| QTD | YTD | *ITD | |

|---|---|---|---|

| Pernas Portfolio* | 10.2% | 34.2% | 24.8% |

| S&P 500 | -3.3% | 13.1% | 12.1% |

| Russell 2000 | -5.1% | 2.7% | 5.5% |

| DJ Industrial Average | -2.1% | 2.6% | 10.4% |

The Pernas Portfolio achieved over 13% outperformance in Q3 driven by core positions Natural Resource Partners (NRP), Remitly (RELY), SES Imagotag (SES-FR), and Donnelly Financial (DFIN), along with a timely multi-bagger bankruptcy play in Yellow Corporation. Broader averages struggled, and apart from our main detractor, Endor (which we recently exited – see below), we’re pleased with how the rest of the portfolio held up. Our year-to-date performance is just shy of 35%, but there’s still much work to be done.

The spotlight in recent months has been on Treasury yields. The 10-year yield surged by ~20% to 4.59%. Equity risk premiums and high-yield spreads remained relatively stable during the quarter, suggesting that the market sell-off is more due to the rise in interest rates than de-risking. With each re-setting of expectations, we hold out hope that market participants are closer to conceding that a good business that has reached maturity is not worth 30 times earnings.

The observed rise in long-term interest rates may seem perplexing given the backdrop of rapid disinflation and a strengthening dollar. Various theories have emerged to explain this phenomenon, from foreign central banks selling treasuries en masse to concerns of government deficits flooding issuance to structurally higher inflation driven by secular cost pressures (Bill Ackman’s tweet on Sep 21 provides a comprehensive defense of these theories and has received six million views1). However, we believe these explanations lack merit for two primary reasons:

Firstly, the U.S. represents only ~25% of the world’s GDP yet ~90% of the world’s trade is denominated in dollars2. The global economy still heavily relies on U.S. dollars for international trade, and these dollars find their home in treasury bonds. For now, it’s safe to say that the global economy can absorb net new treasury issuance comfortably. Secondly, those who believe we will see sustainably higher inflation due to rising cost pressures either misunderstand how inflation is calculated or how sustained inflation is created. Prices of certain products or services may increase in the short term due to cost increases, but sustained price increases can only result from continual missteps in monetary policy (i.e., excessive printing). Even then, this isn’t a sufficient condition for causality; increases in the monetary base would need to be met with sustained transaction activity (i.e., velocity of money – read our full piece on inflation here).

What we find more plausible to explain the rate rise in Q3 is a combination of technical factors driving bond sales, coupled with the possibility that the bond market is showing more confidence in the staying power of the economy. This increased confidence may not be enough for bond investors to shift out of long-term bonds into risk assets, but it could lead them to consider shorter-term debt instruments as an attractive option. The total assets now sitting in money market funds exceed 5.5 trillion dollars.

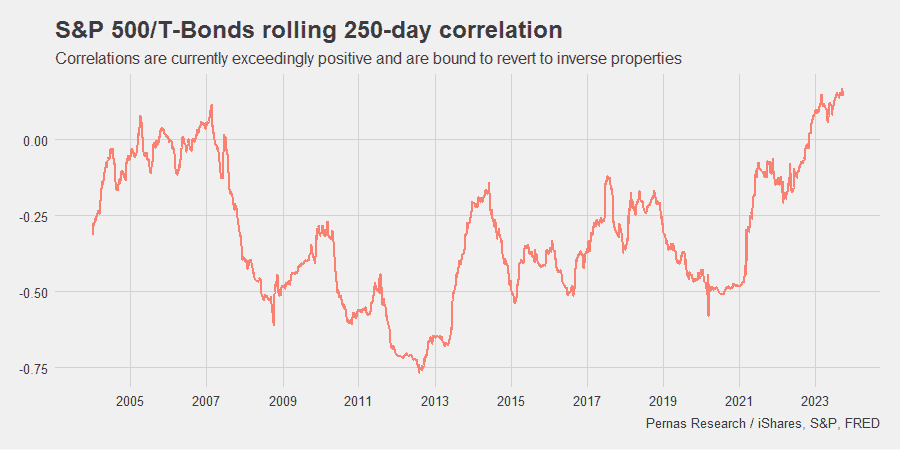

Real interest rates are now meaningfully positive, and we don’t share any treasury market fears. The longer end of the curve is attractively priced, and locking in yields close to 5% on the long end will also act as a risk reducer when inverse correlations return (see chart below). We’ve swapped a large portion of our money market funds for long-term treasuries and see this as an incredibly attractive trade.

Given a stubbornly resilient economy and a Powell Fed that is committed to “sufficiently restrictive” monetary policy, we are indeed in a “higher for longer” rate market. This has led us to tactically screen for certain types of companies: healthy incumbents that have lost share to weak competitors employing “capital as a weapon” along with younger companies that have reached scale in a difficult-to-break-through market after using cheap capital effectively. In other words, they are the new kids on the block that were the final ones to get across the drawbridge before it shut. Our positioning in Remitly is a clear example of this and one we discuss below.

The general consensus is that the Fed is done raising rates, as the longer end of the curve has done the heavy lifting for them. However, the potential for an oil shock and an economy that has shown a tendency to surprise to the upside could see the Fed make one last reach into its quiver. Households, corporations, and governments are all struggling to adjust to massively increased funding expenses. Everyone is in the same boat. As long as this higher-for-longer environment persists, recession fears will continue their merry-go-round.

Positions

Natural Resource Partners (NYSE:NRP)

NRP was a significant contributor to portfolio outperformance, being up almost 40% from when we initiated a position in March 2023. Although it is trading closer to fair value, we are holding due to a combination of a competent and shareholder aligned management team along with the upside potential of carbon sequestration. Carbon sequestration is in the sights of numerous companies given the recent $3B in funding the Infrastructure Investment and Jobs Act (‘IIJA’) provides for carbon capture. NPR owns the mineral rights to 13mm acres in the Appalachia Basin and Wyoming and has signed carbon sequestration agreements with Denbury and Oxy given it possesses the needed prerequisites: These being the right geography, proximity to emissions sources, and large contiguous acreage. So far these agreements allow Denbury and Oxy to sequester almost 800 mm metric tons of CO2. The potential of carbon sequestration segment is vast and the current management team is positioned to take full advantage of it.

Remitly (NAS:RELY)

Remitly is poised to dominate the global cross-border digital remittance market for two reasons. First, their superior digital platform is taking market share from traditional players. Second, the worldwide shift from cash to digital remittances favors them. Despite having limited current cash flows, they are poised to leverage economies of scale in digital remittances as volumes grow, reducing variable costs and spreading fixed costs across a larger customer base. Their advanced digital solutions, infrastructure, and fraud detection will assist in doubling their market share in three to five years

Endor (E2N:MU)

We exited Endor. It is down about 60% from the time when we initiated our position in February 2023. It detracted from portfolio returns by ~350 basis points —making it our worst performer YTD.

Given the strong sim racing industry trend, and Endor’s track record of innovation and customer satisfaction, we believed it to be a sound investment despite supply chain issues we believed were temporary and isolated at the time. After securing years’ worth of chips supply— which we had believed was the main supply chain issue— seven months later Endor’s supply chain problem continue to persist. The issues transformed from a singular nature to a multivariate one. Endor is now struggling with everything from assembly to logistics issues. The solutions to these problems are more encompassing, requiring changes in personnel, work processes, and the culture of the firm.

Although the CEO and founder has a great track record in marketing and creating innovative products, he seems less equipped to instill the operational DNA necessary to run a larger company. It is unfortunate to sell Endor – we are still big believers in sim racing industry growth (written about here) and of Endor as a consumer brand. Although we would still have invested in Endor, our position sizing should have been smaller given the lack of investor communication which prevented us from gaining a look-through into the company’s operations.

1https://www.reuters.com/markets/us/hedge-fund-manager-bill-ackman-sees-us-long-term-rates-rising-2023-09-22/

2Bank for International Settlements

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.