estimate that Fiscal Year 2025 will return them to 1 billion in revenue with an after-tax FCF margin of 9%. After this, revenue will grow by 4-7% over the next 4 to 5 years with gradual increases in FCF margin. With this conservative estimate and averaging over various discount rates and subtracting the net debt, we arrive at an intrinsic value of the equity worth 1.48 billion pounds. This target reflects ~60% upside from current levels.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.