| Price (4/1/2023) | $33.2 |

| Market Cap (mm) | $5,962 |

| 30-Day Avg. Volume | 440,171 |

| 12-month perf (%) | -11.45 |

| Gross Margin % (latest) | 29.7 |

| P/E Ratio (trailing) | 11.28 |

| LT Debt (mm) | $860 |

Neutral rating on Gildan Activewear this month. Through extensive research, analysis, and insider talks, it became apparent that our initial hypothesis for a “buy” rating did not materialize. Our principle: if we don’t add it to our portfolio, no “buy” rating. Despite lacking excitement, neutral ratings are essential for credibility and track record.

Thesis

Gildan is the largest manufacturer of low-cost basic apparel for the Printwear industry (see appendix below for industry primer), producing roughly 1.2 billion shirts per year. This is a company with a durable manufacturing advantage that we will own if the opportunity presents itself, but we are holding off for now and assigning Gildan a neutral rating. We believe their Printwear segment is vulnerable to a slowdown in unit sales within the next 12-24 months and their Branded Products segment, sold through brick-and-mortar retailers, is in a secular downtrend. Gildan’s culture is optimized for manufacturing excellence in the Printwear space and straying away from this segment to uncover separate growth opportunities will continue to prove challenging.

Company Background

Gildan is one of three1 vertically integrated manufacturers of undecorated basic apparel (T-shirts, sports shirts, sweaters) that is sold to distributors who then provide these “blanks” to one of the 100,000 screen printers in North America (Printwear). The Montreal-based company (listed on NYSE) is the most vertically integrated with capabilities such as yarn spinning, garment dying, preshrinking, cutting, and sewing—everything except the U.S.-based farms where they source their cotton. Gildan prides itself on a long-standing commitment to environmentally safe production. Since 2002, Gildan has invested over 2 billion in growing and enhancing their manufacturing and plan to invest significantly more in the next few years (6-8% of rev) to allow for more product flexibility and to expand their capacity.

Business Segments

Although there have been several iterations of Gildan’s business segment reporting since going public in 1998, for the last five years they have reported under two segments: Activewear (T-shirts, sweatshirts, and sports shirts) and hosiery and underwear (socks and private label underwear). A more ideal breakdown of their revenue would segregate what we identify as four distinct revenue streams: Printwear, Branded Apparel, Contract Manufacturing & Private Label. Unfortunately, these segments are not disaggregated in current company filings, so we extrapolated from previous disclosures and current customer concentration data to provide revenue share estimates for each. Below are our estimates and context for each segment that forms the basis for our forward-looking opinion.

Printwear, 73-80% of 2022 Revenue

In addition to being their largest segment, Printwear is also their most profitable with operating margins of 23-26%. A little over two-thirds of this segment is derived from 100% cotton t-shirt sales, the rest is fashion basics and fleece (sweatshirts). They maintain several brands in the Printwear market to broaden their material offering. All the blank apparel they sell displays one of these brands: Gildan, American Apparel, Comfort Colors, Altstyle. Brands in Printwear don’t count for much apart from the basic fabric and design. If you normalize for this, it comes down to price and distributors will tend to buy the apparel that gives them a healthy margin (30-40%) and generates significant turnover. This is overwhelmingly Gildan T-shirts. The Gildan – Heavy Cotton™ T-Shirt – 5000 for example is one of the largest sellers. Screenprinters’ (the customers of distributors) primary concern for T-shirts is reliability and cost as customers care more about the print than the quality or Printwear brand.

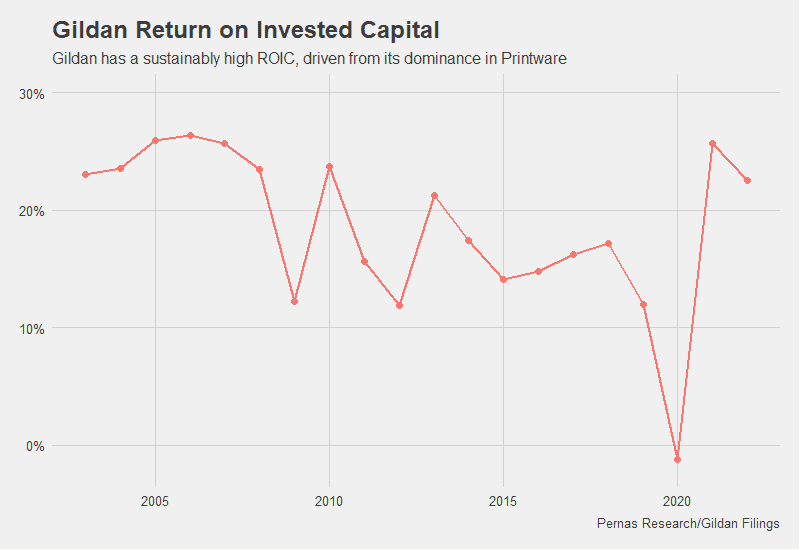

Gildan is undoubtedly the market leader in this category with an estimated 80% North American market share. Their competitive advantage in the Printwear markets is two-fold: First, they are the lowest cost manufacturer of T-shirts supplied to the Printwear industry; each T-shirt sells to distributors for ~$1.3 – $1.5 and their nearest competitors are roughly 20-30% higher in cost. They have a lower production cost given their continual investments in optimizing their vertically integrated structure along with a corporate tax rate of only 5%2. Second, their lead times are significantly faster than competitors. Here is the SanMar CEO, one of Gildan’s largest distribution customers, talking about shortest to longest lead times: “We worked with vendors around orders and lead time. Let’s say a typical Gildan order has a 4-day lead time. Carhartt, they might have a 170-day lead time.” These advantages are borne out in Gildan’s high ROIC figures below:

Roughly 10% of the sales from this segment are from Europe. Growing European sales has been part of company strategy for over 20 years but given their Latin American-based manufacturing base, shipment costs and duties add frictions to fully access this market. Although the company concedes that its European TAM is smaller than the U.S. market, it nevertheless represents a significant opportunity for growth and Gildan has made firm CAPEX commitments (~500mm) to build out its Bangladesh facility to ensure it can meet European demand. This capacity will come online in mid-2024.

Branded Products for Retail, 15-20% of 2022 Revenue

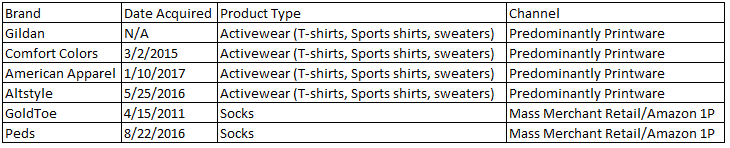

Operating margins for Branded Product sales are significantly lower at ~8-9% given the added SG&A costs associated with dealing with retailers such as additional personnel, marketing, and technology costs. Currently, Gildan does not sell directly to consumers and has a portfolio of several brands, most of which it has acquired:

Beginning 2011, Gildan began to make a big push to become a “major strategically-located supplier of low-cost, high-quality products for mass-market retailers (Walmart, Target, Costco, etc).” The in-house Gildan brand gained shelf space in Walmart but in 2017, Walmart stopped selling Gildan branded innerwear in stores although we have not seen this reported by either Gildan or Walmart (We estimated these sales to be around ~100-150mm). Today, if you walk into a Walmart store the only Gildan branded product being sold are a few assortments of blank T-shirts in the Arts & Crafts section. This was part of a broader strategy by mass merchant retailers to push out lower-tier brands to make more room for their higher-margin private label brands.

Acquisitions were central to Gildan’s strategy to achieve sales in the mass merchant channel. The company acquired seven brands in four years and began to tout its brand portfolio to investors. Although this strategy seemed to show promise early on, it has not met expectations. This segment was roughly 33% of revenue in 2016 when they last reported it. Since this high watermark, it has drifted down markedly both in dollar terms and percentage terms. This has been a result of the previously mentioned private label strategy by retailers along with mall and department store closures. To mark a shift away from this strategy, in 2018 the company announced it was reducing SKUs by 60% in addition to consolidating its distribution and manufacturing footprint.

Gildan ceased selling directly to consumers through Gildan.com and in 2020 announced a 1P relationship with Amazon to sell popular apparel lines. We estimate Gildan’s revenue from partnering with Amazon as a reseller to be relatively modest and in the range of $40-100mm. Gildan is not marketed to consumers and, as a result, we do not see this sub-segment as a large growth area for them. This is evidenced in part by the cessation of infrastructure spending that Gildan was making to deliver products to Amazon consumers in 2021.

As a result of the little marketing and innovation around Gildan’s brands, it is our opinion that retailers do not see any of Gildan’s brands as true consumer brands and will continue to view Gildan as a Printwear oriented meta-brand. Any Gildan brands sold through e-commerce will not receive large traction because of this lack of consumer branding and sales through brick & mortar retailers – where shelf space is scarce – will be vulnerable to being displaced altogether by true consumer brands or by private label.

Contract Manufacturing (“Global Lifestyle Brands”) 2-6% of 2022 Revenue

In the last several years, Gildan has scored some small wins with large brands like Nike, Adidas, and Fanatics to manufacture a small portion of their product lines. These orders usually require meaningful CAPEX investments given the brand would like to customize fabrics and other details. Gildan’s head of manufacturing, Benito Masi, describes this at their 2019 Investor Day:

“If there is a private brand like Nike, for instance, and they want to make an investment in this part of the world, they say (Nike), we want……this particular fabric, we can invest the amount of money to buy machinery in order to produce these goods”

Private Label, 3-5% of 2022 Revenue

Roughly 3-5% of Gildan’s 2022 revenue was from manufacturing private-label products to mass merchants. Roughly all Gildan’s private label revenue is generated from the George Underwear they produce for Walmart3. Like contract manufacturing, these orders would require meaningful CAPEX investment given the brand would like to control details.

Opportunities

Fashion Basics – softer, ring-spun, multi-blends

Gildan defines fashion basics as T-shirts that are ring spun and softer in feel. Also, ones that are not necessarily 100% cotton and have a blend of fabrics, typically polyester or viscose. They are well positioned to see tailwinds from the trend in the Printwear towards higher quality shirts. These shirts do not cost Gildan that much more to produce and is a higher-margin item for them. Currently Gildan estimates their market share in these soft T-shirts at 20-30% and it is likely that their share of this market will continue to grow. We believe this is the most concrete trend that Gildan is poised to capitalize on.

Printwear – Europe

As discussed above, with capacity coming online in mid-2024, Gildan should be better poised to capture more share in the European markets. We believe this will happen slowly given the smaller market and frictions involved in supplying the European market.

Supply Chain Regionalization & Private Label?

Two of the reasons for bullishness in analyst reports is that Gildan could prove to be a large beneficiary of the near-shoring trend along with being a big potential beneficiary of the Private Label trend. The notion is that Gildan is ideally suited to serve as a manufacturer for national brands and/or private label brands.

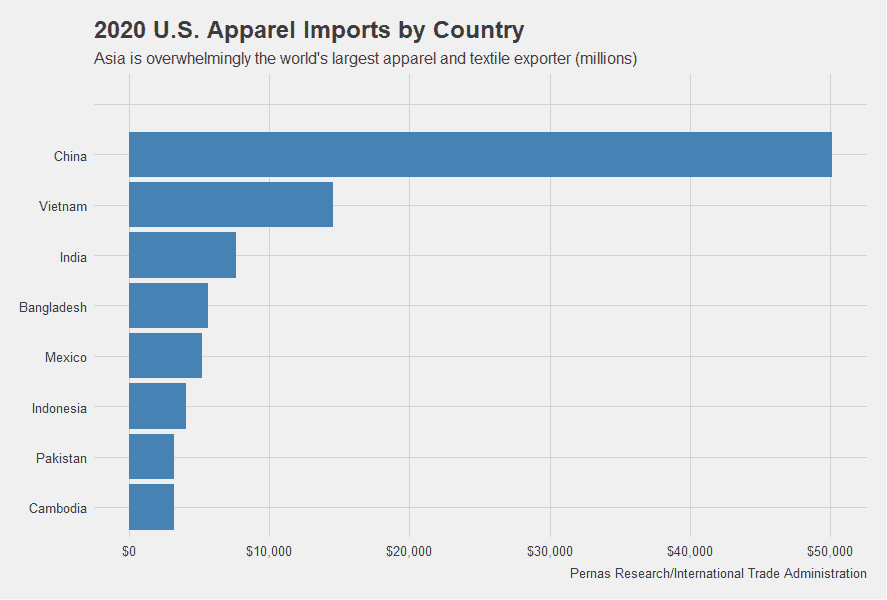

The supply chain for apparel companies is heavily horizontal and modularized. Fashion, by its nature, is dynamic and a horizontal supply chain is better adapted to support the needs of the consumer. Most of the supply chain is Asian-dominated countries like China, India and Pakistan have long histories of textile production and manufacturing (see below chart). National brands and private label brands both want control over each step in the supply chain, starting from the design to the fabric, to the dye, to the stitching etc. Each wants to have the flexibility to innovate frequently and offer a truly differentiated product to drive exclusivity. Why choose from a limited set amount of mills, fabrics and manufacturers when you can easily connect to hundreds? While it is true that macro data is beginning to show more manufacturing coming to the western hemisphere, we believe apparel supply chains will remain heavily horizontal and Gildan, being vertically integrated, is not well suited to be a large recipient of either trend. Wins in either department will require substantial capex and will not be a large revenue driver.

Risks

Printwear is sensitive to the business cycle. Large drops in aggregated demand could meaningfully affect unit sales in the short term. [mitigating factor: Gildan has experienced industry downturns before and came out stronger with increased share.]

Customer concentration. Given the consolidation in the distributor space, the top three distributors represent close to 50% of Gildan’s sales. [mitigating factor: Gildan produces the highest quality T-shirts at the lowest cost and has the best lead times]

Valuation

Gildan’s Printwear segment will decline by single digits over the next 12-24 months given unit sales will likely slow and the company does not plan to raise prices further (they raised prices ~15% in 2022). After which, sales will again begin their ascension driven by a healthier economy and international expansion. Capex will ramp up to 6-8% of sales for the next two years then begin to taper off to ~3%. Our model also assumes their effective tax rate will be raised to the OECD global minimum of 15% in the near future. The company will be able to maintain gross margins at 30% but cost pressure will increase slightly for the next 12 months given the full impact of input cost increases will start to reflect in COGS. Using these assumptions, we arrive close to Gildan’s current market value of ~5.9B.

Appendix

Printwear Industry Primer

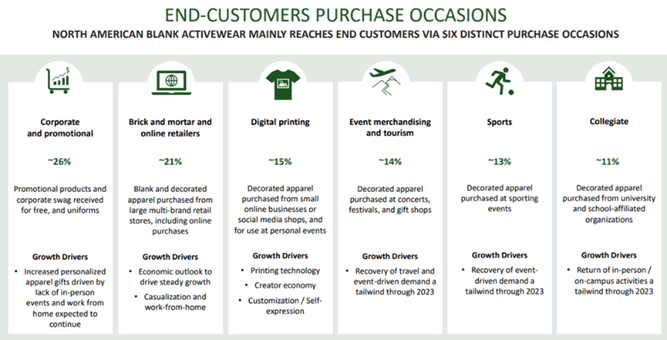

Printwear is the use of either large-scale screen printers or Direct-to-Garment printers to print designs on shirts. Screen-printers require blank apparel to print their designs. T-shirts represent ~70% of blank apparel sales but apparel can also be sports shirts or sweatshirts. Manufacturers of blank apparel have a TAM of roughly 6.5 billion in the U.S. and Canada. They sell to a concentrated set of distributors who supply a fragmented market of roughly 100,000 screen-printers. The channels screen printers sell to are shown in the graphic below (from Gildan). As one can see, this represents a wide swath of the economy and, as such, Printwear is leveraged to the business cycle. For instance, during the GFC recession, Printwear industry unit sales declined ~18% and declined again ~5% during the European Debt Crises of 2011.

Competitive Landscape for Manufacturers of Printwear

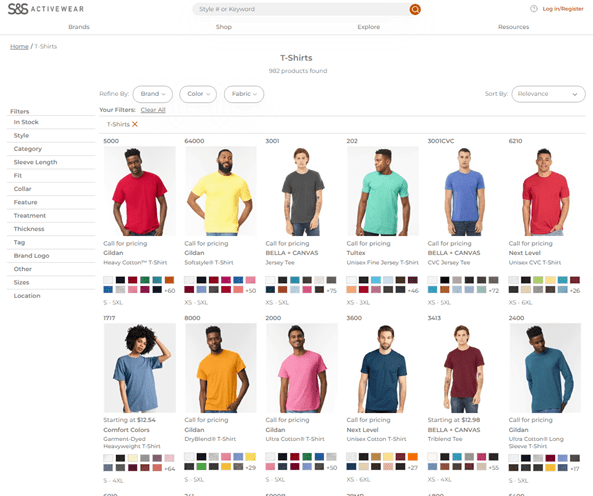

Over ten years ago, the manufacturers for Printwear blank apparel were concentrated among Hanes, Gildan and Fruit of the Loom. Currently, there are a wide assortment of Printwear brands (see below) given customers would like a wider offering of materials and styles. Large distributors such as S&S, Alphabroder and Sanmar can have upwards of 50 brands. Although the quality of fabric and differentiation of style are becoming more important, in Printwear the print is generally more important than the fabric to the end customer so distributors will want to sell the type of T-shirts that give them the healthy margins and the most turnover. Brand equity counts for very little in this market and if one can normalize by material quality, distributors will look to buy from those who have lowest price, are reliable and have the lowest lead times.

Forward Looking

Although the Printwear industry in the U.S. and Canada is mature, screen-printing technology continues to improve which raises the quality and speed of prints; making it easier and faster for consumers to receive their orders. With companies like Vistaprint and Custom ink, one can order custom-printed T-shirts for their corporate event and they will arrive in a few days. We expect the Printwear market to achieve modest growth over the intermediate to long term.

Footnotes:

1Fruit of the Loom and Hanes are also vertically integrated producers of innerwear/basic apparel but are not large sellers of basic apparel to the Printwear market where Gildan has close to 80% share.

2Gildan’s manufacturing hub is headquartered in Honduras. Through a tax treaty, companies in Honduras pay little to no tax and can repatriate profits to the parent at a preferential tax rate. This will likely adjust to the OECD minimum 15% level when the new OECD rules are ratified and go into effect.

3Gildan only produces a portion of Walmart’s George underwear. Mass Merchants will typically use multiple manufacturers when producing high-volume items.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.