| Estimated Upside | 50% |

| Price (11/1/2023) | $38.10 |

| Market Cap (mm) | $660mm |

| 30-Day Avg. Volume | 72k |

| 12-month perf (%) | 26% |

| Gross Margin % (latest) | 9% |

| P/E Ratio (trailing) | 22 |

| LT Debt (mm) | 0 |

Thesis

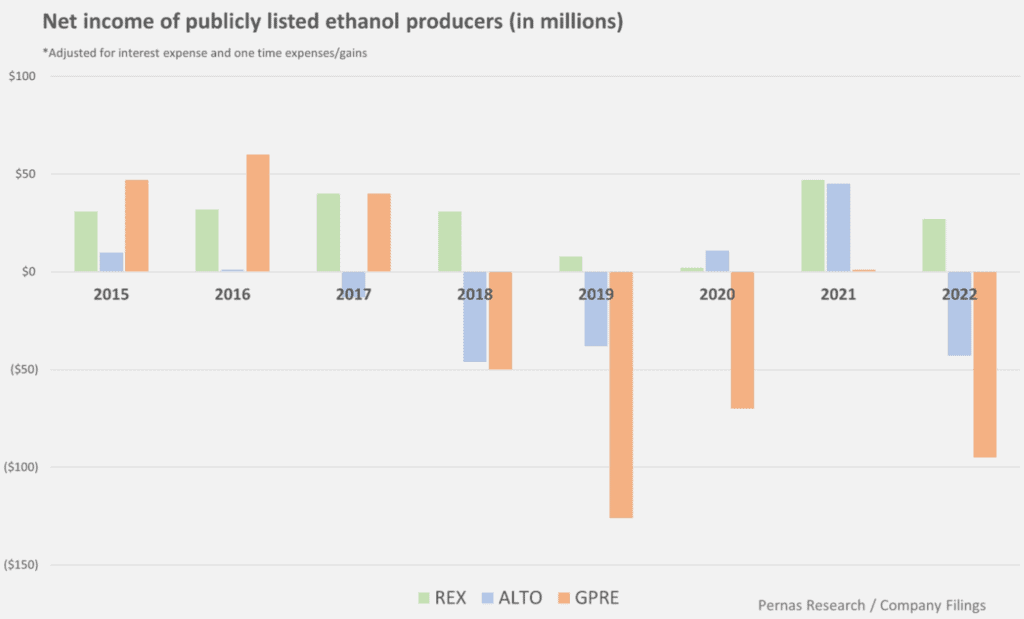

Rex American (‘REX’) is an ethanol producer with about 3% market share in the USA. REX is run by sound operators, having never lost money in the last decade despite volatile commodity cycles. This is in contrast to other publicly traded ethanol producers who have money-losing years frequently. REX is also one of the few ethanol producers that can take advantage of subsidies from the Inflation Reduction Act (‘IRA’), potentially making their earnings power significantly greater in the future. We estimate REX has about 50% upside.

Background

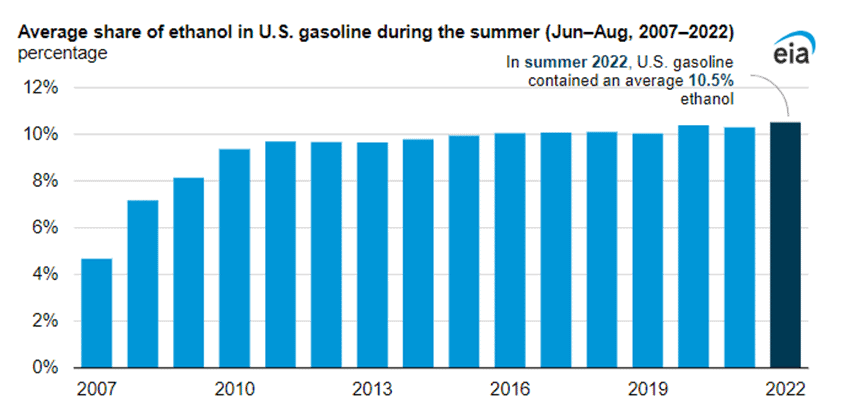

The primary use of ethanol is as a biofuel blend with gasoline to lower carbon footprint. Currently, ethanol makes up ten percent of the gasoline pumped into cars nationwide. Roughly 15B gallons of ethanol and 150B gallons of gasoline are consumed per year in the USA across 130k gas stations. The primary input for ethanol is corn. About 40% of the corn produced in the USA is used to make ethanol!

The ethanol industry grew from approximately 1.5 billion gallons of domestic annual ethanol production in 1999 to about 15B gallons by 2022. This was due to the 2007 Renewable Fuel Standard that was enacted to reduce the US’ dependency on foreign oil, reduce gasoline prices, and lower carbon emissions. The volume that which ethanol is mixed with gasoline does not decrease fuel efficiency in proportion and thus makes cars less carbon emitting. Additionally, corn absorbs CO2. Although there is a lot of back and forth on if conventional biofuels are better for the environment, farmers are a protected class and doing away with the RFS would be catastrophic to farmers nationwide. This is a political stance that likely neither party will adopt for a long time. The larger threat to ethanol is technological obsolescence from electric cars.

The EPA currently sets mandates under the RFS and refiners/importers are expected to buy either ethanol or a Renewable Identification Number (‘RIN’) to satisfy blending requirements.

Source: EIA

Industry Capacity

The United States ethanol industry consists of 199 plants in 25 states with an annual capacity of approximately 18 billion gallons. The largest player is POET whose ethanol production capacity is close to 2B gallons a year or about 7x that of REX. Although there is some international competition, the US is still the dominant ethanol producer in the world. Brazil, Canada, India, South Korea, Netherlands and China are the largest importers of ethanol.

Ethanol prices are affected by numerous things: From industry supply to gasoline prices to RIN prices to regulatory decisions to corn prices. Crush spreads determine the profitability of ethanol producers, this being the difference between the cost of a bushel of corn (divided by the yield) and the selling price of ethanol. Supply is relatively inelastic; the ethanol industry is chronically oversupplied regardless of the duration of unprofitable years. This is due to the high ownership of ethanol plants by farmers who have no other use for the corn that they produce. They simply can turn off ethanol production, store their corn, and wait for more profitable years. Given how competitive the industry is, ethanol producers look to produce other niche derivatives that are more profitable such as specialty alcohols, high protein feed etc.

REX

REX has approximately 270mm gallons of ethanol capacity and sells several byproducts such as Dried Distiller Grains. It has majority control over the facilities One Earth and Nu-Gen along with minority interest in several other plants. REX pivoted into ethanol manufacturing from retailing in the early 2000s when the RFS was enacted (most of the same management is still around today). Coming from retailing, management realized their biggest advantage in a commodity market would be on the buying side. REX owns these plants alongside farmers, is next to two major railroad lines giving them access to more markets, and is next to grain elevators. As a result, REX usually pays below market prices for corn and can access the highest dollar value for their ethanol and byproducts. On top of this REX has state-of-the-art Fagen/ICM plants.

Because of these reasons, REX has always maintained profitability regardless of the ethanol commodity cycle. Below is a graph depicting their profitability vs two publicly traded competitors.

Opportunities

Carbon dioxide is one of the main byproducts of ethanol production. Normally, this gas is released to the atmosphere however the tax credits put forth by the IRA incentivize companies to capture and store CO2. There are two credits the IRA put forth that are directly applicable to REX. These are the 45Q and 45Z credits. The 45Q was already an existing credit that applied to carbon dioxide that was captured and stored, however, the IRA bumped up the credit from $45/ton to $80/ton. The 45Z applies to decarbonized fuels.

Carbon Sequestration

Unlike most companies who are now rushing to get the requisite permitting to pipe compressed CO2 into reservoirs, REX has been working on the permitting for the last four years to be able to use a well located 4 miles away. REX also has the capital structure to do so, whereas other competitors are laden with debt. REX’s original intent was to take advantage of the older 45Q credit. REX has so far drilled 7k foot test wells, completed the seismic testing, run simulations, and collected over 160mm data points. The permitting is notoriously difficult to obtain and subject to a lot of politics. CO2 pipelines suffer from NIMBY and pipeline permitting is difficult. Recently South Dakota regulators denied a permit filed by Navigator for a CO2 pipeline and North Dakota regulators rejected Summit’s CO2 pipeline permit.

Economics of Carbon Sequestration

The theoretical max number of 45 credits a company like REX would receive would be $1 per gallon of ethanol produced. To qualify, the decarbonized ethanol needs to be produced after 2024 and sold before December 31 2027. (The 45Z offers two cents per gallon for every point below 50 on the Carbon Intensity score of a production facility. In technical jargon it means less than 50kilograms of carbon dioxide equivalent per million British thermal units)

REX is planning capital expenditures of roughly $150mm for the entirety of the project which includes increasing capacity to 200mm gallons per year at their One Earth facility. REX will produce 500k tons of CO2 at this production level. Once the permitting is achieved, the construction of the facility and pipeline is expected to be completed by July 31st, 2024. If REX gets the Class VI permit to store 90mm tons of CO2, it also wants to be the reservoir hub of choice for other ethanol producers nearby.

Owning the pipeline will make the economics lucrative for REX. Assuming that REX can achieve half the theoretical max value for the 45Z credits, REX can see a windfall of $400mm between 2025-2027, along with $40mm per year from 2028 to 2032. Combining the two yields $600mm dollars. This is assuming no additional revenue from other ethanol producers. An important distinction between the 45Q and 45Z is that 45Q credits are eligible for direct payment from the US Treasury. 45Z on the other hand is a tax credit that needs to be monetized either through offsetting income or transferability of credits to other entities.

Capital Allocation

One of the reasons we were drawn to REX was their disciplined capital allocation (REX only has five people at their headquarters!). Instead of pursuing numerous novel projects like their competitors to chase margins which rarely pan out, REX has instead chosen to conservatively increase capacity at their plants, repurchase shares at discounted prices, and is now pursuing carbon sequestration. This has resulted in a company that is profitable, has reduced shares by 40% at an average share price of $16, and currently also has almost $300mm in cash.

“ I have watched a lot of companies buy back their stock at the highs and then when it gets to the lows they have no money left to buy back their shares, we are the exact opposite. When the stock is going up, we leave it alone. When it’s coming down, we are there to support the shares, stabilize the stock and whoever is saying – make a market for the people who don’t want to sell their shares.” Stuart Rose

Risks

1. Repeal of the IRA: There’s regulatory risk that would lead to the repeal of the IRA. This would result in all the carbon subsidies to be retracted,

Mitigating Factor: We believe this is unlikely as the IRA provides incentives and does not impose onerous conditions on industry players. As a result, it is a cash grab for all parties and will likely continue to have bipartisan support.

2. Execution Risk: REX still needs to obtain class VI permitting and subsequently build out compression units along with a pipeline to take advantage of carbon credits. All of these tasks are complex and novel processes to REX.

Mitigating Factor: REX management has proven themselves to be prudent operators and has been working on the permitting and building out of the plant and pipeline longer than most ethanol producers. We believe they have a high likelihood of capitalizing on the carbon credits come 2025.

3. Declining Ethanol Usage due to EV: EV penetration will be a persistent headwind to the ethanol industry. Ironically, another subsidized industry could be the death of ethanol as a biofuel.

Mitigating Factor: Ethanol likely has other future use cases such as aviation fuel. Sustainable Aviation Fuel (‘SAF’) demand is forecasted to reach 7B gallons by 2030. It takes about 2 gallons of ethanol to produce 1 gallon of SAF which would increase ethanol demand by 15B gallons.

Valuation

REX generates a normalized FCF of $35mm per year. Add onto this the $250mm of cash and Treasuries it has and REX trades at around fair value. Taking into account the $150mm of capital expenditures to expand its OneEarth facility to be able to sequester CO2, there is a wide range of outcomes. Conservatively, the carbon credits are worth about $500mm discounted back to the present value. Adding the extra earnings that REX will have from additional capacity will be another 5mm to REX’s earnings power. Combined, we estimate the fair value for REX is about $1B or about 50% upside.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.