The Metallurgical Coal Industry

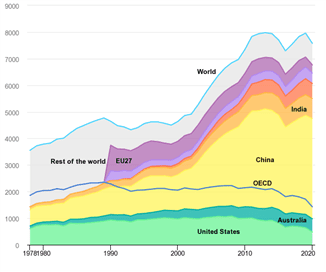

Coal. It conjures up images of smokestacks and rampant pollution. One would imagine that given the push for renewable energy and clean power, the coal industry is on its last legs and about to exit the manufacturing stage. The reality is that global coal consumption is at the highest it has ever been and growing. What is occurring is a bifurcation between the more developed countries and the less developed ones in their coal consumption. Figure 1 below illustrates this disparity. Due to environmental and regulatory pressures, more developed countries have been phasing out coal, using cleaner energy sources...