| Estimated Upside | Neutral |

| Price (12/1/2023) | $8.39 |

| Market Cap (mm) | $276 |

| 30-Day Avg. Volume | 500,000 |

| 12-month perf (%) | -23.5 |

| Gross Margin % (latest) | 14.7 |

| P/E Ratio (trailing) | 10.6 |

| LT Debt (mm) | 60 |

Neutral rating on El Pollo Loco (NAS:LOCO) this month. Through extensive research, analysis, and insider talks, it became apparent that our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

El Pollo Loco, a California-based fast-food chain, initially caught our attention through our special dividend and value screens. The initial setup seemed promising: the valuation looked attractive on an absolute basis, it was a brand we were familiar with, showed growth potential, had diligently reduced substantial debt post-IPO, aligned with certain trends, and the selling pressure from its large private equity owner seemed to be waning. However, deeper research raised doubts, leading us to question the business’s sustainability. We underestimated the fierce competition in the fast-food industry, and it wasn’t until we gathered pricing data that we realized El Pollo Loco’s competitive position fell short. Despite a few potential opportunities, the list of negatives led us to assign it a neutral rating.

Company Background

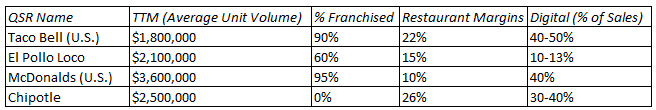

El Pollo Loco, a well-established fast-food chain founded in 1975 by Juan Francisco Ochoa in Guasave, Sinaloa, Mexico, gained popularity over the years in the greater Los Angeles region and across California. However, growth outside of California has been inconsistent, with about 80 units added since going public in 2014.

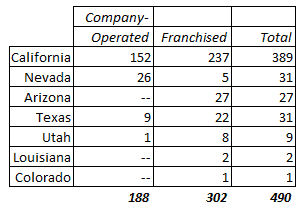

El Pollo Loco distinguishes itself in the market by positioning as a Mexican-style QSR+ (Quick Service Restaurant, aka Fast Food) brand, aiming to bridge the gap between traditional fast-food chains like Taco Bell and fast-casual restaurants like Chipotle. They believe their quality flame-grilled chicken justifies premium pricing relative to other fast-food chains. The table below illustrates El Pollo Loco’s average unit economics compared to competitors.

El Pollo Loco’s average check sizes are notably higher, and its traffic tends to be lower than competitors. Traditionally, they’ve adhered to their core offerings with limited menu innovations and have been slow to adopt digital innovations like sales through kiosks and apps. Approximately 25% of their sales come from carry-out, 25% from dine-in, and the rest from the drive-thru. Sales are roughly evenly split between lunch and dinner, with delivery services like DoorDash and UberEats contributing 8% of sales (All data sourced from transcripts and the latest filings).

The ownership of El Pollo Loco has changed hands over the years, with American Securities Capital Partners (ASCP) acquiring the company in 1999 from Denny’s, followed by its sale to Trimaran Capital Partners in 2005, and later its IPO in 2014. The company has witnessed several CEO changes in recent years and is currently searching for a new leader, most likely from outside the organization.

Opportunities

Digital Sales Penetration

Competitors have seen average check increases of approximately 10% when customers order through digital means like in-store kiosks. Customers tend to order more when the menu is readily available, which makes increasing LOCO’s digital penetration a potentially significant value enhancement opportunity.

Trends

With a focus on grilled chicken, El Pollo Loco offers a healthier option compared to its QSR peers. Chicken consumption in the U.S. surpassed beef in 1993 and continues to grow. Additionally, the trend of Hispanification in the U.S., with Hispanics predicted to make up nearly one-third of the population in 20 years (source: Pew Research), makes it easier to popularize Mexican cuisine and the El Pollo Loco brand.

Expansion Opportunity

El Pollo Loco’s presence in the United States is still underdeveloped. Given the recruitment of high-quality leadership, the company could potentially compete successfully in numerous new markets, improving its economics.

Cost Pressures Softening

While the restaurant industry has faced challenges from rising labor and commodity costs, these pressures are starting to ease. Poultry, which constitutes 40% of El Pollo Loco’s input costs, is expected to see price decreases, which will positively impact their bottom line. These cost reductions have yet to fully reflect on margins, as most QSRs have likely locked in supply contracts for several quarters.

Headwinds

Competition

The restaurant industry is mature, with growth expected to align closely with GDP growth at around 2%. To achieve meaningful growth, players must capture market share. Well-capitalized competitors with strong digital experiences have outperformed others, especially in the QSR segment. Players like YUM brands are investing heavily and moving towards 100% digital sales. In a high-priced labor market, well-capitalized players with scale advantages have the upper hand over smaller competitors like LOCO.

Labor Legislation

California’s legislation to raise the minimum wage for fast-food workers to $20 an hour, effective April 1, 2024, will pressure LOCO’s margins. Given that 80% of their units are concentrated in California, we estimate a margin impact of 100-150bps.

Plagued by Poor Strategy

While financial information has been publicly available since their 2014 IPO, prior debt security registrations reveal substantial pre-IPO information. Over the last 20 years, LOCO has experienced flat to 2% traffic growth, with most same-store sales increases attributed to price hikes. Below is from the most recent CEO early this year discussing their pricing strategy:

“I go back historically….we’ve never played the discount game that others play. Others may go really aggressive on discounts and we just haven’t gone there just because it’s detrimental to the brand. And quite frankly, we believe our consumers understand the value they’re getting for the way we prepare our food in restaurant”

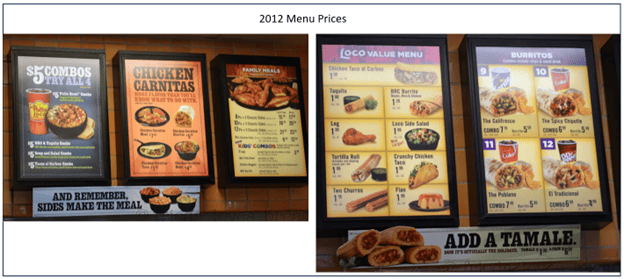

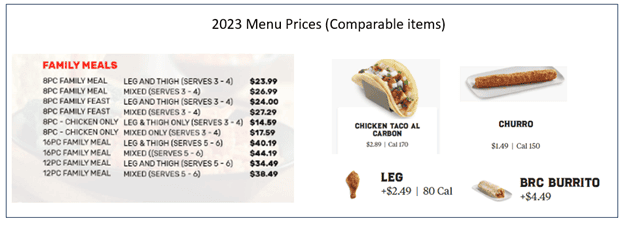

On the surface, this strategy appears reasonable, but only if the quality indeed surpasses that of the competition and the pricing aligns with this perceived value. While we acknowledge that El Pollo Loco offers higher food quality than most QSRs, we contend that their pricing has escalated significantly beyond the value. This situation arguably makes El Pollo Loco one of the most aggressive price takers in the QSR category over the past decade. To illustrate this point, we can examine two snapshots: pricing data from El Pollo Loco captured by a blogger in 2012 compared to the most recent available pricing (link here).

Value menu items like the Taco Al Carbon have seen a cumulative increase of 189% over the period, a single drumstick has risen by 149%, and the BRC burrito has surged by 248%! Burritos and churros have experienced a more modest increase of approximately 50% over the same period. Their core family meal offering, the 12-piece mixed, has jumped by roughly 60%, going from $24 to $38. (At some point, fast-food prices of $40 or higher for a family meal may generate sticker shock.) While a significant portion of these price hikes can be attributed to post-COVID inflation and pre-IPO adjustments, LOCO has consistently employed price increases to counterbalance sluggish traffic growth. We estimate that, on most items, they have averaged annual price increases of 4-8% over the last 11 years.

Above all, to remain competitive, QSRs must allocate a portion of their menu to cater to value-conscious consumers. LOCO’s failure to do so has led them into direct competition with fast-casual chains like Chipotle, known for offering higher-quality food. What makes their mistake even more glaring is the competition from grocery stores that sell a comparable item to their bone-in chickens—rotisserie chickens. Notably, Costco has efficiently managed its chicken supply chain, maintaining a $4.99 rotisserie chicken price for decades. These chickens typically operate as loss leaders for most grocery stores and are priced significantly lower compared to LOCO.

To their credit, they have made recent attempts to introduce more value-oriented items like their five-dollar chicken bowls. However, we consider these efforts to be insufficient and arriving too late. El Pollo Loco faces a deeply rooted perception problem that can only be addressed through menu innovation, substantial marketing investment, and effective management. Unfortunately, the company has displayed limited indications that it is prepared for this challenge.

Conclusion

There are too many negatives for us to justify an initiation. Ultimately, El Pollo Loco’s story is one of missed opportunities. With the right management, they could have outpaced Chipotle and gained national recognition, but they failed to seize the moment. Timing is critical in the QSR industry, especially for franchises, where expanding during periods of rising brand popularity attracts the best franchisees, improves store economics, drives popularity, and attracts more franchisees in a virtuous cycle. Unfortunately, for El Pollo Loco, this cycle appears to be working against them, and our best-case scenario for the company is acquisition by a larger player willing to make substantial investments to revitalize the brand. Given its low multiple on an absolute basis, we assign LOCO a neutral rating.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.