| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 15.8% | 55.4% | 26.5% |

| S&P 500 | 11.7% | 26.3% | 13.4% |

| Russell 2000 | 14.0% | 17.0% | 7.3% |

| DJ Industrial Average | 13.1% | 16.0% | 12.0% |

There are years where every possible portfolio decision goes awry, and the universe seems quite determined to make you look as foolish as possible. This was definitely not one of those years. Equity markets defied practically every conceivable expectation, and the Pernas Portfolio significantly outperformed the S&P 500 by 29.1%. Core Positions in META, DFIN, and NRP were up 194%, 61%, and 65% respectively. Even smaller positions saw outsized attributions, with bankrupt Yellow Corporation up over 400% and a well-timed Enphase purchase up over 70%. Our only blemish of any note was a Core Position in Endor that we exited (painfully) down 60% — our exit is discussed here. It’s nice to periodically glance at the scoreboard, but lengthy victory laps have a way of dissolving the deposits of paranoia necessary for optimal decision-making. We are perpetually “risk on” investors, and as Kenny Rogers says, “You never count your money when you’re sittin’ at the table.”

2023: The Year Behind

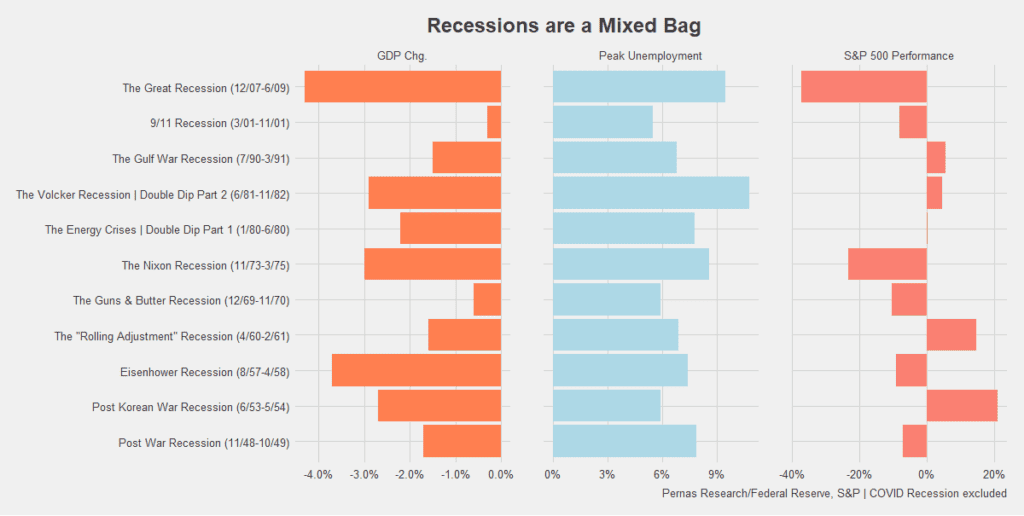

As we reflect on the past year, we began with an outlook that indicated a significant slowdown in the business cycle. At the time, the most powerful driver of the economy, business optimism, had markedly declined, and funding costs for households and businesses had risen over 400bps in less than a year. Amid debates over a potential soft or hard economic landing, we presented the below chart illustrating how economic statistics and price patterns can vary significantly during recessionary periods.

Data collected from periods of reduced consumption and business activity (aka recessions), demonstrate this key point all investors should do well to remember: The intensity, duration of economic slowdowns, and the stock market’s reaction can differ greatly in each recessionary period. Because of this, our 2023 forecast retained intellectual humility, and we highlighted factors ex-ante like rapid disinflation and a potential Federal Reserve policy shift, as reasons to reconsider our stance. Indeed, rapid disinflation did contribute to the communication of a Federal Reserve pivot, but the economy proved far stronger than we had expected.

In our Q2 letter (here), we shifted to a more optimistic outlook on the economy. We observed strong momentum in Artificial Intelligence development and better-than-expected consumer health. The infrastructure bill spurred demand for U.S. manufacturing across various sectors, and initiatives like the IRA and Chips Acts kickstarted subsidy-driven reshoring. The labor market’s resilience, combined with housing supply-demand imbalances, helped sustain property values, leading to the lowest levels of negative equity in well over a decade. While certain cyclical sectors faced challenges, overall, business conditions were stable, with year-over-year earnings and revenue growth for the S&P 500 at 0.5% and 2.2%, respectively.

2024: The Year Ahead

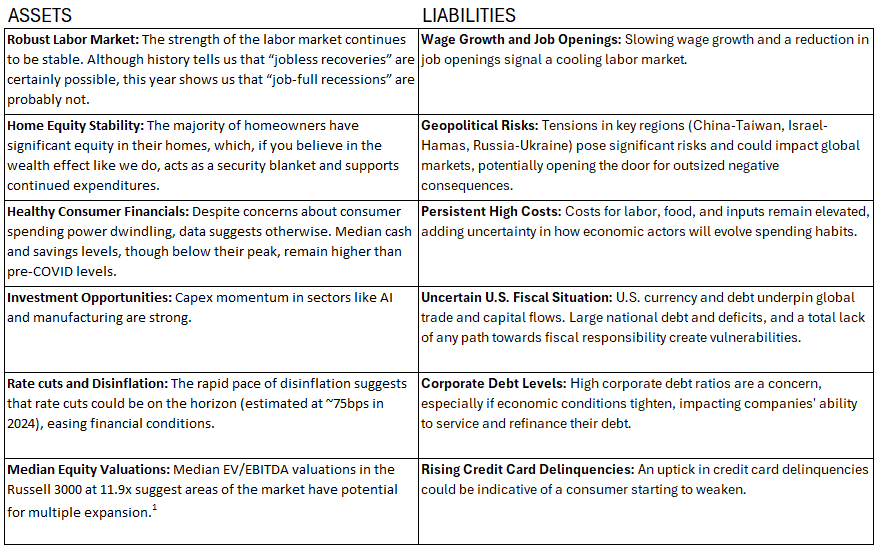

As we start the new year, our outlook for the U.S. economy and markets in 2024 is cautiously optimistic. We believe that the year will turn out to be a benign one for markets, supported by a mix of positive and negative factors we have identified:

While there are certainly risks and challenges to be mindful of, the positive aspects, particularly the robust labor market and consumer financial health, potential for rate cuts, continued business investment momentum in re-shoring and AI, provide a solid foundation for cautious optimism in 2024. As always, this forecast will be quite sensitive to new (high-signal) information along with potential shifts in perspective that could cause us to change our mind – something forecasters should do more often.

Companies We Look For in This Environment

Although our macro forecast is a key input in driving our risk-taking (discussed here), ultimately, we are bottom-up investors and spend the vast majority of our time analyzing companies. The world has changed considerably since pre-COVID, and our job as “company pickers” is to identify businesses that will perform well in the evolving environment.

Judging by stable corporate earnings and revenue, it is clear most companies have successfully passed on higher costs to their customers and are now breathing a sigh of relief that costs have stabilized. While this is certainly true, it glosses over the fact that the price level for most products and services has made large increases in only a few years. Because of this, economic actors of all stripes are continuing to rationalize their spending habits. Judging by the hundreds of transcripts we have read this year, everyone from retailers to luxury brands to solar companies to even funeral homes have uncertainty over whether demand for their products or services has normalized. The principle reason for this is that demand elasticities are often lower in the short run than the long run. “Business as usual” after a series of significant price increases can deceive some companies into thinking they have more pricing power than they actually do. The challenge for most businesses will be if demand elasticity for their products and services operates with a lag. In other words, time will tell if ongoing changes in consumer spending habits affect them negatively.

In this landscape, certain companies will be unable to recoup their loss in margins, certain companies have margins that are unsustainable, and others will continue to grow margins. Investors that tend to assume the future for companies will look similar to their past will be poorly situated. Below are key company attributes that have far more relevance in today’s environment:

- Products and services offering value: Companies that have been conservative with price increases and continue to focus on providing their customers with value will outcompete. In this environment, we favor companies that have intentionally traded lower margin for increased share potential.

- Strong companies paying down debt: Businesses capable of aggressively paying down high-cost debt while maintaining their competitive positioning will reduce their vulnerability to capital markets.

- Deep customer understanding and pricing intelligence: Companies that have translated vast amounts of their data into gaining deep insights into the behavior of their customers. These companies have been more intelligent (not necessarily more conservative) with price increases versus competitors.

- Investment in business improvement: Well-capitalized companies boldly investing in automation, increased digital integration, AI, and supply chain de-risking.

Capital is once again a weapon but only for those companies that have it on their balance sheet and are willing to use it. Companies that are well-capitalized, well-run, and long-term focused will take share from slow-moving and heavily indebted competition. We believe a reshuffling of market shares and industry leadership within certain sectors is likely and are more excited than ever to see what opportunities the year brings.

1Russell 3000 ex financials and companies with negative EBITDA.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.