Pernas Research Letter to Zumiez Board of Directors

Deiya Pernas

PO BOX 9022416

San Juan PR 00901

[email protected]

July 7th, 2023

Board of Directors/Management Team

Zumiez Inc.

4001 204th Street SW

Lynnwood, WA 98036

Subject: Urgent Reconsideration of Buyback Practices for the Benefit of Long-Term Shareholders

Dear Board of Directors/Management Team,

I hope this letter finds you well. As a committed shareholder, I am writing to address a critical issue that has been impacting the long-term performance of Zumiez—your buyback practices. Since Zumiez went public in 2005, the operational growth of the firm has been impressive: a 440% increase in store count, a 520% growth in revenue, and a 189% increase in profits. However, during the same period, shareholders have only experienced a total annualized return of 1.8% (significantly lower than the stock market averages of 10.4%). The reason for this discrepancy lies in misguided buyback strategies.

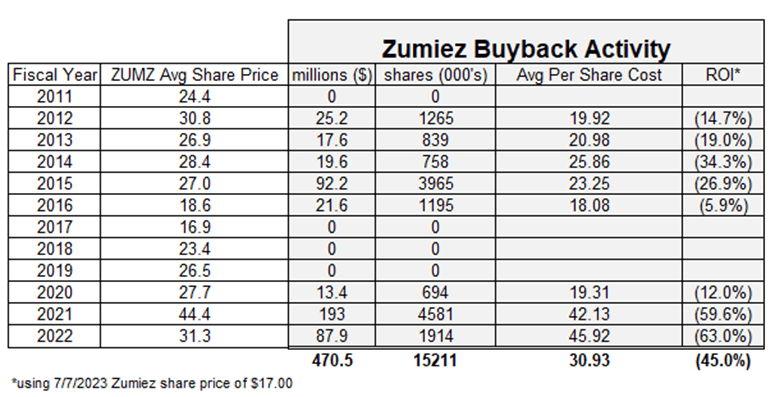

Zumiez initiated its buyback programs in fiscal year 2012, with over $470 million being spent on buybacks to date. This amount is significantly greater than the current market capitalization of the entire firm. Unfortunately, loyal shareholders have not benefited from these corporate payouts. Our comprehensive analysis of Zumiez’s buyback activities reveals that shareholder underperformance is attributed to the excessive repurchasing of shares at high prices:

As shown in the table above, the buyback ROI for Zumiez has been disappointing. The company’s buyback strategies tend to be heavily procyclical, buying back stock during cyclical upswings and reducing buybacks during downswings. Unfortunately, most of Zumiez’s buyback activity was conducted close to record highs, which reflects a “buy high, sell low” approach that characterizes misguided buyback strategies. This pattern raises concerns about the effectiveness and timing of the buybacks, ultimately resulting in suboptimal returns for shareholders.

We urge you to consider the following:

- Conduct a thorough evaluation of the effectiveness and impact of the buybacks executed thus far.

-

Explore alternative strategies for delivering returning value to shareholders.

- Consider deploying buybacks tactically, particularly during market downturns or when stock prices are below fair value. This counter-cyclical approach will maximize benefits for loyal shareholders and ensure repurchases are made at reasonable prices.

- Consider utilizing special dividends instead of buybacks, as successfully done by your competitor, Tillys. Using special dividends would have resulted in an annualized shareholder return of 7% instead of the current 1.8% (representing a significant difference of 200% in cumulative return).

To provide a comprehensive understanding of the detrimental impact of current buyback practices, I have attached my firm’s research report titled “The Dangerous Disconnect Between Stock Valuations and Buybacks.” I strongly urge the board and management to thoroughly review this report, which delves into the historical evolution of buybacks, highlights the negative consequences of poor buyback strategies, explores alternative strategies for delivering shareholder value, and discusses effective investor messaging. The insights presented in this report offer valuable perspectives that can inform strategic decision-making and drive positive change within Zumiez.

Zumiez has long been recognized as a leading brand in the retail industry, admired for its commitment to brand partners, employees and its differentiated culture. As a committed shareholder, I look forward to witnessing positive changes in corporate payout strategies that will benefit both the company and its loyal investors.

Thank you once again for your attention to this matter.

Sincerely,

Deiya Pernas

Pernas Research LLC