| Price (7/1/2023) | $29.50 |

| Market Cap (mm) | 668 |

| 30-Day Avg. Volume | 292,961 |

| 12-month perf (%) | 30.8% |

| Gross Margin % (latest) | 20.8% |

| P/E Ratio (trailing) | 6.5 |

| LT Debt (mm) | 0 |

Thesis

Titan Machinery (“TITN”) is the leading dealer of CNH Industrial equipment (“CNHI”), boasting a network of approximately 120 dealerships spanning the globe. CNHI is the second largest agricultural original equipment manufacturer (OEM) worldwide, ranking behind industry giant John Deere. Titan Machinery operates its dealerships predominantly within the United States, offering a comprehensive range of CNHI equipment complemented by dedicated parts and service provisions. These dealerships function on a semi-exclusive basis with CNHI equipment. TITN has undergone significant operational changes over the last several years to increase inventory turnover and margins and has recently benefited from the increase in farmer income given higher crop prices and beneficial regulation. In our assessment, the current market sentiment underestimates the sustainability of this favorable business environment for TITN, as we anticipate its continued ability to generate substantial cash flows. We believe TITN has about 30% upside from its present valuation.

Background

Agricultural equipment is purchased primarily by commercial farmers and cooperatives to help produce crops. Farmers have equipment dealerships that have the equipment, parts, and service that are needed. These are lasting relationships that develop for both the brand and the dealer. As a result, throughout the farms in the USA there are pockets of red (CNHI) and green (John Deere) that persist for decades. The primary driver of agricultural equipment demand is the profitability of farmers, and that is determined by a host of factors: These range from commodity prices and federal legislation to tariffs, trade policies, and crop yields. It is important to provide a brief historical backdrop of what occurred over the last 18 years to help provide context.

2006-2012

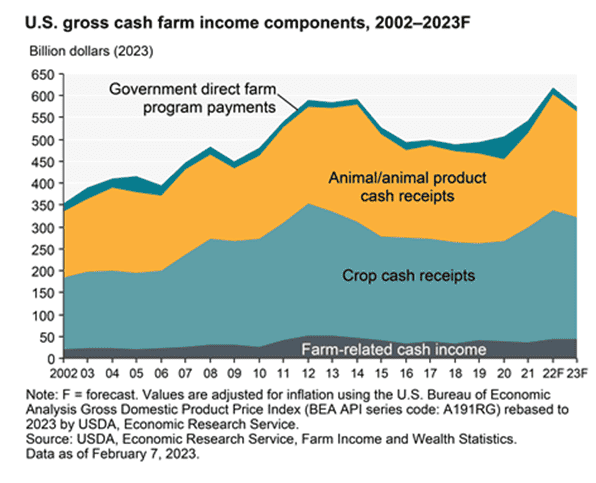

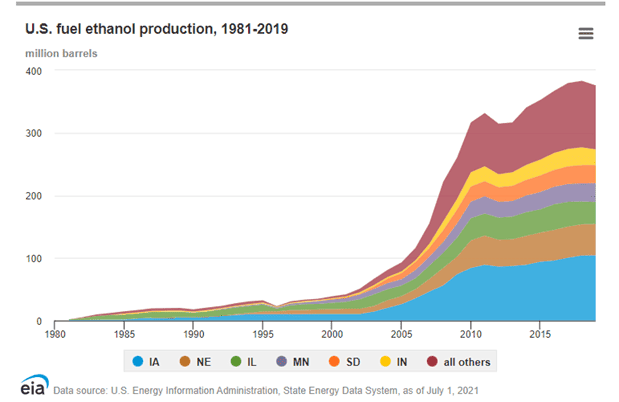

Looking at the cash crop receipts (farmer revenues) in the graph above, these years marked a significant bullish run in the US agricultural sector. High commodity prices were driven by a deluge of federal aid via the 2008 Farm Bill, ethanol mandates, along with a strong US export market due to the increasing appetite of China. Ethanol production (graph shown below) soared and corn prices subsequently increased being a primary feed ingredient. The combination of these factors resulted in crop cash receipts increasing by almost 80% in the span of 6 years to an all-time high of $330B. As farmers experienced a surge in profitability, they wanted to lower their taxable income and one significant way of doing so is buying farm equipment. The implementation of Bonus depreciation tax rules allowed farmers to depreciate up to 50% of the asset value in the first year.

2013-2020

During this seven-year duration, a complete change of fortunes unfolded. Aggregate farm income decreased by about 30%. This was due to a reversal of most of the trends that precipitated the prior period. Regulation was less favorable, geopolitical tensions eased, and export bans were lifted. The Farm Bill of 2013 (Farm bills come up for renewal every 5 years) was not as amenable to farmers as the 2008 Farm Bill. It introduced a reduction in subsidies and other provisions such as direct payments to farmers. These were payments made based off crop production regardless of income. Overall, this period marked a stark contrast to the preceding years.

The evolution of TITN

TITN was founded in 1980 by David Meyer who remains as the CEO today. The dealer space was (and still is) heavily fragmented, presenting an opportunity for industry consolidation. TITN currently opreates 100 dealerships, making it the largest CNHI dealer by a significant factor. Acquisitions are done on a working capital basis and not off a multiple basis. TITN rarely has goodwill on its balance sheet. OEMs favor a more consolidated dealer network as these dealers can provide better distribution and service than smaller independent ones. The interaction between the dealer and a farmer ultimately controls the perception of the brand. John Deere dealerships have achieved a notably higher level of consolidation than that of competitors CNHI and Kubota in this regard, and this has likely contributed to Deere’s competitive advantages in recent decades.

The commodity run-up from 2006 until 2012 disrupted the natural flow of a large portion of TITN’s business, namely selling used equipment. Typically, when a farmer comes into a dealership, they generally upgrade equipment to a newer model or one with less run time. When they buy this equipment, they also trade-in their used equipment. This is mostly due to convenience and to reduce their taxes versus if they elected cash proceeds. For a trade-in, TITN provides the customer with an accurate estimate (deducting applicable carrying cost and margin) and credits it against the equipment the farmer is buying. The estimate TITN provides is paramount as their future margin depends on selling that equipment to other farmers.

Generally, new equipment goes through three to five trade-downs before a dealership will only pay cash for the equipment and not accept a trade-in. A dealership will have 3 to 4 strata of customers, those who pay for new equipment, those who buy slightly used, and those who buy more used etc. Going back to the ’06-’12 commodity bull run, the lower strata customers atypically bought new equipment (instead of used) given their increased profitability and when the downturn eventually occurred, they were content to hold onto the new equipment they had acquired. Normally, they would have to acquire equipment by necessity, however, with new equipment, they was no need for purchases. The mass buying of new inventory caused a large inventory build-up of used equipment that TITN then spent years trying to offload with various incentive schemes and exports.

Working through this glut of inventory took significant time and costs. Heavy equipment has carrying cost in the form of interest expenses along with maintenance. A rule of thumb in the industry is that it costs about .5% of the asset value per month or 6% per year. Gross margins declined 15% on a percentage basis. TITN closed several underperforming dealerships and divested 8 others. Along with rationalization of their dealer network, TITN improved operational efficiencies, namely around standardization and organizational structure.

- Dealer managers no longer made the decisions on the purchase price of used equipment. TITN developed an internal Kelley Blue Book that standardizes purchasing decisions, and as a result future margins are more protected. Decision making is standardized.

- Larger focus on pre-selling new equipment to be able to forecast demands for new and used models. Currently, pre-sells make up 40% of the new inventory coming in.

- A change from a ‘strong store manager structure’ to an expert team model. Under a strong store manager, one individual is responsible for all operations at a dealership. Under the new model, there is a product support manager and a sales manager who manage and pull on the combination of two to four dealer locations. This enables better focus on competencies along with leveraging the strengths of owning multiple dealer locations.

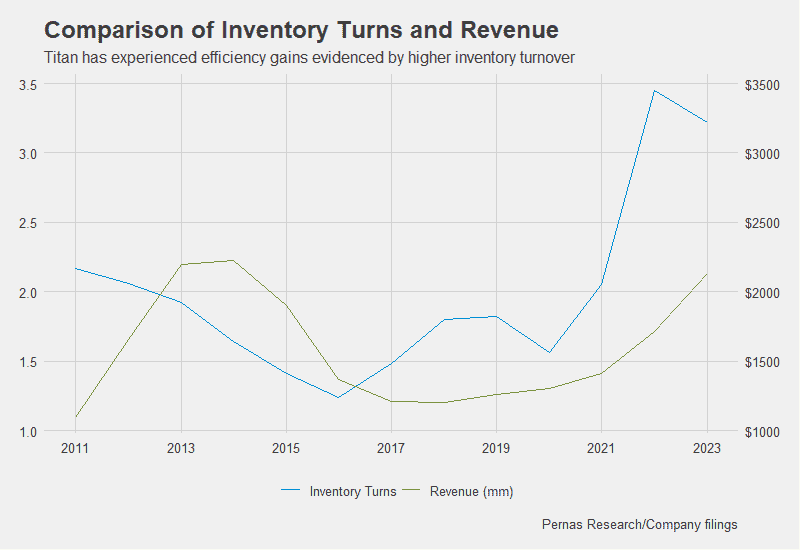

All of these changes resulted in TITN becoming more operationally efficient. This can be seen in their higher inventory turnovers, going from a low of 1.2 to currently 3.2. This has resulted in higher net margins for the business at around 5%, the highest in TITN operating history.

2021-202?

Since 2021, the broader agriculture market has been profitable for US farmers. Crop prices have increased due to inflation and geopolitical tensions with Russia and Ukraine. Russia is the largest wheat exporter in the world at around 90 mm tons per year while Ukraine is the fifth largest at around 14mm tons per year.

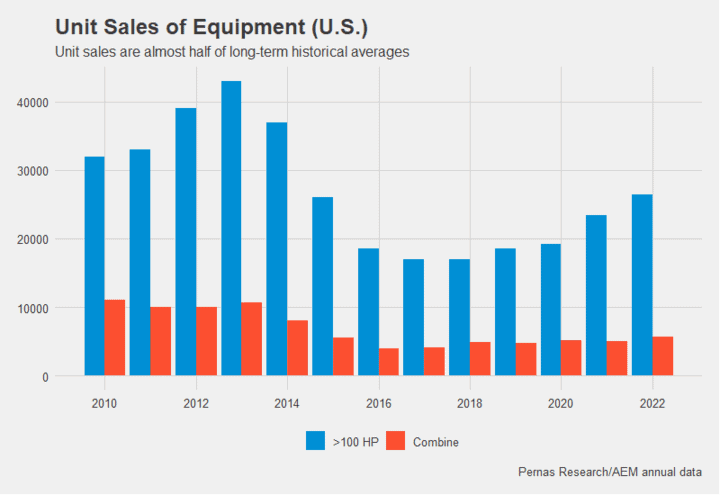

Given the high crop prices and the high revenues OEMs and dealers are reporting, one would imagine that manufacturers and dealers are at over-capacity and have large inventories akin to the 2006- 2012 period. The reality is that OEMs are STILL dealing with supply chain issues and farmers won’t be able to get some equipment lines until 2024! Deere and CNHI both had worker strikes in 2021 that slowed down production and this was exacerbated by supply chain issues from chips to steel. Manufacturing capacities have diminished since 2012 due to less demand for new equipment and OEMs do not have the flex to be able to ramp up production on heavy equipment. Pent up demand continues to increase as the lack of new equipment causes farmers to run more hours on their equipment. The supply side constraints are abating for smaller horsepower tractors but still exist for larger equipment such as Combines and large horsepower (>100 HP) tractors. These supply-side constraints are a good thing in the long run as it prevented a glut of inventory from building up. A much more measured pace of buying should occur as a result. The lack of supply can be seen in unit sales in the USA shown below.

Tailwinds

Geo-political tensions will likely persist. Aside from Ukraine and Russia producing a significant amount of crops, Russia also exports significant fertilizer to countries such as Brazil which is the largest producer of soybean in the world, producing about 50% of the soybeans in the world.

CNHI has recently divested non-core assets and changed its C suite to better compete against Deere. CHNI has also acquired several precision agricultural technology companies to expand its offerings. We believe the better CNHI’s offerings are, the better it is for TITN as farmers either look to upgrade equipment sooner or look to have additional parts installed. Both of which benefit TITN.

TITN also sells and rents CNHI construction equipment which makes up about 13% of revenues. This segment is primarily impacted by the demand due to commercial and infrastructure construction. With the large boost to infrastructure spending via the Infrastructure BIll, this segment will continue to see tailwinds. Same-store sales in 2022 were up 25%.

Risks

Recently, the ‘Right to repair’ law passed which enables farmers to be able to diagnose and repair their equipment. Parts and Services is a high-margin business for dealerships, and this would hurt their business. This will take time as it is a state decision, and likely only a small subset of farmers will do this. Regardless, TITN will likely be able to negotiate better margins on the equipment side with the OEM to mitigate any shortfall.

Nearly 40% of corn production is used to generate ethanol to be used as a biofuel. The continued penetration of electric cars will continue to erode at this demand, a small but sustained headwind for corn prices.

Valuation

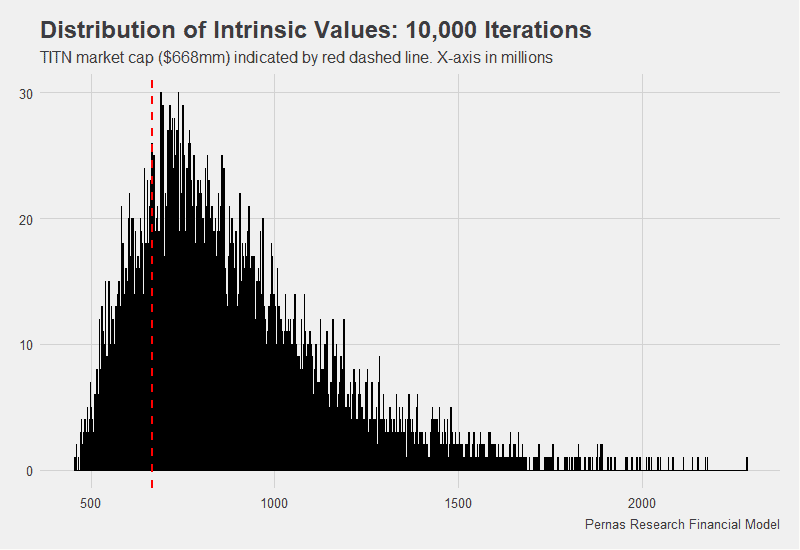

TITN’s balance sheet looks laden with debt given a cursory glance, however, the majority of this is non-interest-bearing payables to CNHI. The payables get settled when TITN sells new equipment,it is an interest-free revolver and should not be characterized as debt. Excluding this, TITN is significantly cheaper. TITN currently generates about $100mm FCF per year, however we believe in a normalized demand environment, that number will likely be closer to $60mm of FCF per year. We believe TITN has about 30% upside from its present valuation.

INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk, and it’s important to note that we are not in the business of providing investment advice. All investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.